Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate the WACC for Walmart (NYSE: WMT). Please utilize the attached file for the cost of debt calculation and Yahod Finance historical data for

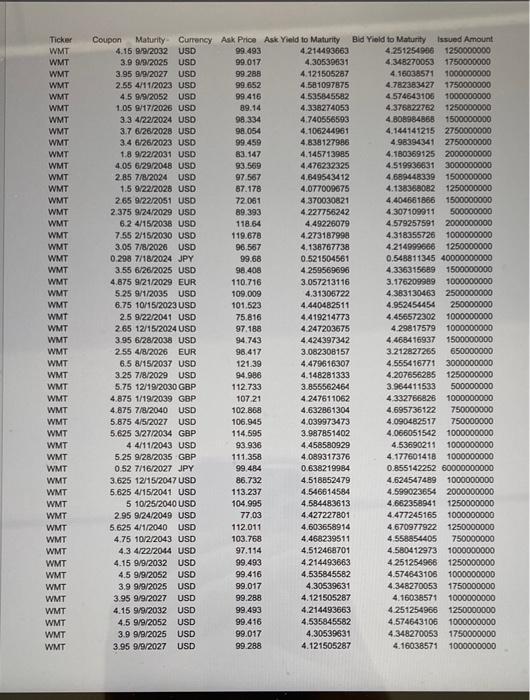

Calculate the WACC for Walmart (NYSE: WMT). Please utilize the attached file for the cost of debt calculation and Yahod Finance historical data for the time period of January 1, 2018 through January 1, 2023 for the other components of the WACC. Consider 20% as the effective tax rate for Walmart. For your final submission, please screenshot your Cost of Debt sheet, Beta calculation sheet, market return calculation sheet, and submit inside a pdf along with screenshots of the remainder of your WACC calculation. Please use =FORMULATEXT in Excel to show any applicable formulas you used. Note: For the cost of debt calculation, please use the midpoint of the ask yield and bid yield. Please let me know if you have any questions. This is NOT a group assignment. Please honor pledge. Ticker Coupon Maturity Currency Ask Price Ask Yield to Maturity WMT 99.493 4.214493663 WMT 99.017 4.30539631 4.121505287 99.288 99.652 4.581097875 4.15 9/9/2032 USD 3.9 9/9/2025 USD 3.95 9/9/2027 USD 2.55 4/11/2023 USD 4.5 9/9/2052 USD 1.05 9/17/2026 USD 3.3 4/22/2024 USD 3.7 6/26/2028 USD 3.4 6/26/2023 USD 4.535845582 4.338274053 4.740556593 4.106244961 4.838127986 WMT WMT WMT WMT WMT WMT WMT WMT WMT WMT WMT WMT WMT WMT WMT WMT WMT WMT WMT WMT WMT WMT WMT WMT WMT WMT WMT WMT WMT WMT WMT WMT WMT WMT WMT WMT WMT WMT WMT WMT WMT WMT WMT WMT WMT WMT WMT WMT WMT WMT 1.8 9/22/2031 USD 4.05 6/29/2048 USD: 2.85 7/8/2024 USD 1.5 9/22/2028 USD 2.65 9/22/2051 USD 2.375 9/24/2029 USD 6.2 4/15/2038 USD 7.55 2/15/2030 USD. 3.05 7/8/2026 USD 0.298 7/18/2024 JPY 3.55 6/26/2025 USD 4.875 9/21/2029 EUR 5.25 9/1/2035 USD 6.75 10/15/2023 USD 2.5 9/22/2041 USD 2.65 12/15/2024 USD 3.95 6/28/2038 USD 2.55 4/8/2026 EUR 6.5 8/15/2037 USD 3.25 7/8/2029 USD 5.75 12/19/2030 GBP 4.875 1/19/2039 GBP 4.875 7/8/2040 USD 5.875 4/5/2027 USD 5.625 3/27/2034 GBP 4 4/11/2043 USD 5.25 9/28/2035 GBP 0.52 7/16/2027 JPY 3.625 12/15/2047 USD 5.625 4/15/2041 USD 5 10/25/2040 USD 2.95 9/24/2049 USD 5.625 4/1/2040 USD 4.75 10/2/2043 USD 4.3 4/22/2044 USD 4.15 9/9/2032 USD 4.5 9/9/2052 USD 3.9 9/9/2025 USD 3.95 9/9/2027 USD 4.15 9/9/2032 USD 4.5 9/9/2052 USD 3.9 9/9/2025 USD 3.95 9/9/2027 USD 99.416 89.14 98.334 98.054 99.459 83.147 93.569 97.567 67.178 72.061 89.393 118.64 119.678 96.567 99.68 98.408 110.716 109.009 101.523 75.816 97.188 94.743 96.417 121.39 94.986 112.733 107.21 102.868 106.945 114.595 93.936 111.358 99.484 86.732 113.237 104.995 77.03 112.011 103.768 97.114 99.493 99.416 99.017 99.288 99.493 99.416 99.017 99.288 4.145713985 4.476232325 4.649543412 4.077009675 4.370030821 4.227756242 4.49226079 4.273187998 4.138767738 0.521504561 4.259569696 3.057213116 4.31306722 4.440482511 4.419214773 4.247203675 4.424397342 3.082308157 4.479616307 4.148281333 3.855562464 4.247611062 4.632861304 4.039973473 3.987851402 4.458580929 4.089317376 0.638219984 4.518852479 4.546614584 4.584483613 4.427227801 4.603658914 4.468239511 4.512468701 4.214493663 4.535845582 4.30539631 4.121505287 4.214493663 4.535845582 4.30539631 4.121505287 Bid Yield to Maturity Issued Amount 4.251254906 1250000000 4.348270053 1750000000 4.16038571 1000000000 4.782383427 175000000 4.574643106 100000 4.376822762 12500 4.808984868 15000000 4.144141215 2750000000 4.98394341 275000000 4.180369125 2000000000 4.519936631 30000000 4.689448339 150000 4.138368082 4.404661866 15000 4.307109911 5000 4.579257591 20000 4.318355726 100000000 4.214999666 12500 0.548811345 4000 4.336315689 15000 3.176209989 10000 4.383130463 25000 4.952454454 2500000 4.456572302 10000 4.29817579 100000000 4.468416937 150000 3.212827265 65000000 4.555416771 300000000 4.207656285 12500000 3.964411533 5000 4.332766826 10000000 4.695736122 75000000 4.090482517 750000000 4.066051542 1000000000 4.53690211 10000000 4.177601418 10000 0.855142252 60000 4.624547489 1000 4.599023654 200000 4.662358941 1250 4.477245165 10000 4.670977922 12500 4.558854405 7500 4.580412973 10000000 4.251254966 125000 4.574643106 10000000 4.348270053 17500 4.16038571 1000000 4.251254966 1250 4.574643106 10000000 4.348270053 1750000 4.16038571 1000000000

Step by Step Solution

★★★★★

3.26 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started