Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculating 'cash flows at the start' The following information relates to TTA Corporation (TTA): TTA is considering building a new factory. Over the past three

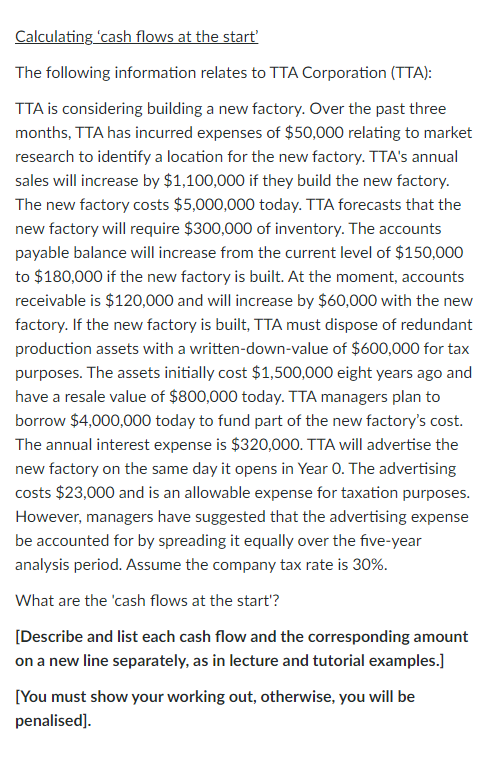

Calculating 'cash flows at the start' The following information relates to TTA Corporation (TTA): TTA is considering building a new factory. Over the past three months, TTA has incurred expenses of $50,000 relating to market research to identify a location for the new factory. TTA's annual sales will increase by $1,100,000 if they build the new factory. The new factory costs $5,000,000 today. TTA forecasts that the new factory will require $300,000 of inventory. The accounts payable balance will increase from the current level of $150,000 to $180,000 if the new factory is built. At the moment, accounts receivable is $120,000 and will increase by $60,000 with the new factory. If the new factory is built, TTA must dispose of redundant production assets with a written-down-value of $600,000 for tax purposes. The assets initially cost $1,500,000 eight years ago and have a resale value of $800,000 today. TTA managers plan to borrow $4,000,000 today to fund part of the new factory's cost. The annual interest expense is $320,000. TTA will advertise the new factory on the same day it opens in Year 0 . The advertising costs $23,000 and is an allowable expense for taxation purposes. However, managers have suggested that the advertising expense be accounted for by spreading it equally over the five-year analysis period. Assume the company tax rate is 30%. What are the 'cash flows at the start'? [Describe and list each cash flow and the corresponding amount on a new line separately, as in lecture and tutorial examples.] [You must show your working out, otherwise, you will be penalised]

Calculating 'cash flows at the start' The following information relates to TTA Corporation (TTA): TTA is considering building a new factory. Over the past three months, TTA has incurred expenses of $50,000 relating to market research to identify a location for the new factory. TTA's annual sales will increase by $1,100,000 if they build the new factory. The new factory costs $5,000,000 today. TTA forecasts that the new factory will require $300,000 of inventory. The accounts payable balance will increase from the current level of $150,000 to $180,000 if the new factory is built. At the moment, accounts receivable is $120,000 and will increase by $60,000 with the new factory. If the new factory is built, TTA must dispose of redundant production assets with a written-down-value of $600,000 for tax purposes. The assets initially cost $1,500,000 eight years ago and have a resale value of $800,000 today. TTA managers plan to borrow $4,000,000 today to fund part of the new factory's cost. The annual interest expense is $320,000. TTA will advertise the new factory on the same day it opens in Year 0 . The advertising costs $23,000 and is an allowable expense for taxation purposes. However, managers have suggested that the advertising expense be accounted for by spreading it equally over the five-year analysis period. Assume the company tax rate is 30%. What are the 'cash flows at the start'? [Describe and list each cash flow and the corresponding amount on a new line separately, as in lecture and tutorial examples.] [You must show your working out, otherwise, you will be penalised] Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started