Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Western Plants Co. (Western) leased a new forklift on January 1. The lease agreement is for eight years, with an annual payment of $5,000

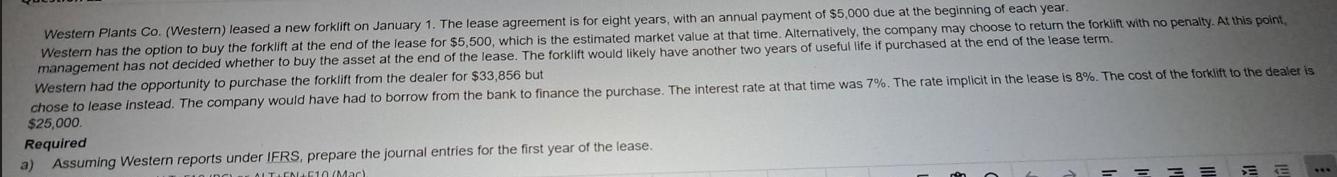

Western Plants Co. (Western) leased a new forklift on January 1. The lease agreement is for eight years, with an annual payment of $5,000 due at the beginning of each year. Western has the option to buy the forklift at the end of the lease for $5,500, which is the estimated market value at that time. Alternatively, the company may choose to return the forklift with no penalty. At this point, management has not decided whether to buy the asset at the end of the lease. The forklift would likely have another two years of useful life if purchased at the end of the lease term. Western had the opportunity to purchase the forklift from the dealer for $33,856 but chose to lease instead. The company would have had to borrow from the bank to finance the purchase. The interest rate at that time was 7%. The rate implicit in the lease is 8%. The cost of the forklift to the dealer is $25,000. Required a) Assuming Western reports under IFRS, prepare the journal entries for the first year of the lease. FLO (DC) ALTEN+F10 (Mac). S

Step by Step Solution

★★★★★

3.34 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

Under IFRS International Financial Reporting Standards when a company leases an asset it is required ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started