Answered step by step

Verified Expert Solution

Question

1 Approved Answer

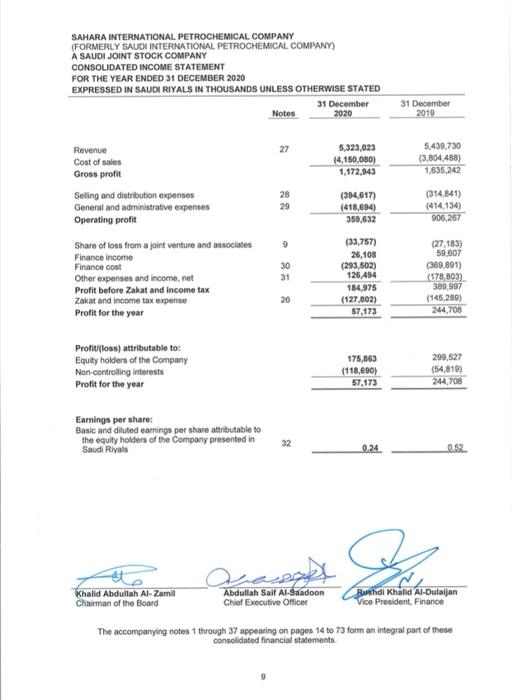

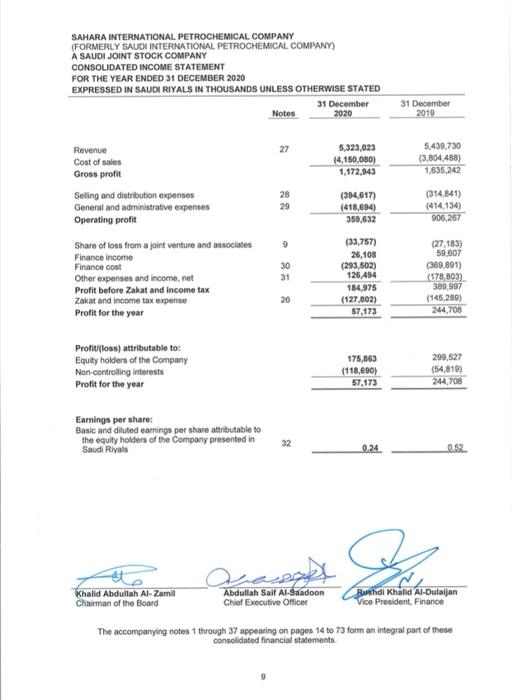

Calculate Times interest earned and fix charge coverage from this income statment SAHARA INTERNATIONAL PETROCHEMICAL COMPANY (FORMERLY SAUDI INTERNATIONAL PETROCHEMICAL COMPANY) A SAUDI JOINT STOCK

Calculate Times interest earned and fix charge coverage from this income statment

SAHARA INTERNATIONAL PETROCHEMICAL COMPANY (FORMERLY SAUDI INTERNATIONAL PETROCHEMICAL COMPANY) A SAUDI JOINT STOCK COMPANY CONSOLIDATED INCOME STATEMENT FOR THE YEAR ENDED 31 DECEMBER 2020 EXPRESSED IN SAUDI RIYALS IN THOUSANDS UNLESS OTHERWISE STATED 31 December Notes 2020 31 December 2010 27 Revenue Cost of sales Gross profit 5,323,023 (4,150,080) 1,172,943 5.439,730 (3,804488) 1,635,242 28 29 (394,617) (418,694) 359,632 (314,841) (414,134) 906,267 9 Selling and distribution expenses General and administrative expenses Operating profit Share of loss from a joint venture and associates Finance income Finance cost Other expenses and income, net Profit before Zakat and income tax Zakat and income tax expense Profit for the year 30 31 (33,757) 26,108 (293,602) 126,494 184,975 (127.802) 57,173 (27.183) 59,607 (369,891) (178,803) 389997 (145.289) 244,700 26 Profitfloss) attributable to: Equity holders of the Company Non-controlling interests Profit for the year 175,863 (118,690) 57.173 299,527 (54,819) 244,708 Earnings per share: Basic and diluted earnings per share attributable to the equity holders of the Company presented in Saudi Riyals 32 0.24 052 Quase Khalid Abdullah Al-Zamil Chairman of the Board Abdullah Saif Al-Saadoon Chief Executive Officer Rushdi Khalid Al-Dutaijan Vice President, Finance The accompanying notes through 37 appearing on pages 14 to 73 form an integral part of these consolidated financial statements

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started