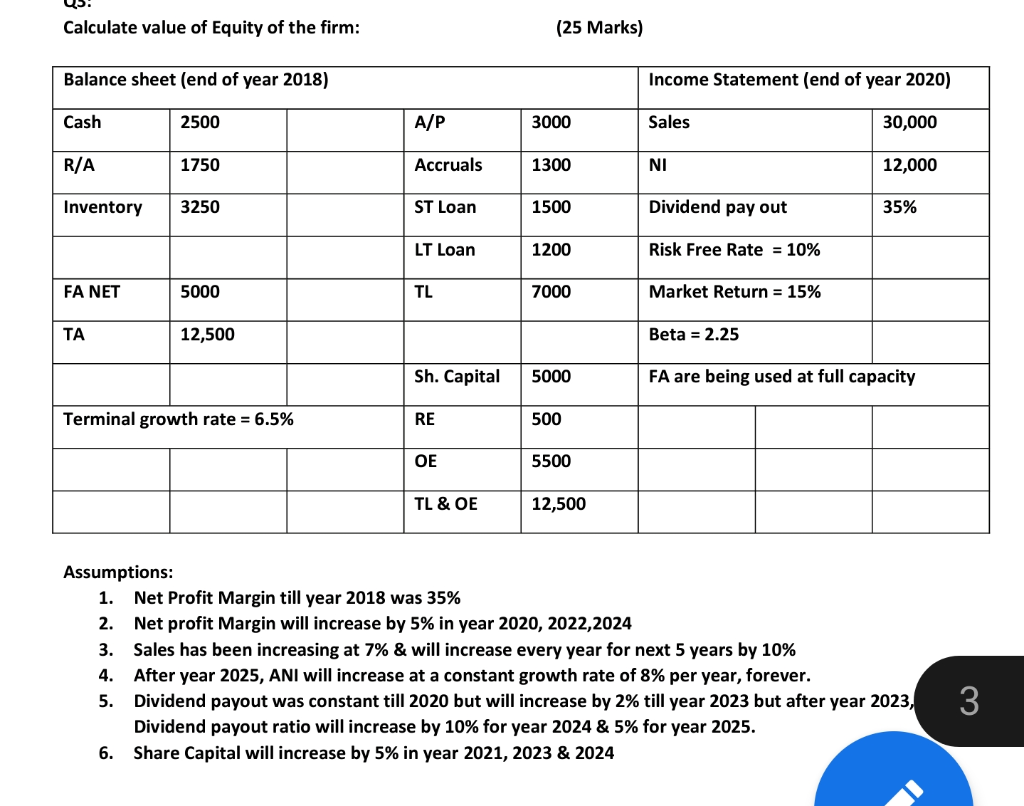

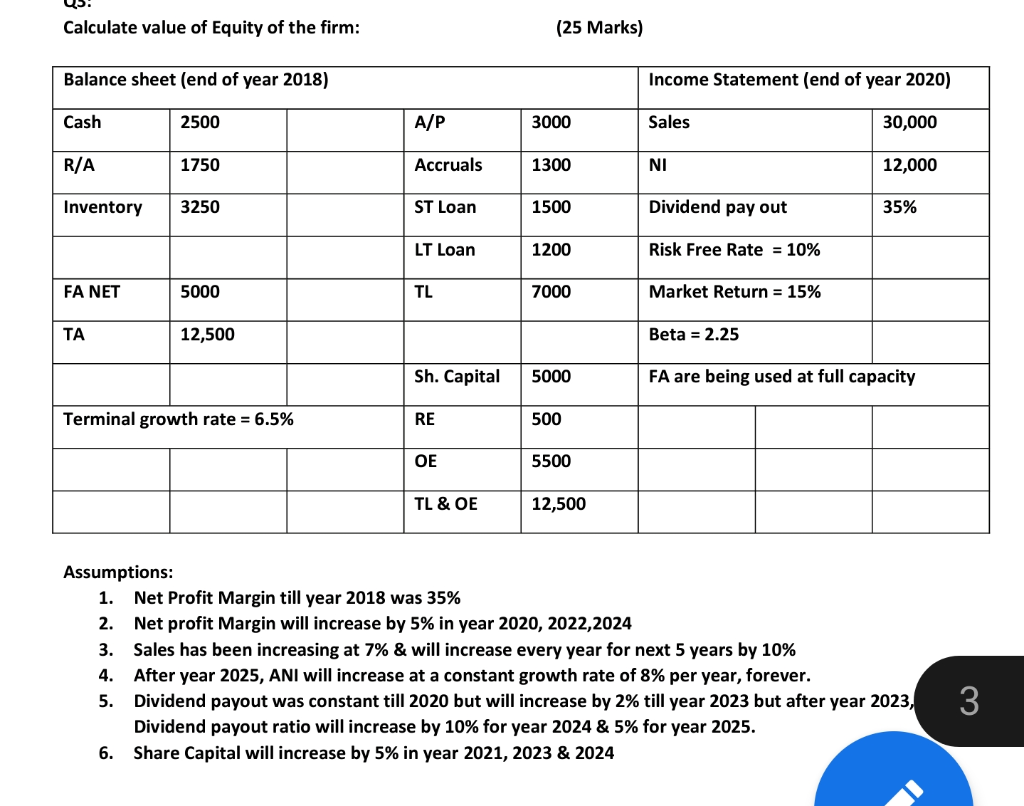

Calculate value of Equity of the firm: (25 Marks) Balance sheet (end of year 2018) Income Statement (end of year 2020) Cash 2500 A/P 3000 Sales 30,000 R/A 1750 Accruals 1300 NI 12,000 Inventory 3250 ST Loan 1500 Dividend pay out 35% LT Loan 1200 Risk Free Rate = 10% FA NET 5000 TL 7000 Market Return = 15% TA 12,500 Beta = 2.25 Sh. Capital 5000 FA are being used at full capacity Terminal growth rate = 6.5% RE 500 OE 5500 TL & OE 12,500 Assumptions: 1. Net Profit Margin till year 2018 was 35% 2. Net profit Margin will increase by 5% in year 2020, 2022,2024 3. Sales has been increasing at 7% & will increase every year for next 5 years by 10% 4. After year 2025, ANI will increase at a constant growth rate of 8% per year, forever. 5. Dividend payout was constant till 2020 but will increase by 2% till year 2023 but after year 2023, Dividend payout ratio will increase by 10% for year 2024 & 5% for year 2025. 6. Share Capital will increase by 5% in year 2021, 2023 & 2024 3 Calculate value of Equity of the firm: (25 Marks) Balance sheet (end of year 2018) Income Statement (end of year 2020) Cash 2500 A/P 3000 Sales 30,000 R/A 1750 Accruals 1300 NI 12,000 Inventory 3250 ST Loan 1500 Dividend pay out 35% LT Loan 1200 Risk Free Rate = 10% FA NET 5000 TL 7000 Market Return = 15% TA 12,500 Beta = 2.25 Sh. Capital 5000 FA are being used at full capacity Terminal growth rate = 6.5% RE 500 OE 5500 TL & OE 12,500 Assumptions: 1. Net Profit Margin till year 2018 was 35% 2. Net profit Margin will increase by 5% in year 2020, 2022,2024 3. Sales has been increasing at 7% & will increase every year for next 5 years by 10% 4. After year 2025, ANI will increase at a constant growth rate of 8% per year, forever. 5. Dividend payout was constant till 2020 but will increase by 2% till year 2023 but after year 2023, Dividend payout ratio will increase by 10% for year 2024 & 5% for year 2025. 6. Share Capital will increase by 5% in year 2021, 2023 & 2024 3