Answered step by step

Verified Expert Solution

Question

1 Approved Answer

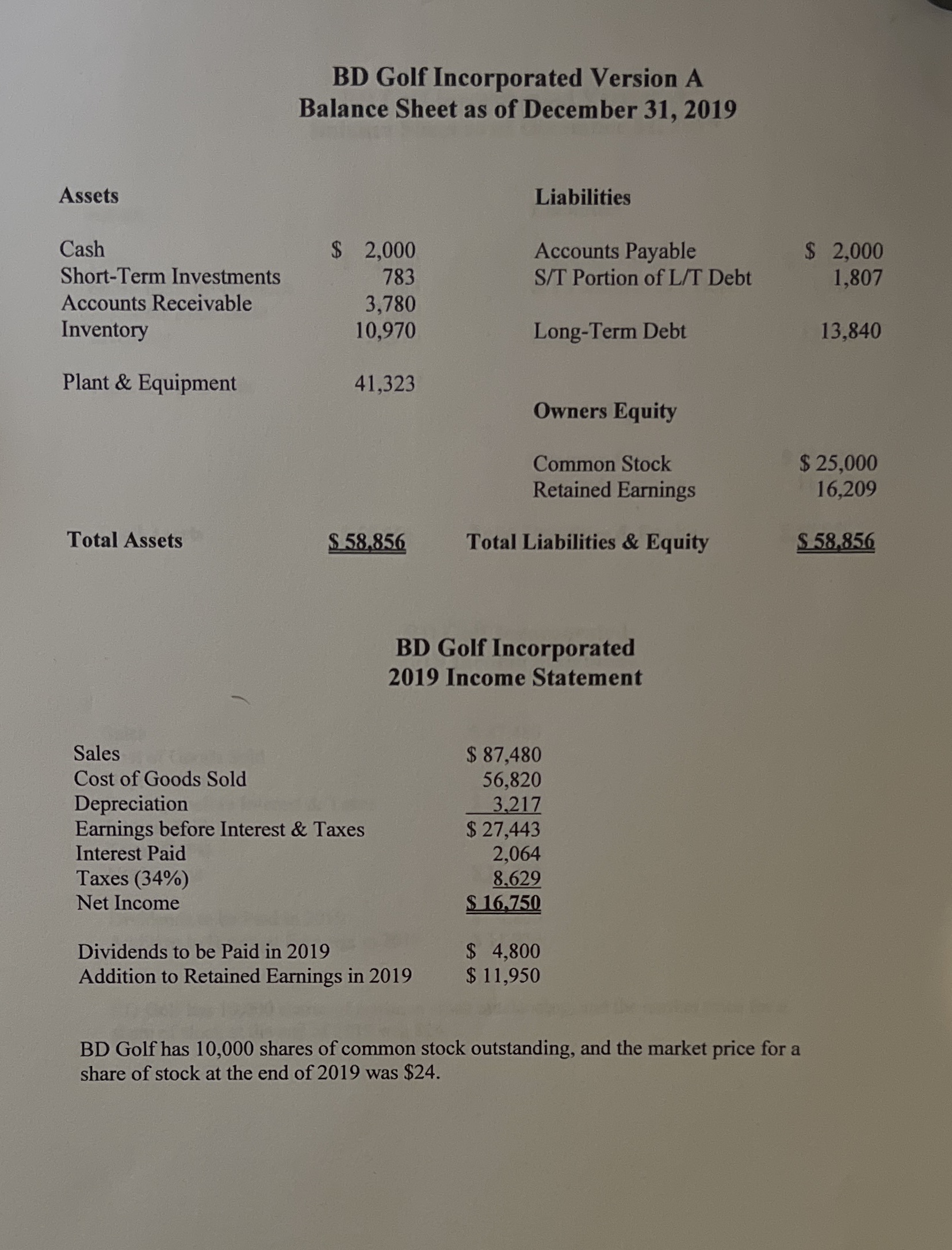

Calculate Total Asset Turnover Calculate Total Deb RatioCalculate Equity Multiplier Assets BD Golf Incorporated Version A Balance Sheet as of December 31, 2019 Liabilities Cash

Calculate Total Asset Turnover Calculate Total Deb RatioCalculate Equity Multiplier

Assets BD Golf Incorporated Version A Balance Sheet as of December 31, 2019 Liabilities Cash $ 2,000 Accounts Payable $ 2,000 Short-Term Investments 783 S/T Portion of L/T Debt 1,807 Accounts Receivable 3,780 Inventory 10,970 Long-Term Debt 13,840 Plant & Equipment 41,323 Owners Equity Common Stock Retained Earnings $ 25,000 16,209 Total Assets $58,856 Total Liabilities & Equity $ 58.856 Sales Cost of Goods Sold Depreciation Earnings before Interest & Taxes Interest Paid Taxes (34%) BD Golf Incorporated 2019 Income Statement $ 87,480 56,820 3,217 $ 27,443 2,064 8.629 Net Income Dividends to be Paid in 2019 $ 16,750 $ 4,800 Addition to Retained Earnings in 2019 $ 11,950 BD Golf has 10,000 shares of common stock outstanding, and the market price for a share of stock at the end of 2019 was $24.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the Total Asset Turnover Total Debt Ratio and Equity Multiplier for BD Golf Incorporate...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started