Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Complete the simple cash budget given below by using the assumptions in points 1 and 2. Then answer the questions in point 3. All

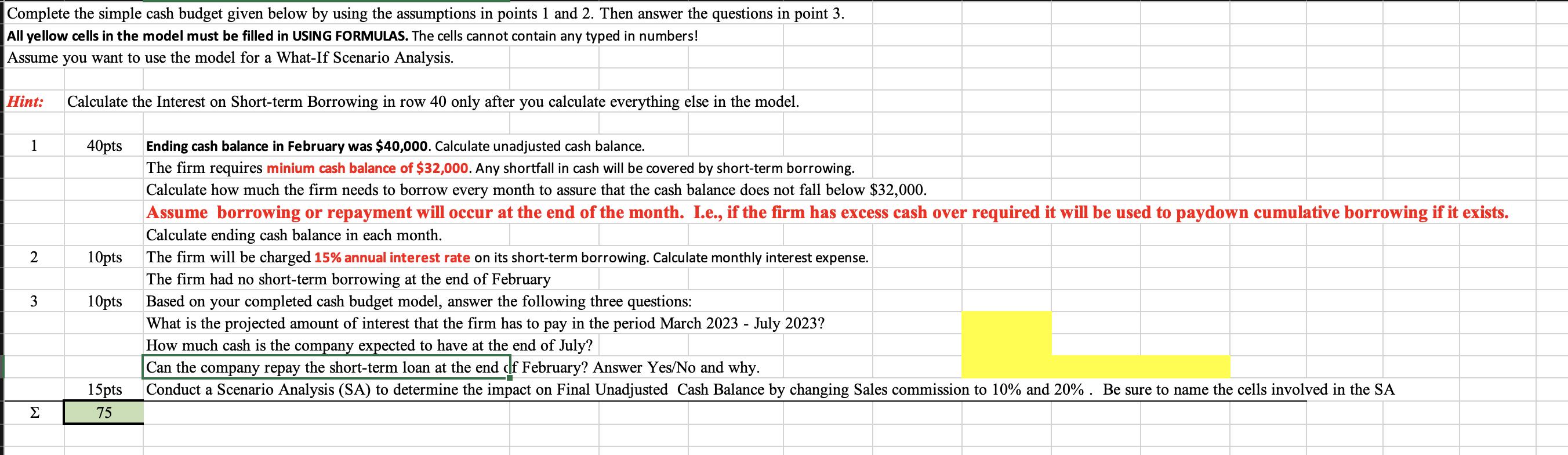

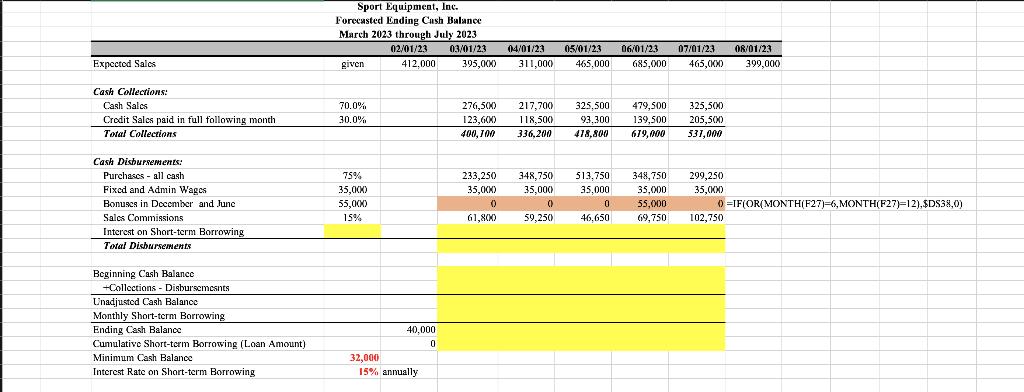

Complete the simple cash budget given below by using the assumptions in points 1 and 2. Then answer the questions in point 3. All yellow cells in the model must be filled in USING FORMULAS. The cells cannot contain any typed in numbers! Assume you want to use the model for a What-If Scenario Analysis. Calculate the Interest on Short-term Borrowing in row 40 only after you calculate everything else in the model. 40pts Hint: 1 2 3 10pts 10pts 15pts 75 Ending cash balance in February was $40,000. Calculate unadjusted cash balance. The firm requires minium cash balance of $32,000. Any shortfall in cash will be covered by short-term borrowing. Calculate how much the firm needs to borrow every month to assure that the cash balance does not fall below $32,000. Assume borrowing or repayment will occur at the end of the month. I.e., if the firm has excess cash over required it will be used to paydown cumulative borrowing if it exists. Calculate ending cash balance in each month. The firm will be charged 15% annual interest rate on its short-term borrowing. Calculate monthly interest expense. The firm had no short-term borrowing at the end of February Based on your completed cash budget model, answer the following three questions: What is the projected amount of interest that the firm has to pay in the period March 2023 - July 2023? How much cash is the company expected to have at the end of July? Can the company repay the short-term loan at the end of February? Answer Yes/No and why. Conduct a Scenario Analysis (SA) to determine the impact on Final Unadjusted Cash Balance by changing Sales commission to 10% and 20%. Be sure to name the cells involved in the SA Expected Sales Cash Collections: Cash Sales Credit Sales paid in full following month Total Collections Cash Disbursements: Purchases all cash Fixed and Admin Wages Bonuses in December and Junc Sales Commissions Interest on Short-term Borrowing Total Disbursements Beginning Cash Balance +Collections - Disbursements Unadjusted Cash Balance Monthly Short-term Borrowing Ending Cash Balance Cumulative Short-term Borrowing (Loan Amount) Minimum Cash Balance Interest Rate on Short-term Borrowing Sport Equipment, Inc. Forecasted Ending Cash Balance March 2023 through July 2023 02/01/23 412,000 given 70.0% 30.0% 75% 35.000 55,000 15% 32,000 40,000 0 15% annually 03/01/23 04/01/23 05/01/23 06/01/23 07/01/23 08/01/23 395,000 311,000 465,000 685.000 465,000 399,000 276,500) 217,700 325,500 479,500 123,600) 118,500 400,100 336,200 233,250 35,000) 0 61,800 325,500 93.300 139,500 205,500) 418,800 619,000 531,000 348,750 513.750 35,000 0 59,250 35,000 0 46,650 348,750 35,000 55,000 69,750 299,250 35,000 102,750 =IF(OR(MONTH(F27)=6,MONTH(F27)-12),$DS38,0)

Step by Step Solution

★★★★★

3.50 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Here is the completed cash budget model with formulas in the yellow cells ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started