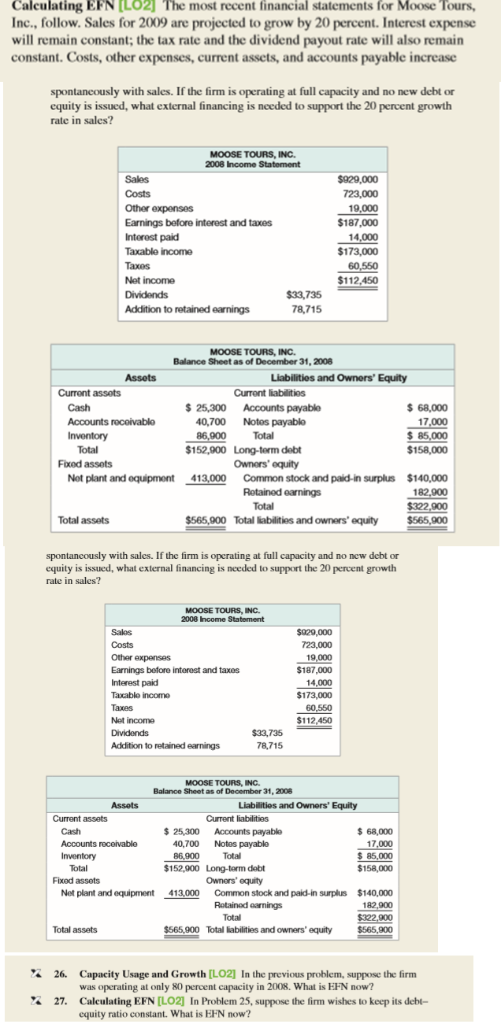

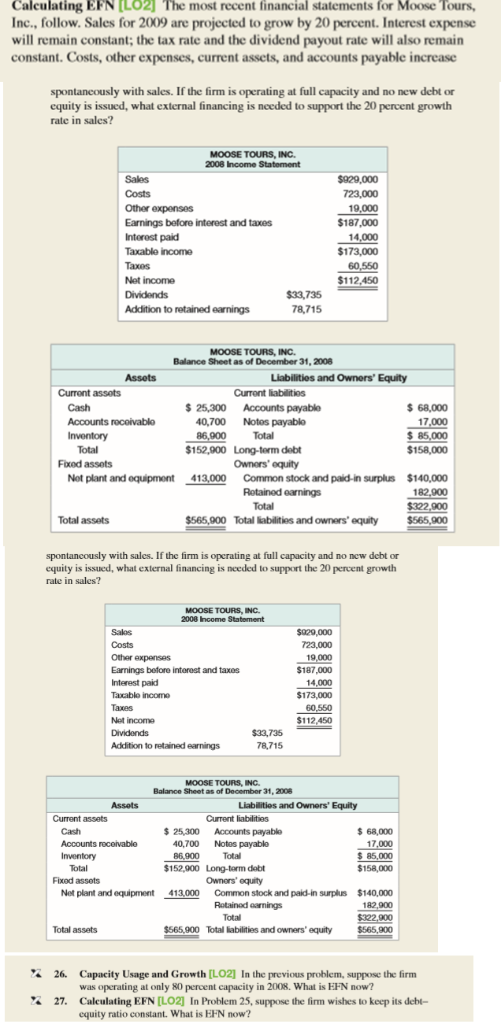

Calculating EFN [LO21 The most recent financial statements for Moose Tours, Inc., follow. Sales for 2009 are projected to grow by 20 percent. Interest expense will remain constant; the tax rate and the dividend payout rate will also remain constant. Costs, other expenses, current assets, and accounts payable increase spontancously with sales. If the firm is operating at full capacity and no new debt or equity is issued, what external financing is needed to support the 20 percent growth rate in sales? MOOSE TOURS, INC. 2008 Income Staterment Sales Costs Other expenses Earnings before interest and taxes Intorost pald Taxable income 723,000 19.000 $187,000 14,000 $173,000 60 $112,450 Net income 33,735 78,715 Addlition to retained earnings MOOSE TOURS, INC. Balance Sheet as of December 31, 2006 Liabilitios and Owners' Equity Curront assots Curront liabilitios 25,300 Accounts payablo $ 68,000 17,000 Accounts rocoivablo 0,700 Notos payablo 86,900 Total Total Foxod assets 152,900 Long-torm debt Ownors' oquity $158,000 Not plant and equipmont 413000 Common stock and paid-in surplus$140,000 182,900 322,900 $565,900 Retained earnings Total assets $565,900 Total labilities and owners' equity spontancously with sales. If the firm is operating at full capacity and no new debt or equity is issued, what external financing is needed to support the 20 percent growth rate in sales? MOOSE TOURS, INC 2008 Income Statement Costs Other expenses Earnings betore intorest and taxes Interest paid Taxablo income 19,000 $187,000 14,000 $173,000 60,550 $112,450 Net income Addition to retained earnings 78,715 MOOSE TOURS, INC Balance Sheet as of December 31, 2008 Liabilitios and Owners Equity Current assets Current liabilities 68,000 17,000 25,300 Accounts payabke 40,700 Notes payable Accounts receivable 86.900 Total $158,000 Total Fixod assets 152,900 Long-torm dabt Ownors' oquity Net plant and equipment 413000 Common stock and paid-in surplus $140,000 182,900 Rotained earnings Total assets $565,900 Total labilities and owners equity $565,900 26 Capacity Usage and Growth [LO2] In the previous problem, suppose the firm was operating at only 80 percent capacity in 2008. What is EFN now? % 27, Calculating EFN [LO2] In Problem 25, suppose the firm wishes to keep its debt- equity ratio constant. What is EFN now