Answered step by step

Verified Expert Solution

Question

1 Approved Answer

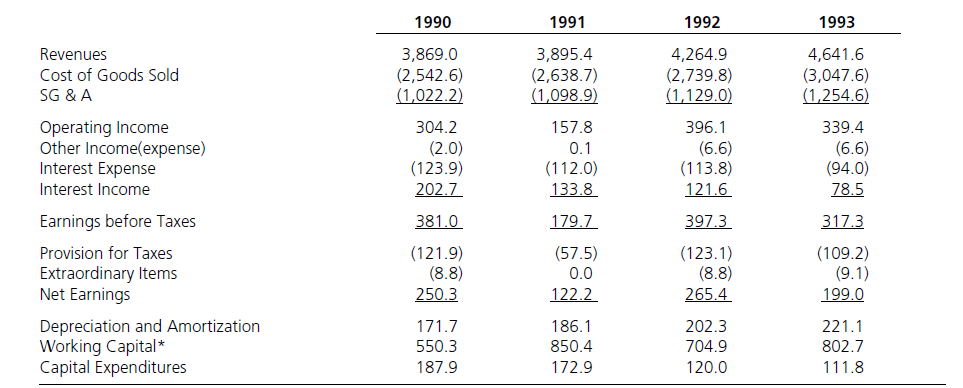

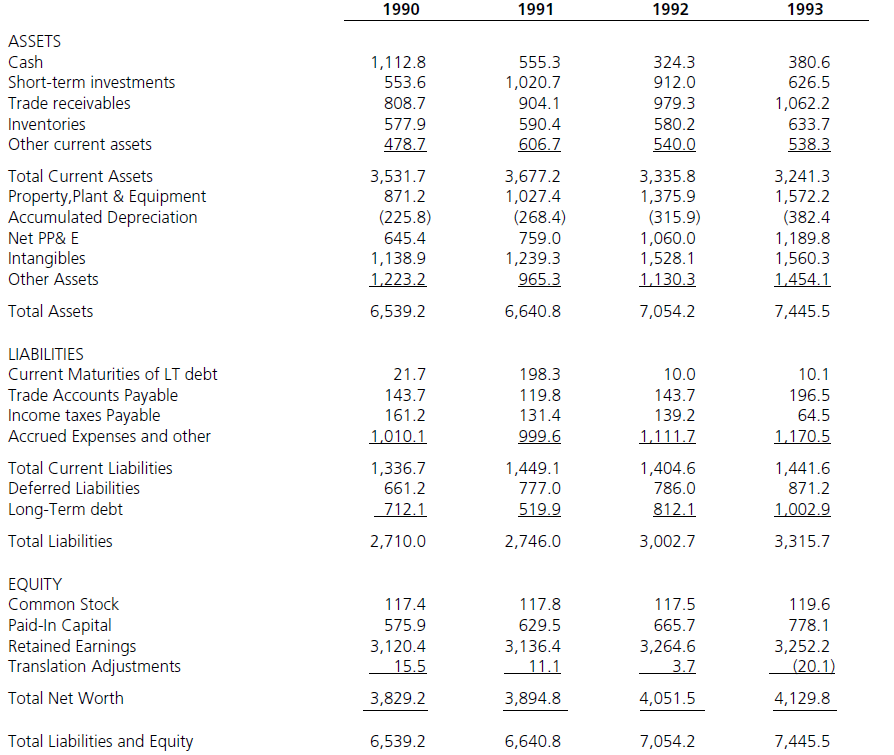

Calculate WACC & DCF using the following variables: Marginal Tax Rate = 37% Equity Market Risk-Premium = 7% 1990 1991 1992 1993 Revenues Cost of

Calculate WACC & DCF using the following variables:

Marginal Tax Rate = 37% Equity Market Risk-Premium = 7%

1990 1991 1992 1993 Revenues Cost of Goods Sold SG & A 3,869.0 (2,542.6) (1,022.2) 4,264.9 (2,739.8) (1,129.0) 4,641.6 (3,047.6) (1,254.6) 304.2 (2.0) (123.9) 202.7 3,895.4 (2,638.7) (1,098.9) 157.8 0.1 (112.0) 133.8 396.1 (6.6) (113.8) 121.6 339.4 (6.6) (94.0) 78.5 381.0 179.7 397.3 317.3 Operating Income Other Income(expense) Interest Expense Interest Income Earnings before Taxes Provision for Taxes Extraordinary Items Net Earnings Depreciation and Amortization Working Capital* Capital Expenditures (121.9) (8.8) 250.3 (57.5) 0.0 122.2 (123.1) (8.8) 265.4 (109.2) (9.1) 199.0 171.7 550.3 187.9 186.1 850.4 172.9 202.3 704.9 120.0 221.1 802.7 111.8 1990 1991 1992 1993 1,112.8 553.6 808.7 577.9 478.7 324.3 912.0 979.3 580.2 540.0 ASSETS Cash Short-term investments Trade receivables Inventories Other current assets Total Current Assets Property, Plant & Equipment Accumulated Depreciation Net PP& E Intangibles Other Assets Total Assets 3,531.7 871.2 (225.8) 645.4 1,138.9 1.223.2 6,539.2 555.3 1,020.7 904.1 590.4 606.7 3,677.2 1,027.4 (268.4) 759.0 1,239.3 965.3 3,335.8 1,375.9 (315.9) 1,060.0 1,528.1 1,130.3 380.6 626.5 1,062.2 633.7 538.3 3,241.3 1,572.2 (382.4 1,189.8 1,560.3 1,454.1 7,445.5 6,640.8 7,054.2 21.7 143.7 161.2 1,010.1 1,336.7 661.2 712.1 198.3 119.8 131.4 999.6 10.0 143.7 139.2 1.111.7 LIABILITIES Current Maturities of LT debt Trade Accounts Payable Income taxes Payable Accrued Expenses and other Total Current Liabilities Deferred Liabilities Long-Term debt Total Liabilities 10.1 196.5 64.5 1,170.5 1,449.1 777.0 519.9 1,404.6 786.0 812.1 1,441.6 871.2 1,002.9 3,315.7 2,710.0 2,746.0 3,002.7 EQUITY Common Stock Paid-In Capital Retained Earnings Translation Adjustments Total Net Worth 117.4 575.9 3,120.4 15.5 117.8 629.5 3,136.4 11.1 117.5 665.7 3,264.6 3.7 119.6 778.1 3,252.2 (20.1) 3,829.2 3,894.8 4,051.5 4,129.8 Total Liabilities and Equity 6,539.2 6,640.8 7,054.2 7,445.5 1990 1991 1992 1993 Revenues Cost of Goods Sold SG & A 3,869.0 (2,542.6) (1,022.2) 4,264.9 (2,739.8) (1,129.0) 4,641.6 (3,047.6) (1,254.6) 304.2 (2.0) (123.9) 202.7 3,895.4 (2,638.7) (1,098.9) 157.8 0.1 (112.0) 133.8 396.1 (6.6) (113.8) 121.6 339.4 (6.6) (94.0) 78.5 381.0 179.7 397.3 317.3 Operating Income Other Income(expense) Interest Expense Interest Income Earnings before Taxes Provision for Taxes Extraordinary Items Net Earnings Depreciation and Amortization Working Capital* Capital Expenditures (121.9) (8.8) 250.3 (57.5) 0.0 122.2 (123.1) (8.8) 265.4 (109.2) (9.1) 199.0 171.7 550.3 187.9 186.1 850.4 172.9 202.3 704.9 120.0 221.1 802.7 111.8 1990 1991 1992 1993 1,112.8 553.6 808.7 577.9 478.7 324.3 912.0 979.3 580.2 540.0 ASSETS Cash Short-term investments Trade receivables Inventories Other current assets Total Current Assets Property, Plant & Equipment Accumulated Depreciation Net PP& E Intangibles Other Assets Total Assets 3,531.7 871.2 (225.8) 645.4 1,138.9 1.223.2 6,539.2 555.3 1,020.7 904.1 590.4 606.7 3,677.2 1,027.4 (268.4) 759.0 1,239.3 965.3 3,335.8 1,375.9 (315.9) 1,060.0 1,528.1 1,130.3 380.6 626.5 1,062.2 633.7 538.3 3,241.3 1,572.2 (382.4 1,189.8 1,560.3 1,454.1 7,445.5 6,640.8 7,054.2 21.7 143.7 161.2 1,010.1 1,336.7 661.2 712.1 198.3 119.8 131.4 999.6 10.0 143.7 139.2 1.111.7 LIABILITIES Current Maturities of LT debt Trade Accounts Payable Income taxes Payable Accrued Expenses and other Total Current Liabilities Deferred Liabilities Long-Term debt Total Liabilities 10.1 196.5 64.5 1,170.5 1,449.1 777.0 519.9 1,404.6 786.0 812.1 1,441.6 871.2 1,002.9 3,315.7 2,710.0 2,746.0 3,002.7 EQUITY Common Stock Paid-In Capital Retained Earnings Translation Adjustments Total Net Worth 117.4 575.9 3,120.4 15.5 117.8 629.5 3,136.4 11.1 117.5 665.7 3,264.6 3.7 119.6 778.1 3,252.2 (20.1) 3,829.2 3,894.8 4,051.5 4,129.8 Total Liabilities and Equity 6,539.2 6,640.8 7,054.2 7,445.5Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started