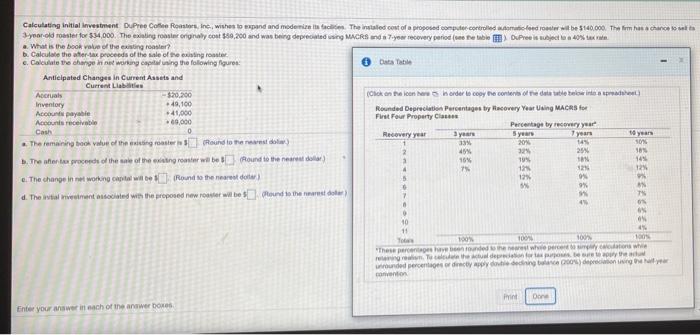

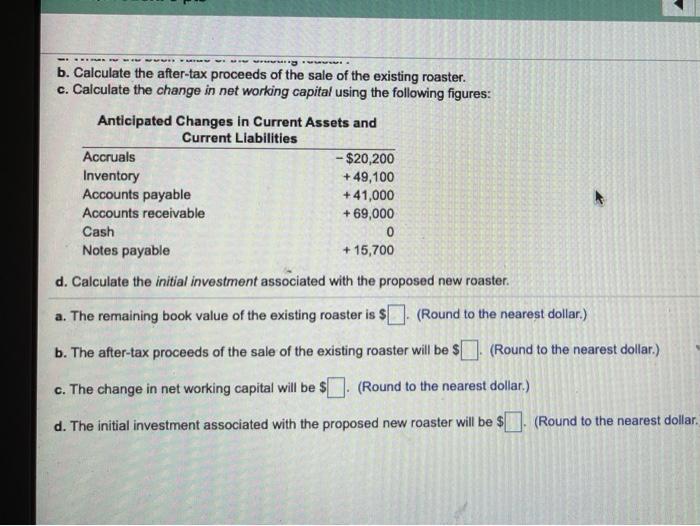

Calculating initial Investment DuPro Rosso Inc., wishes to expand and modernist The installed cost of a proposed computer controlled od wit be $140.000. The firm has a chance 3-year-old roster for $4,000. The existing only cost $50,200 and was being deprecated using MACRS and your recovery period the labe DuPreesbject to a 40% a. What is the book value of the gro? b. Calculate the after tax proceeds of the sale of the casting router c. Calculate the change in working capitening the following figures Anticipated Changes in Current Assets and Current Labates Accruals $20.00 (Click on the center in order to copy the contenis of the date table with Inventory 49,100 ACO payable 41,000 Rounded Depreciation Pourcentages by Hecovery Year Using MACRS for Accounts receivable 69,000 First Four Property Cits 0 Percentage by ownery year Recovery year 3 year 5 years 7 years The remaining book value of the rooster Round to the red) 33 20 149 30 4% 324 25 The after a proces of the sale of the ingroaster will be found to the need 1 10 19% 199 7 12 12 129 e. The change in networking capital t + Round to the nearest do 129 ON 5 9% d. The wil vestur sociated with the proposed new rooster wil be $cound to the tinarest der 49 Cash 5 10 4 100 1001 so 100% These pended when we Theory wounded percentage decyd-dding on conto Pin bora Enter your answer in each of the answer box - . b. Calculate the after-tax proceeds of the sale of the existing roaster. c. Calculate the change in net working capital using the following figures: Anticipated Changes in Current Assets and Current Liabilities Accruals - $20,200 Inventory +49,100 Accounts payable +41,000 Accounts receivable +69,000 Cash 0 Notes payable + 15,700 d. Calculate the initial investment associated with the proposed new roaster. a. The remaining book value of the existing roaster is $(Round to the nearest dollar) b. The after-tax proceeds of the sale of the existing roaster will be $ (Round to the nearest dollar.) c. The change in net working capital will be $ . (Round to the nearest dollar) d. The initial investment associated with the proposed new roaster will be $ (Round to the nearest dollar