Question

On January 1, 2021, Kramer International Inc. issued $200,000, 9%, 5-year bonds for $ 192,278. The bonds were sold to yield an effective interest

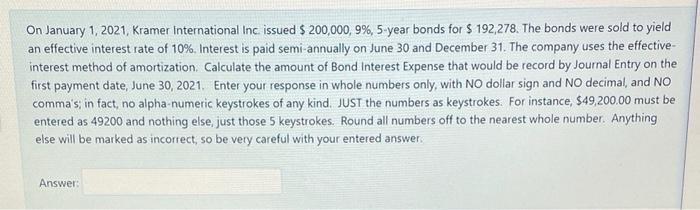

On January 1, 2021, Kramer International Inc. issued $200,000, 9%, 5-year bonds for $ 192,278. The bonds were sold to yield an effective interest rate of 10%. Interest is paid semi-annually on June 30 and December 31. The company uses the effective- interest method of amortization. Calculate the amount of Bond Interest Expense that would be record by Journal Entry on the first payment date, June 30, 2021. Enter your response in whole numbers only, with NO dollar sign and NO decimal, and NO comma's; in fact, no alpha-numeric keystrokes of any kind. JUST the numbers as keystrokes. For instance, $49,200.00 must be entered as 49200 and nothing else, just those 5 keystrokes. Round all numbers off to the nearest whole number. Anything else will be marked as incorrect, so be very careful with your entered answer. Answer:

Step by Step Solution

3.64 Rating (173 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting IFRS

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield

3rd edition

1119372933, 978-1119372936

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App