Answered step by step

Verified Expert Solution

Question

1 Approved Answer

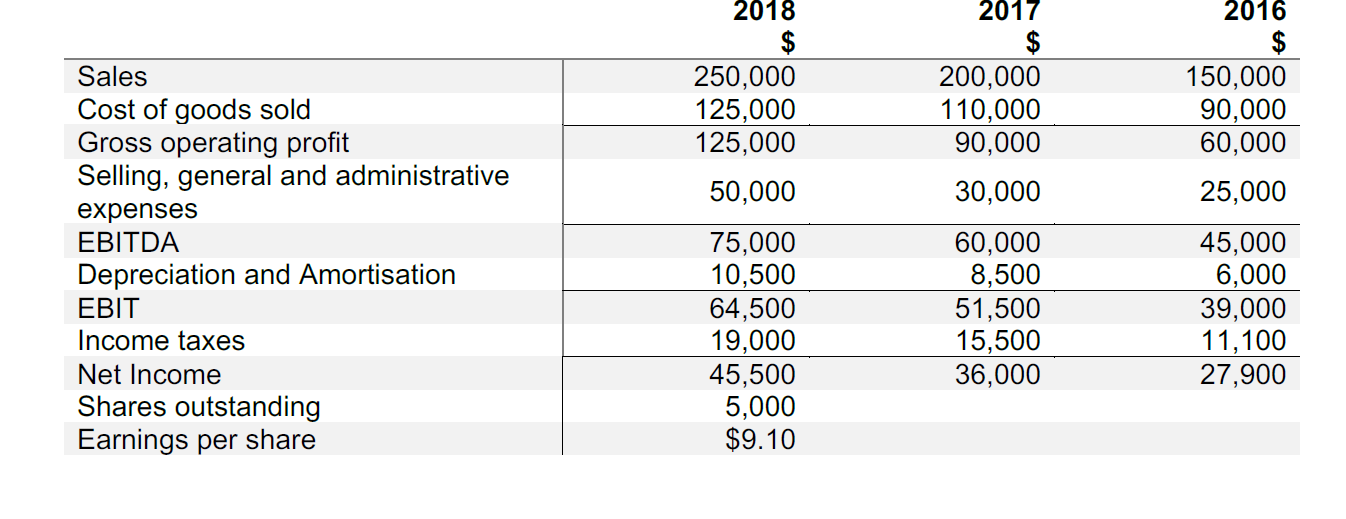

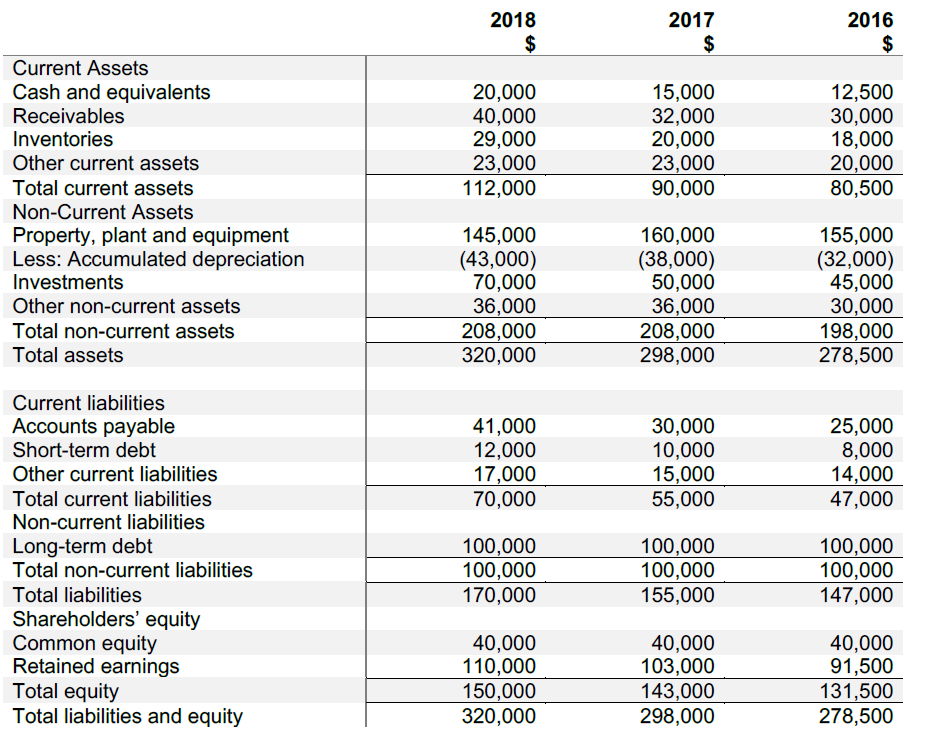

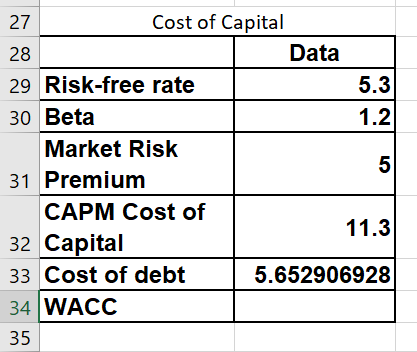

Calculate the WACC (weighted average cost of capital) based on the information. (any method) + Yield on the company's long term debt 8%. 2018 2016

Calculate the WACC (weighted average cost of capital) based on the information. (any method)

+ Yield on the company's long term debt 8%.

2018 2016 2017 $ 250,000 125,000 125,000 $ 200,000 110,000 90,000 $ 150,000 90,000 60,000 Sales Cost of goods sold Gross operating profit Selling, general and administrative 50,000 30,000 25,000 expenses EBITDA 75,000 10,500 64,500 19,000 45,500 5,000 $9.10 45,000 6,000 39,000 60,000 8,500 51,500 15,500 36,000 Depreciation and Amortisation EBIT 11,100 27,900 Income taxes Net Income Shares outstanding Earnings per share 2018 2017 2016 $ $ Current Assets Cash and equivalents Receivables 20,000 40,000 29,000 23,000 112,000 15,000 32,000 20,000 23,000 90,000 12,500 30,000 18,000 20,000 80,500 Inventories Other current assets Total current assets Non-Current Assets 145,000 (43,000) 70,000 36,000 208,000 320,000 160,000 (38,000) 50,000 36,000 208,000 298,000 Property, plant and equipment Less: Accumulated depreciation Investments 155,000 (32,000) 45,000 30,000 198,000 278,500 Other non-current assets Total non-current assets Total assets Current liabilities Accounts payable Short-term debt 41,000 12,000 17,000 70,000 30,000 10,000 15,000 55,000 25,000 8,000 14,000 47,000 Other current liabilities Total current liabilities Non-current liabilities Long-term debt Total non-current liabilities 100,000 100,000 155,000 100,000 100,000 170,000 100,000 100,000 147,000 Total liabilities Shareholders' equity Common equity Retained earnings Total equity Total liabilities and equity 40,000 91,500 131,500 278,500 40,000 110,000 150,000 320,000 40,000 103,000 143,000 298,000 Cost of Capital 27 Data 28 29 Risk-free rate 5.3 30 Beta 1.2 Market Risk 5 31 Premium CAPM Cost of 11.3 32 apital 33 Cost of debt 5.652906928 34 WACC 35

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started