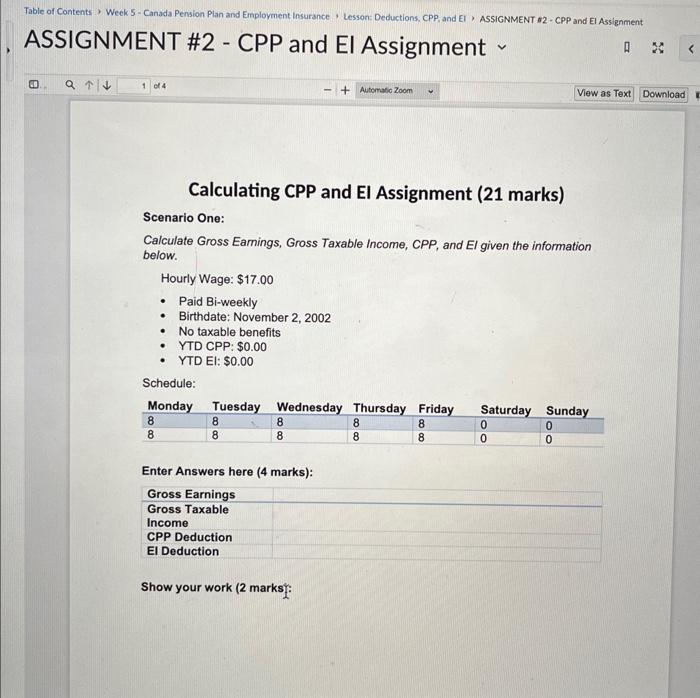

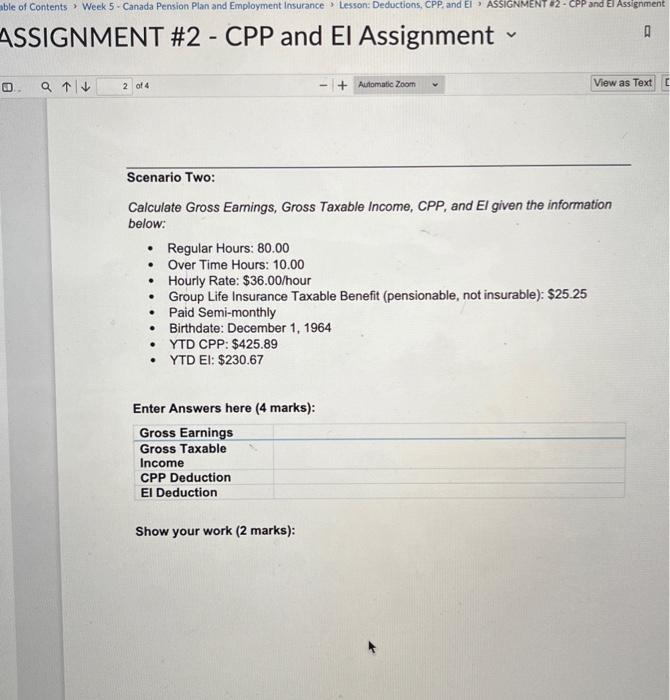

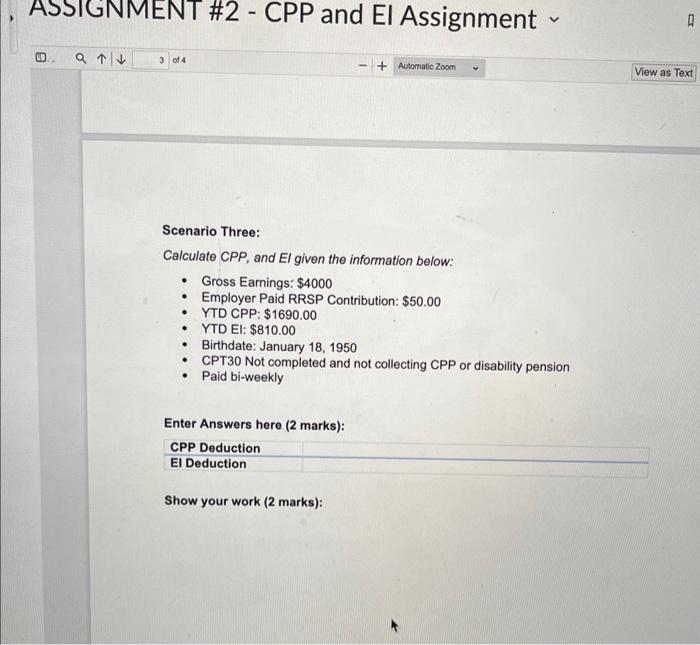

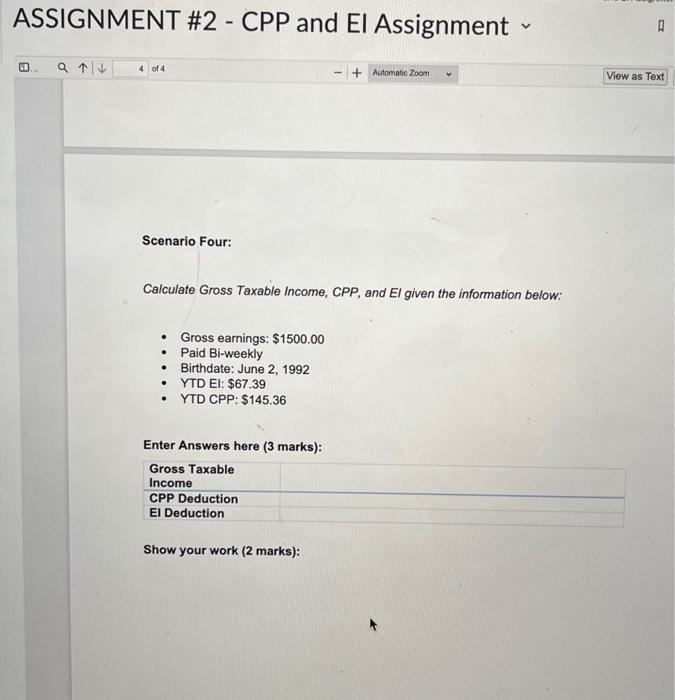

Calculating CPP and El Assignment (21 marks) Scenario One: Calculate Gross Earnings, Gross Taxable Income, CPP, and El given the information below. Hourly Wage: $17.00 - Paid Bi-weekly - Birthdate: November 2, 2002 - No taxable benefits - YTD CPP: $0.00 - YTD EI: $0.00 Schedule: Enter Answers here ( 4 marks): Show your work (2 marks): Scenario Two: Calculate Gross Earnings, Gross Taxable Income, CPP, and El given the information below: - Regular Hours: 80.00 - Over Time Hours: 10.00 - Hourly Rate: $36.00/ hour - Group Life Insurance Taxable Benefit (pensionable, not insurable): \$25.25 - Paid Semi-monthly - Birthdate: December 1, 1964 - YTD CPP: $425.89 - YTD EI: $230.67 Scenario Three: Calculate CPP, and El given the information below: - Gross Earnings: $4000 - Employer Paid RRSP Contribution: $50.00 - YTD CPP: $1690.00 - YTD EI: $810.00 - Birthdate: January 18, 1950 - CPT30 Not completed and not collecting CPP or disability pension - Paid bi-weekly ASSIGNMENT #2 - CPP and El Assignment [1. a 4 1+ Scenario Four: Calculate Gross Taxable Income, CPP, and El given the information below: - Gross earnings: $1500.00 - Paid Bi-weekly - Birthdate: June 2, 1992 - YTDEI: \$67.39 - YTD CPP: $145.36 Enter Answers here ( 3 marks): Gross Taxable Income CPP Deduction El Deduction Show your work ( 2 marks): Calculating CPP and El Assignment (21 marks) Scenario One: Calculate Gross Earnings, Gross Taxable Income, CPP, and El given the information below. Hourly Wage: $17.00 - Paid Bi-weekly - Birthdate: November 2, 2002 - No taxable benefits - YTD CPP: $0.00 - YTD EI: $0.00 Schedule: Enter Answers here ( 4 marks): Show your work (2 marks): Scenario Two: Calculate Gross Earnings, Gross Taxable Income, CPP, and El given the information below: - Regular Hours: 80.00 - Over Time Hours: 10.00 - Hourly Rate: $36.00/ hour - Group Life Insurance Taxable Benefit (pensionable, not insurable): \$25.25 - Paid Semi-monthly - Birthdate: December 1, 1964 - YTD CPP: $425.89 - YTD EI: $230.67 Scenario Three: Calculate CPP, and El given the information below: - Gross Earnings: $4000 - Employer Paid RRSP Contribution: $50.00 - YTD CPP: $1690.00 - YTD EI: $810.00 - Birthdate: January 18, 1950 - CPT30 Not completed and not collecting CPP or disability pension - Paid bi-weekly ASSIGNMENT #2 - CPP and El Assignment [1. a 4 1+ Scenario Four: Calculate Gross Taxable Income, CPP, and El given the information below: - Gross earnings: $1500.00 - Paid Bi-weekly - Birthdate: June 2, 1992 - YTDEI: \$67.39 - YTD CPP: $145.36 Enter Answers here ( 3 marks): Gross Taxable Income CPP Deduction El Deduction Show your work ( 2 marks)