= Consider the following discrete time two-period market model. The savings account is given by t 5 55 where and are 51 t for

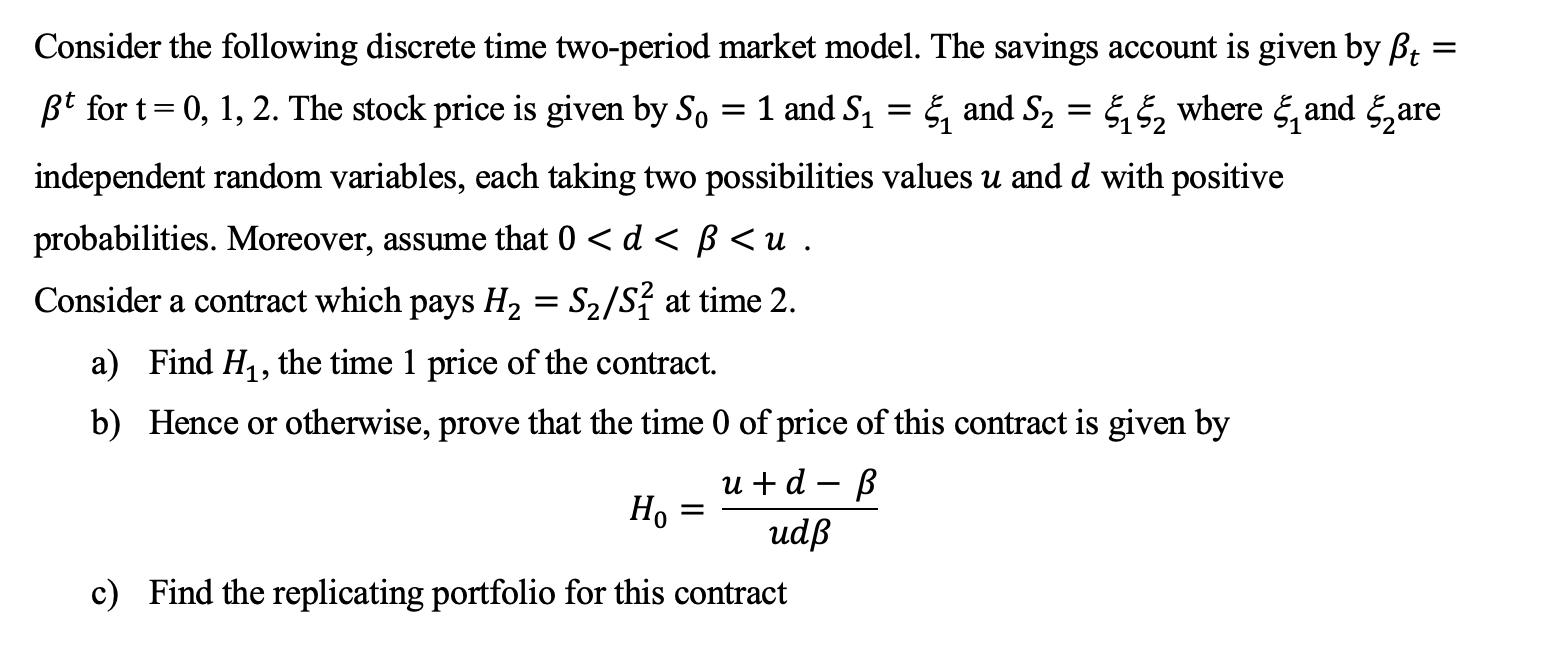

= Consider the following discrete time two-period market model. The savings account is given by t 5 55 where and are 51 t for t= 0, 1, 2. The stock price is given by So = 1 and S = and S = independent random variables, each taking two possibilities values u and d with positive probabilities. Moreover, assume that 0 < d < < u . Consider a contract which pays H = S/S at time 2. a) Find H, the time 1 price of the contract. b) Hence or otherwise, prove that the time 0 of price of this contract is given by u + d Ho c) Find the replicating portfolio for this contract = udp = Consider the following discrete time two-period market model. The savings account is given by t 5 55 where and are 51 t for t= 0, 1, 2. The stock price is given by So = 1 and S = and S = independent random variables, each taking two possibilities values u and d with positive probabilities. Moreover, assume that 0 < d < < u . Consider a contract which pays H = S/S at time 2. a) Find H, the time 1 price of the contract. b) Hence or otherwise, prove that the time 0 of price of this contract is given by u + d Ho c) Find the replicating portfolio for this contract = udp

Step by Step Solution

3.41 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

a To find the time 1 price of the contract we need to find the expected value of H2 discounted back ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started