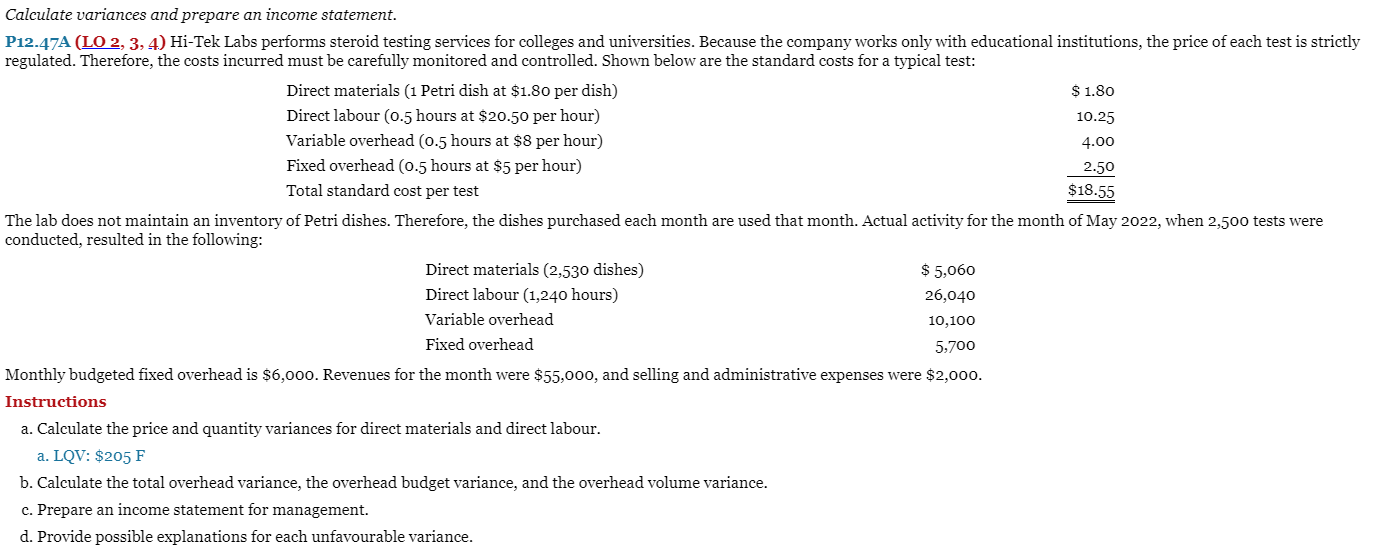

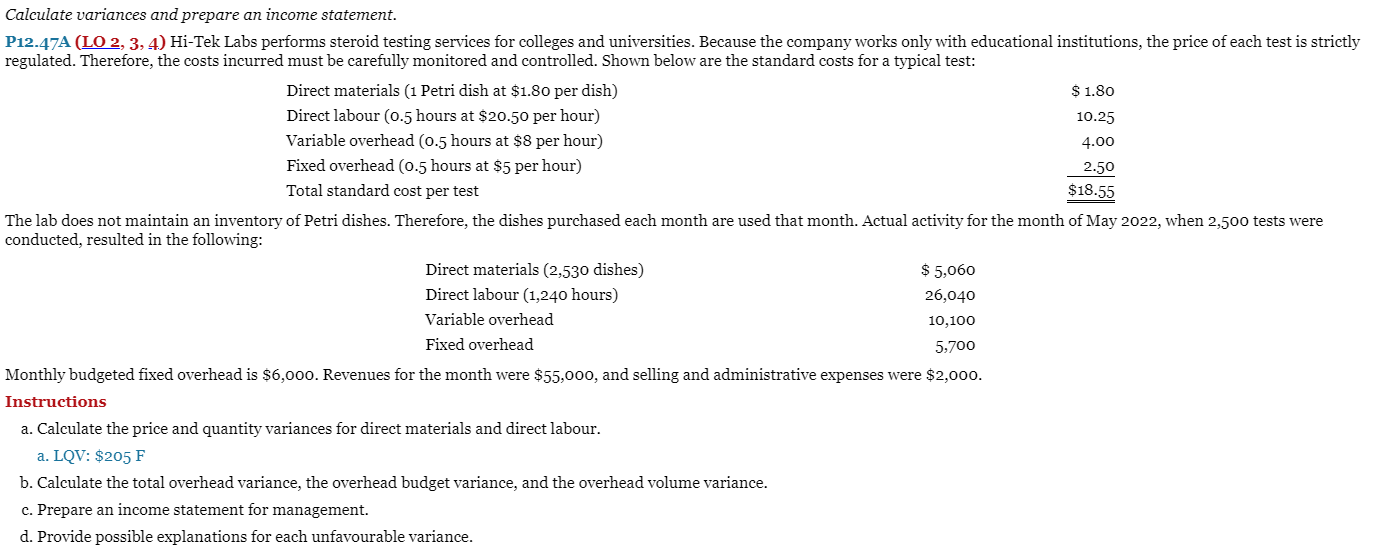

Calculate variances and prepare an income statement. P12.47A (LO 2, 3, 4) Hi-Tek Labs performs steroid testing services for colleges and universities. Because the company works only with educational institutions, the price of each test is strictly regulated. Therefore, the costs incurred must be carefully monitored and controlled. Shown below are the standard costs for a typical test: I I I F J The lab does not maintain an inventory of Petri dishes. Therefore, the dishes purchased each month are used that month. Actual activity for the month of May 2022, when 2,50o tests were conducted, resulted in the following: Monthly budgeted fixed overhead is $6,000. Revenues for the month were $55,000, and selling and administrative expenses were $2,000. Instructions a. Calculate the price and quantity variances for direct materials and direct labour. a. LQV: $205F b. Calculate the total overhead variance, the overhead budget variance, and the overhead volume variance. c. Prepare an income statement for management. d. Provide possible explanations for each unfavourable variance. Calculate variances and prepare an income statement. P12.47A (LO 2, 3, 4) Hi-Tek Labs performs steroid testing services for colleges and universities. Because the company works only with educational institutions, the price of each test is strictly regulated. Therefore, the costs incurred must be carefully monitored and controlled. Shown below are the standard costs for a typical test: I I I F J The lab does not maintain an inventory of Petri dishes. Therefore, the dishes purchased each month are used that month. Actual activity for the month of May 2022, when 2,50o tests were conducted, resulted in the following: Monthly budgeted fixed overhead is $6,000. Revenues for the month were $55,000, and selling and administrative expenses were $2,000. Instructions a. Calculate the price and quantity variances for direct materials and direct labour. a. LQV: $205F b. Calculate the total overhead variance, the overhead budget variance, and the overhead volume variance. c. Prepare an income statement for management. d. Provide possible explanations for each unfavourable variance