Question

Calculating a Required Minimum Distribution from a Traditional IRA Kevin is age 73 in 2023. On December 31, 2022, he owned a Traditional IRA that

Calculating a Required Minimum Distribution from a Traditional IRA

Kevin is age 73 in 2023. On December 31, 2022, he owned a Traditional IRA that had a value of $750,000. What is the Required Minimum Distribution amount Kevin must take for calendar year 2023?

Assume that it is now one year later and Kevin is one year older. Further, assume that the value of his Traditional IRA on December 31, 2023 is now $800,000. What is the Required Minimum Distribution amount Kevin must take for calendar year 2024?

For both calculations, please show how you calculated these Required Minimum Distribution amounts? Below is a link to the IRS Unified Lifetime Table, which you will need to calculate Required Minimum Distribution amounts.

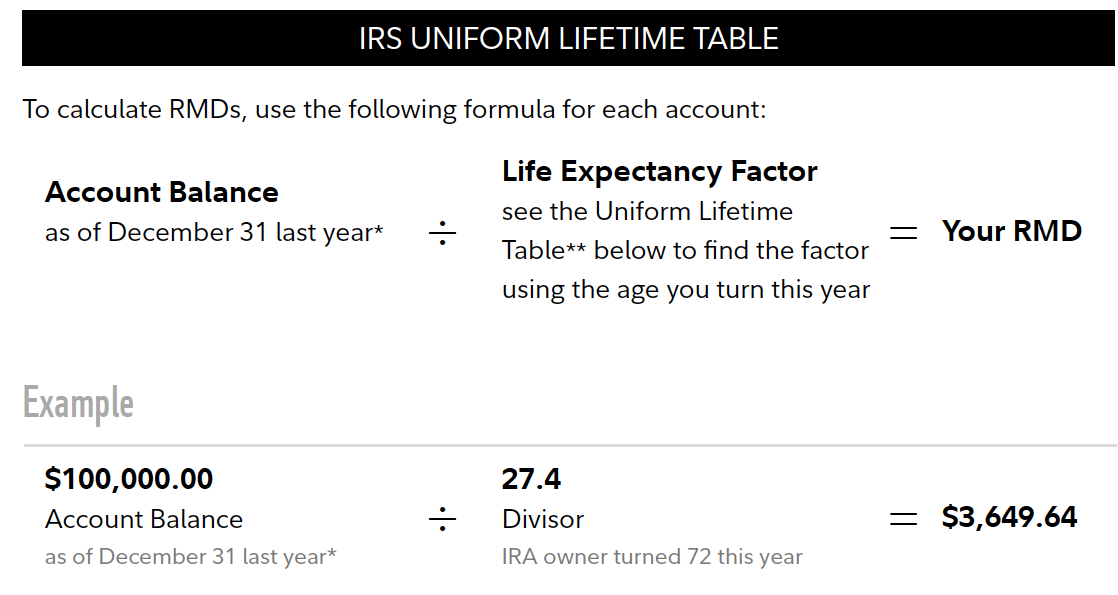

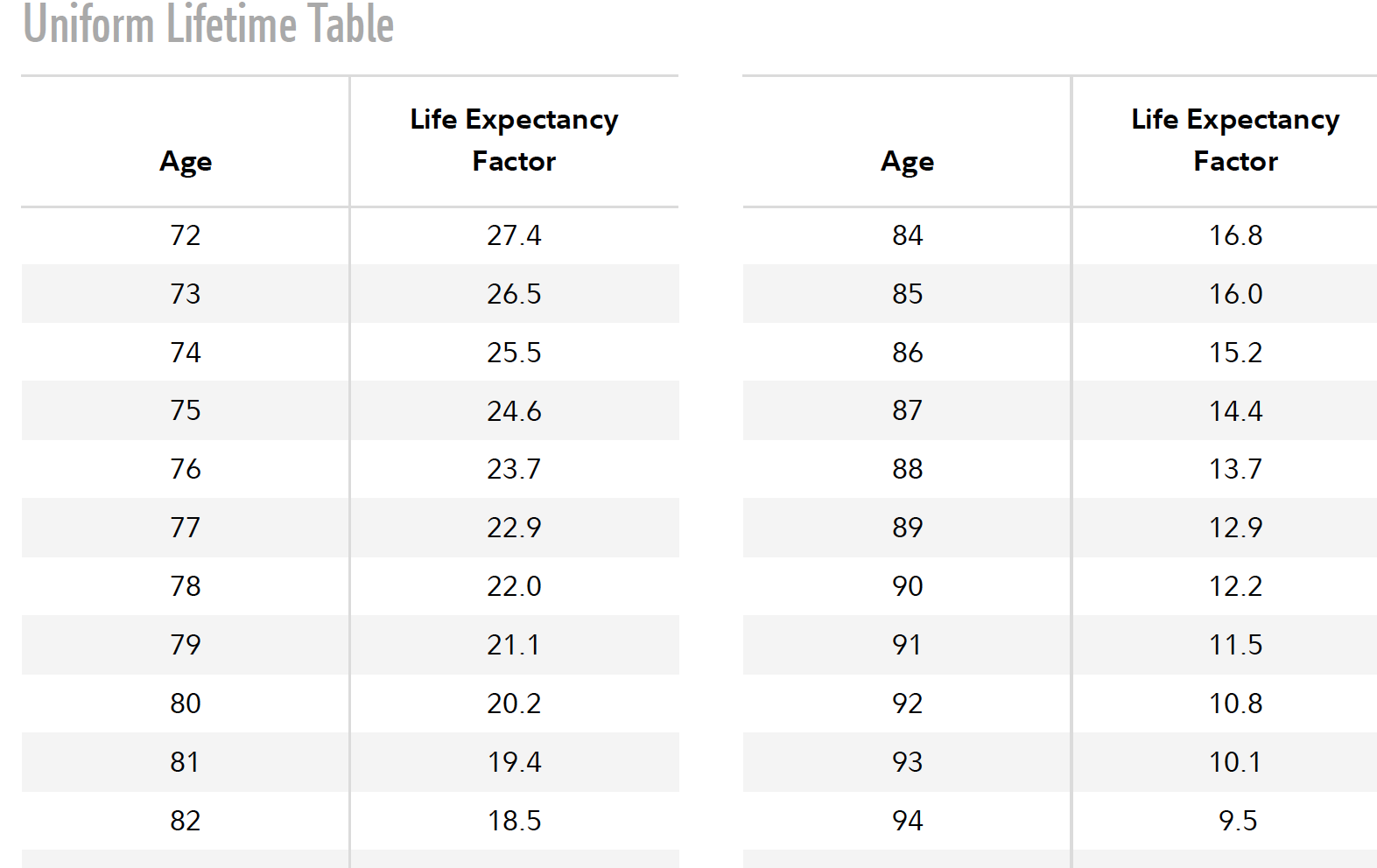

To calculate RMDs, use the following formula for each account: Example Uniform Lifetime Table

To calculate RMDs, use the following formula for each account: Example Uniform Lifetime Table Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started