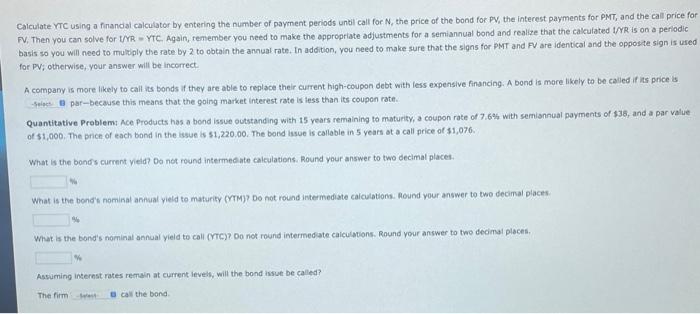

Calculate YTC using a finandal calculator by entering the number of payment periods unbil call for N, the price of the bond for PV, the interest payments for PMT, and the call price for FV, Then you can solve for UMR = YTC. Again, remember you need to make the oppropriate adjustments for a semiannual bond and realize that the calculated t/R is on a periodic basis so you will need to muliply the rate by 2 to obtain the annual rate. In addition, you need to make sure that the slgns for pNT and FV are identical and the opposte sign is ured for PV; otherwise, your answer will be incorrect A company is more likely to call its bonds if they are able to replace their current high-coupon debt with less expensive financing. A bond is more likely to be calied if its price is par-because this means that the gaing market interest rate is less than its coupon rate. Quantitative Problemy Ace Products has a bond issue outstanding with 15 years remaining to maturity, a coupon rate of 7.6% with semiannual payments of 336 , and a par value of $1,000. The prich of each band in the issue is $1,220,00. The bond lasue is callable in 5 years of a call price of $1,076. What is the bonds curnent vield? Do not round intermee ate calculations. Round your answer to two decimal places. What is the bond's nominal annual yield to maturity (rTM)? Do not round intermediate caiculations. Aound your answer to two decimal places. What is the bond's nominal annual yieid to call (rrc)? Do not round intermedate caiculations. Round your answer to two decimal places. Assuming interest rotes remsin at current leveib, will the bond issue be caled? The firm call the bona. Calculate YTC using a finandal calculator by entering the number of payment periods unbil call for N, the price of the bond for PV, the interest payments for PMT, and the call price for FV, Then you can solve for UMR = YTC. Again, remember you need to make the oppropriate adjustments for a semiannual bond and realize that the calculated t/R is on a periodic basis so you will need to muliply the rate by 2 to obtain the annual rate. In addition, you need to make sure that the slgns for pNT and FV are identical and the opposte sign is ured for PV; otherwise, your answer will be incorrect A company is more likely to call its bonds if they are able to replace their current high-coupon debt with less expensive financing. A bond is more likely to be calied if its price is par-because this means that the gaing market interest rate is less than its coupon rate. Quantitative Problemy Ace Products has a bond issue outstanding with 15 years remaining to maturity, a coupon rate of 7.6% with semiannual payments of 336 , and a par value of $1,000. The prich of each band in the issue is $1,220,00. The bond lasue is callable in 5 years of a call price of $1,076. What is the bonds curnent vield? Do not round intermee ate calculations. Round your answer to two decimal places. What is the bond's nominal annual yield to maturity (rTM)? Do not round intermediate caiculations. Aound your answer to two decimal places. What is the bond's nominal annual yieid to call (rrc)? Do not round intermedate caiculations. Round your answer to two decimal places. Assuming interest rotes remsin at current leveib, will the bond issue be caled? The firm call the bona