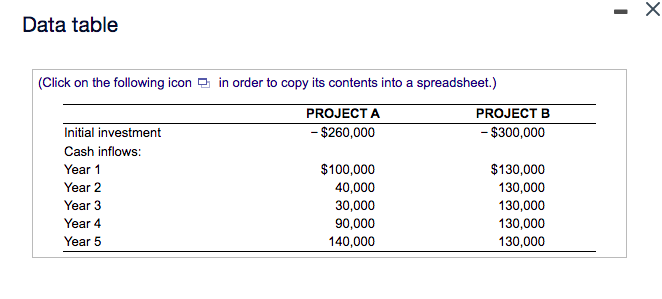

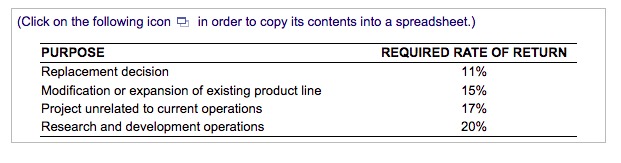

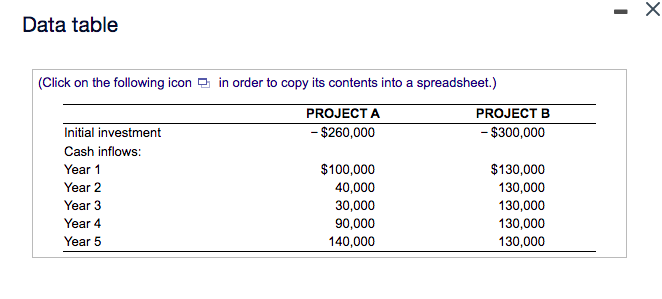

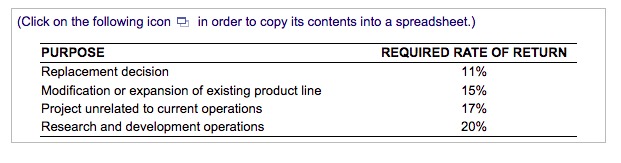

(Calculating free cash flows) Spartan Stores is expanding operations with the introduction of a new distribution center. Not only will sales increase but investment in inventory will decline due to increased efficiencies in getting inventory to showrooms. As a result of this new distribution center, Spartan expects a change in EBIT of $900,000. Although inventory is expected to drop from $85,000 to $62,000, accounts receivables are expected to climb as a result of increased credit sales from $89,000 to $180,000. In addition, accounts payable are expected to increase from $69,000 to $85,000. This project will also produce $300,000 of bonus depreciation in year 1 and Spartan Stores is in the 36 percent marginal tax rate. What is the project's free cash flow in year 1? The project's free cash flow in year 1 is $ 860000. (Round to the nearest dollar.) (Risk-adjusted discount rates and risk classes) The G. Wolfe Corporation is examining two capital-budgeting projects with 5-year lives. The first, project A, is a replacement project; the second, project B, is a project unrelated to current operations. The G. Wolfe Corporation uses the risk-adjusted discount rate method and groups projects according to purpose, and then it uses a required rate of return or discount rate that has been preassigned to that purpose risk class. The expected cash flows for these projects are given in the popup window, E. The purpose/risk classes and preassigned required rates of return are shown in the popup window, Determine each project's risk-adjusted net present value. . What is the risk-adjusted NPV of project A? (Round to the nearest cent.) - Data table (Click on the following icon in order to copy its contents into a spreadsheet.) PROJECT A PROJECT B Initial investment - $260,000 - $300,000 Cash inflows: Year 1 $100,000 $130,000 Year 2 40,000 130,000 Year 3 30,000 130,000 Year 4 90,000 130,000 Year 5 140,000 130,000 (Click on the following icon in order to copy its contents into a spreadsheet.) PURPOSE REQUIRED RATE OF RETURN Replacement decision 11% Modification or expansion of existing product line 15% Project unrelated to current operations 17% Research and development operations 20% (Calculating free cash flows) Spartan Stores is expanding operations with the introduction of a new distribution center. Not only will sales increase but investment in inventory will decline due to increased efficiencies in getting inventory to showrooms. As a result of this new distribution center, Spartan expects a change in EBIT of $900,000. Although inventory is expected to drop from $85,000 to $62,000, accounts receivables are expected to climb as a result of increased credit sales from $89,000 to $180,000. In addition, accounts payable are expected to increase from $69,000 to $85,000. This project will also produce $300,000 of bonus depreciation in year 1 and Spartan Stores is in the 36 percent marginal tax rate. What is the project's free cash flow in year 1? The project's free cash flow in year 1 is $ 860000. (Round to the nearest dollar.) (Risk-adjusted discount rates and risk classes) The G. Wolfe Corporation is examining two capital-budgeting projects with 5-year lives. The first, project A, is a replacement project; the second, project B, is a project unrelated to current operations. The G. Wolfe Corporation uses the risk-adjusted discount rate method and groups projects according to purpose, and then it uses a required rate of return or discount rate that has been preassigned to that purpose risk class. The expected cash flows for these projects are given in the popup window, E. The purpose/risk classes and preassigned required rates of return are shown in the popup window, Determine each project's risk-adjusted net present value. . What is the risk-adjusted NPV of project A? (Round to the nearest cent.) - Data table (Click on the following icon in order to copy its contents into a spreadsheet.) PROJECT A PROJECT B Initial investment - $260,000 - $300,000 Cash inflows: Year 1 $100,000 $130,000 Year 2 40,000 130,000 Year 3 30,000 130,000 Year 4 90,000 130,000 Year 5 140,000 130,000 (Click on the following icon in order to copy its contents into a spreadsheet.) PURPOSE REQUIRED RATE OF RETURN Replacement decision 11% Modification or expansion of existing product line 15% Project unrelated to current operations 17% Research and development operations 20%