Answered step by step

Verified Expert Solution

Question

1 Approved Answer

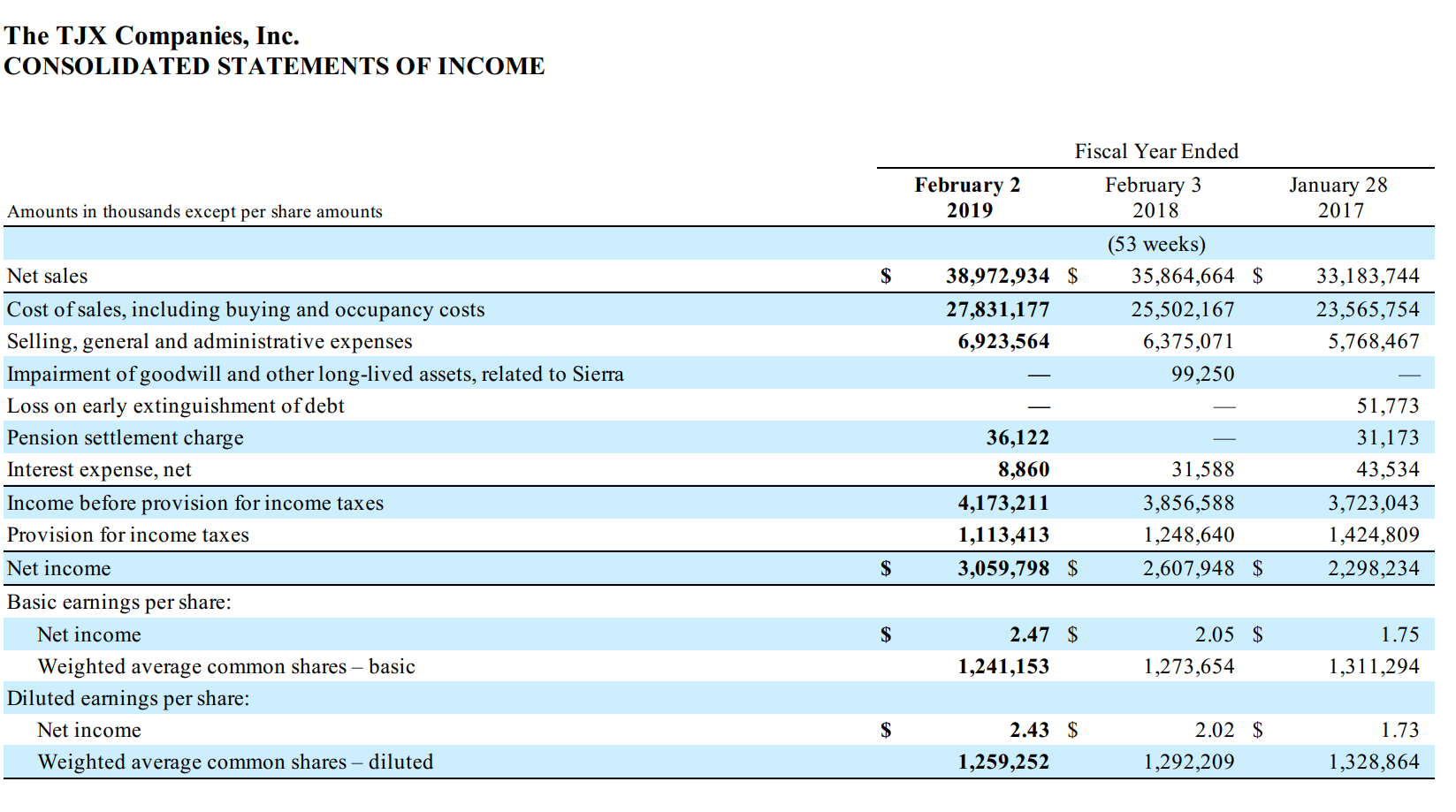

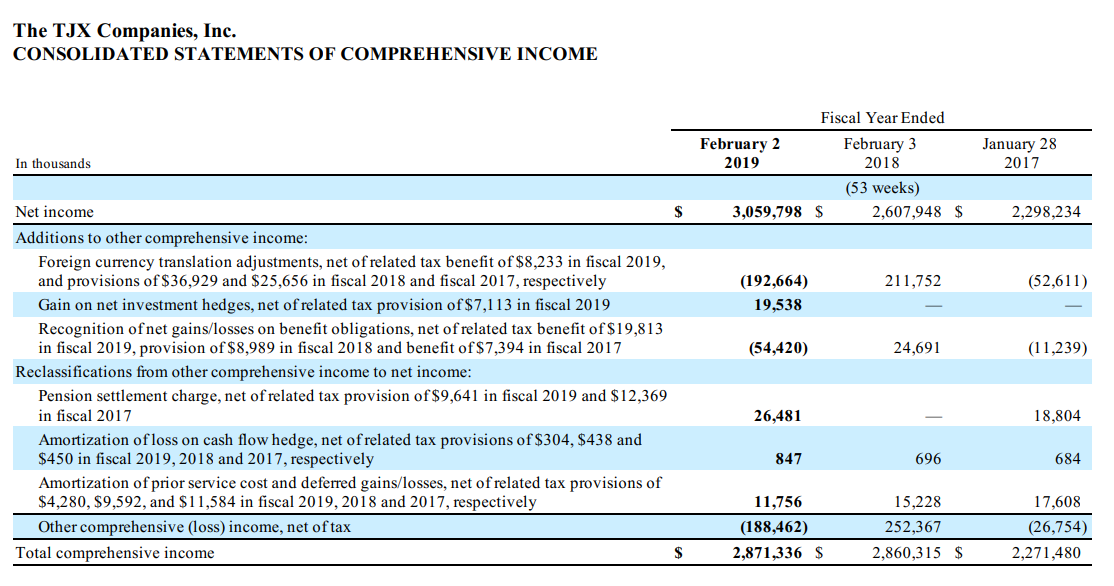

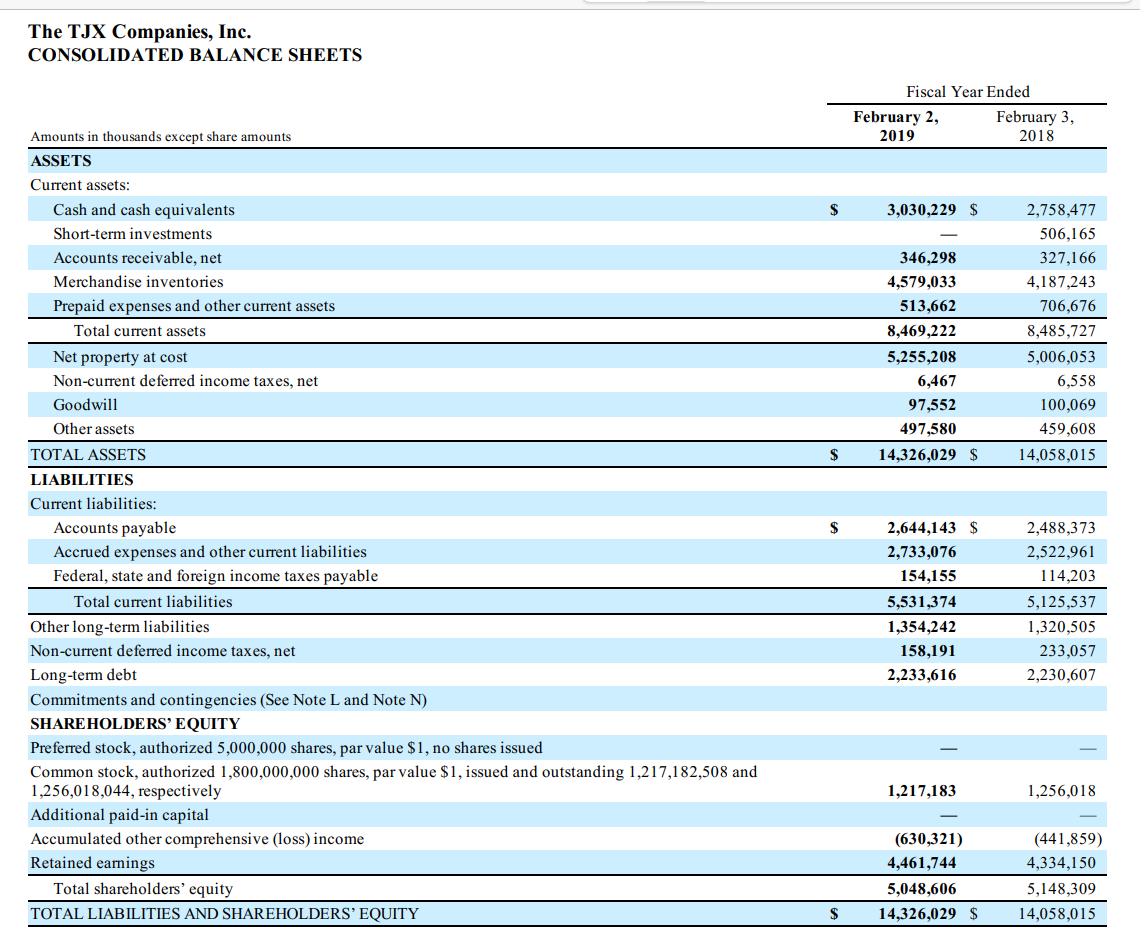

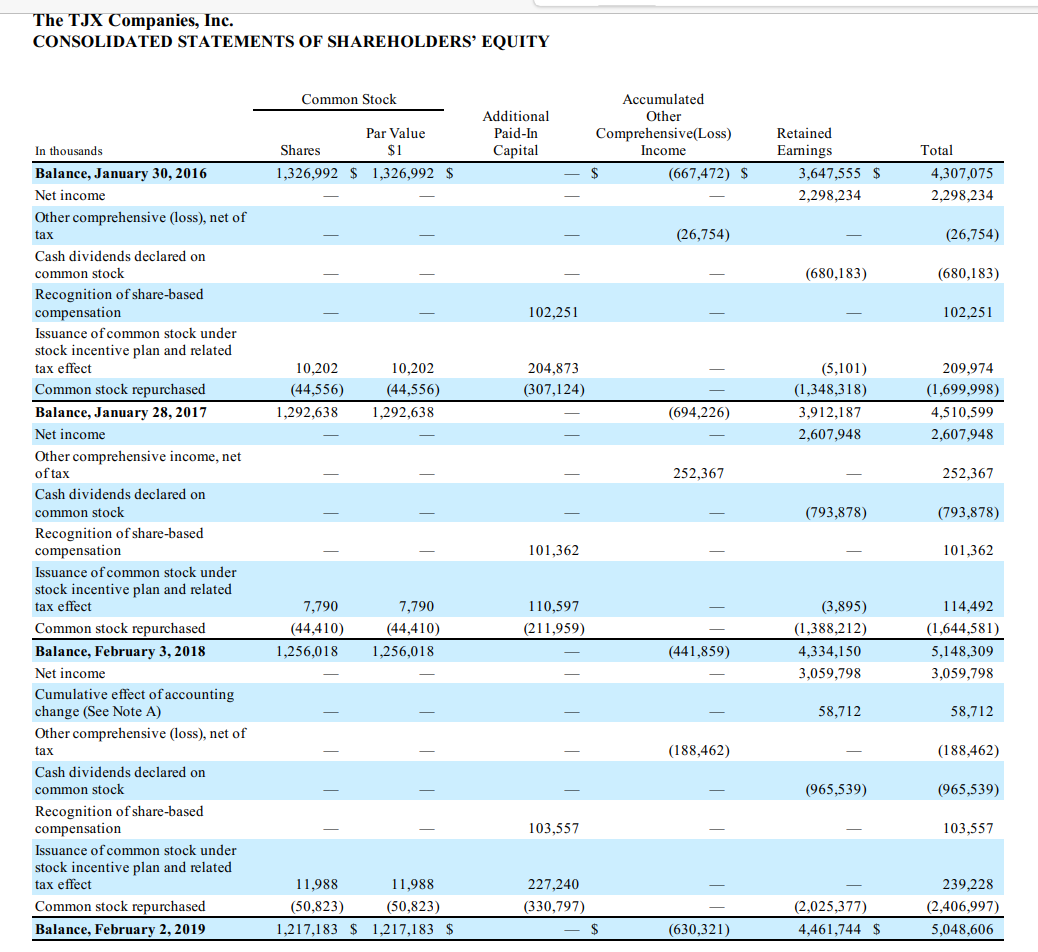

Calculate TJX Companies' current year return on equity, return on assets, net profit margin, and earnings quality, using TJX Companies' Financial Statements attached. You will

Calculate TJX Companies' current year return on equity, return on assets, net profit margin, and earnings quality, using TJX Companies' Financial Statements attached.

You will also need the following amounts for their FYE 2017: Total stockholders' equity $4,510,599 and total assets $12,883,808. Round the ROE, ROA, and net profit margin to tenths of a percent, and the earnings quality to hundredths.

Net income $ 3,059,798 February 2, 2019

Net income$ 2,607,948 February 3, 2018

Net income $ 2,298,234 January 28, 2017

| Ratio | 2019 | 2018 |

|---|---|---|

| ROE | % | % |

| Ratio | 2019 | 2018 |

|---|---|---|

| ROA | % | % |

| Ratio | 2019 | 2018 |

|---|---|---|

| Net Profit Margin | 7.9% | % |

| Ratio | 2019 | 2018 |

|---|---|---|

| Earnings Quality |

The TJX Companies, Inc. CONSOLIDATED STATEMENTS OF INCOME The TJX Companies, Inc. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME The TJX Companies, Inc. CONSOLIDATED BALANCE SHEETS The TJX Companies, Inc. CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY The TJX Companies, Inc. CONSOLIDATED STATEMENTS OF INCOME The TJX Companies, Inc. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME The TJX Companies, Inc. CONSOLIDATED BALANCE SHEETS The TJX Companies, Inc. CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY

The TJX Companies, Inc. CONSOLIDATED STATEMENTS OF INCOME The TJX Companies, Inc. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME The TJX Companies, Inc. CONSOLIDATED BALANCE SHEETS The TJX Companies, Inc. CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY The TJX Companies, Inc. CONSOLIDATED STATEMENTS OF INCOME The TJX Companies, Inc. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME The TJX Companies, Inc. CONSOLIDATED BALANCE SHEETS The TJX Companies, Inc. CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started