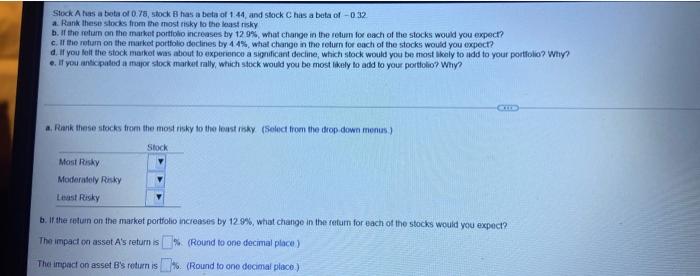

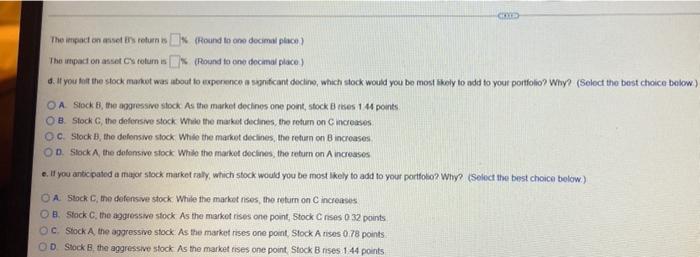

Stock Alusa bots of 0.78, stock Bhas a bets of 1.44, and stock Chas a bota of -032 Rank these stocks from the most risky to the least risky h. If the return on the market portfolio increases by 129%, what change in the return for each of the stocks would you expect? c. If the return on the market portfolio declines by 44%, what change in the return for each of the stocks would you expect? d. If you tell the stock market was about to experience a significant decline, which stock would you be most likely to add to your portfolio? Why? e. If you anticipated a major stock market rally, which stock would you be most likely to add to your portfolio Why? a. Rank these stocks from the most risky to the least risky (Select from the drop down menus) Stock Most Risky Moderately Risky Least Risky b. If the return on the market portfolio increases by 12 9%, what change in the return for each of the stocks would you expect? The impact on asset A's retumis (Round to one decimal place) The impact on asset B's return is II (Round to ono decimal place) mo The impact on et returns * {Round to one decimal place The impact on at Crotum (Round to one decimal place) d. It you hit the stock market was about to experience a significant decline, which stock would you be most likely to add to your portfoho? Why? (Select the best choice below) O A Stock B, the aggressive stock As the market declines one point, stock Bros 1 points OB. Stock C, the defensive stock Who the market decines, the retum on Cincreases OC Stock B the defensive stock While the market decines the return on Bincreases On Stock A the defensivo stock While the market decines, the return on A increases e. If you antic pated a major stock market rally, which stock would you be most likely to add to your portfolio? Why? (Select the best choice below) O A Stock C, the defensive stock While the market rises, the return on increases OB. Stock C, the aggressive stock As the market rises one point, Stock Cnses 032 points OC Stock A the aggressive stock. As the market rises one point Stock Arises 078 points OD Stock the aggressive stock. As the market rises one point Stock Brises 1 44 points Stock Alusa bots of 0.78, stock Bhas a bets of 1.44, and stock Chas a bota of -032 Rank these stocks from the most risky to the least risky h. If the return on the market portfolio increases by 129%, what change in the return for each of the stocks would you expect? c. If the return on the market portfolio declines by 44%, what change in the return for each of the stocks would you expect? d. If you tell the stock market was about to experience a significant decline, which stock would you be most likely to add to your portfolio? Why? e. If you anticipated a major stock market rally, which stock would you be most likely to add to your portfolio Why? a. Rank these stocks from the most risky to the least risky (Select from the drop down menus) Stock Most Risky Moderately Risky Least Risky b. If the return on the market portfolio increases by 12 9%, what change in the return for each of the stocks would you expect? The impact on asset A's retumis (Round to one decimal place) The impact on asset B's return is II (Round to ono decimal place) mo The impact on et returns * {Round to one decimal place The impact on at Crotum (Round to one decimal place) d. It you hit the stock market was about to experience a significant decline, which stock would you be most likely to add to your portfoho? Why? (Select the best choice below) O A Stock B, the aggressive stock As the market declines one point, stock Bros 1 points OB. Stock C, the defensive stock Who the market decines, the retum on Cincreases OC Stock B the defensive stock While the market decines the return on Bincreases On Stock A the defensivo stock While the market decines, the return on A increases e. If you antic pated a major stock market rally, which stock would you be most likely to add to your portfolio? Why? (Select the best choice below) O A Stock C, the defensive stock While the market rises, the return on increases OB. Stock C, the aggressive stock As the market rises one point, Stock Cnses 032 points OC Stock A the aggressive stock. As the market rises one point Stock Arises 078 points OD Stock the aggressive stock. As the market rises one point Stock Brises 1 44 points