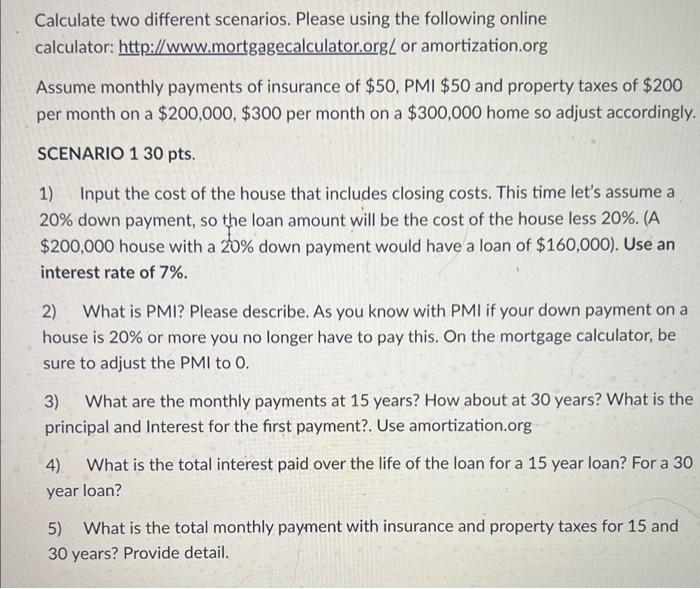

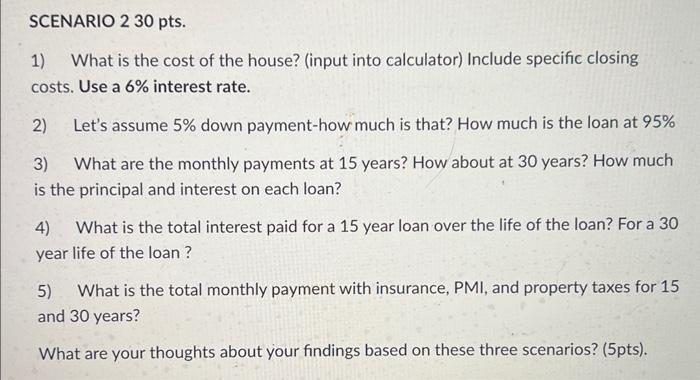

Calculate two different scenarios. Please using the following online calculator: http:///www.mortgagecalculator.orgL or amortization.org Assume monthly payments of insurance of $50,PMI$50 and property taxes of $200 per month on a $200,000,$300 per month on a $300,000 home so adjust accordingly. SCENARIO 130pts. 1) Input the cost of the house that includes closing costs. This time let's assume a 20% down payment, so the loan amount will be the cost of the house less 20%. (A $200,000 house with a 20% down payment would have a loan of $160,000 ). Use an interest rate of 7%. 2) What is PMI? Please describe. As you know with PMI if your down payment on a house is 20% or more you no longer have to pay this. On the mortgage calculator, be sure to adjust the PMI to 0 . 3) What are the monthly payments at 15 years? How about at 30 years? What is the principal and Interest for the first payment?. Use amortization.org 4) What is the total interest paid over the life of the loan for a 15 year loan? For a 30 year loan? 5) What is the total monthly payment with insurance and property taxes for 15 and 30 years? Provide detail. SCENARIO 230 pts. 1) What is the cost of the house? (input into calculator) Include specific closing costs. Use a 6% interest rate. 2) Let's assume 5% down payment-how much is that? How much is the loan at 95% 3) What are the monthly payments at 15 years? How about at 30 years? How much is the principal and interest on each loan? 4) What is the total interest paid for a 15 year loan over the life of the loan? For a 30 year life of the loan? 5) What is the total monthly payment with insurance, PMI, and property taxes for 15 and 30 years? What are your thoughts about your findings based on these three scenarios? (5pts). Calculate two different scenarios. Please using the following online calculator: http:///www.mortgagecalculator.orgL or amortization.org Assume monthly payments of insurance of $50,PMI$50 and property taxes of $200 per month on a $200,000,$300 per month on a $300,000 home so adjust accordingly. SCENARIO 130pts. 1) Input the cost of the house that includes closing costs. This time let's assume a 20% down payment, so the loan amount will be the cost of the house less 20%. (A $200,000 house with a 20% down payment would have a loan of $160,000 ). Use an interest rate of 7%. 2) What is PMI? Please describe. As you know with PMI if your down payment on a house is 20% or more you no longer have to pay this. On the mortgage calculator, be sure to adjust the PMI to 0 . 3) What are the monthly payments at 15 years? How about at 30 years? What is the principal and Interest for the first payment?. Use amortization.org 4) What is the total interest paid over the life of the loan for a 15 year loan? For a 30 year loan? 5) What is the total monthly payment with insurance and property taxes for 15 and 30 years? Provide detail. SCENARIO 230 pts. 1) What is the cost of the house? (input into calculator) Include specific closing costs. Use a 6% interest rate. 2) Let's assume 5% down payment-how much is that? How much is the loan at 95% 3) What are the monthly payments at 15 years? How about at 30 years? How much is the principal and interest on each loan? 4) What is the total interest paid for a 15 year loan over the life of the loan? For a 30 year life of the loan? 5) What is the total monthly payment with insurance, PMI, and property taxes for 15 and 30 years? What are your thoughts about your findings based on these three scenarios? (5pts)