Question

Calculating Key Metrics to be included in the Board report Jane prepared the following key information (amounts in thousands of dollars) as part of the

Calculating Key Metrics to be included in the Board report

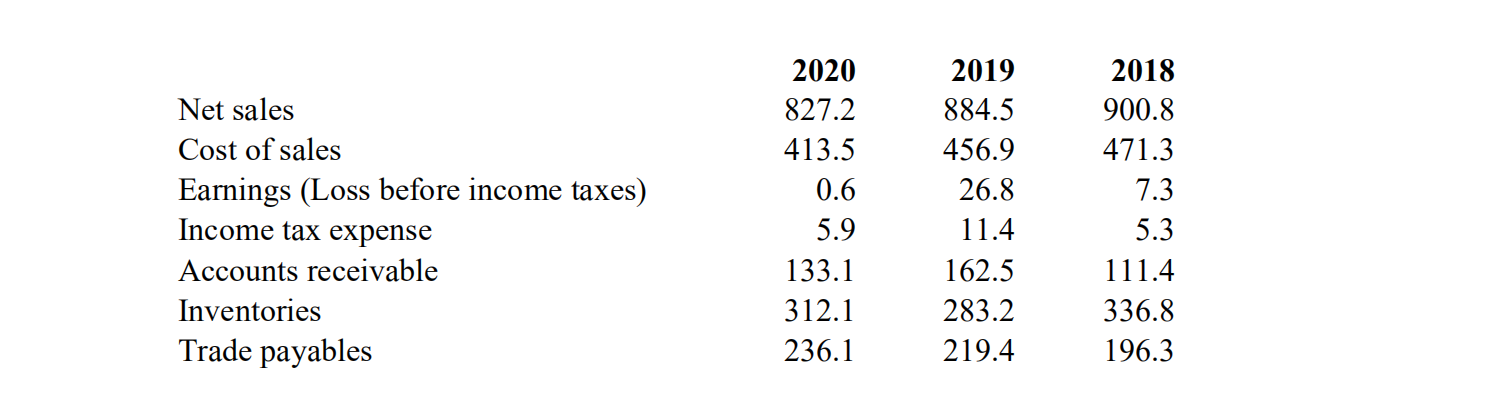

Jane prepared the following key information (amounts in thousands of dollars) as part of the

board report. The figures below is a draft version and did not include the accounting issues

noted above. The effective tax rate is 35%.

She has asked you to compute the following amounts for each of the fiscal years 2019 and 2020

that will be included in the board report. No explanation is needed. Jane just needs to include

these figures in her board report.

1. Collections from customers

2. Purchases of merchandise from suppliers. All purchases are made on account.

3. Payments to suppliers

4. Receivables turnover ratio and the average collection period

5. Inventory turnover ratio and the average period to sell inventory

6. Average period for conversion of inventories into cash

In the notes to its financial statements, the company states that the cost of merchandise is

determined by using the weighted-average costing method. Given the cost of inventory is rising, Jane wants to know whether the companys net income will increase or decrease if it uses FIFO instead of weighted-average cost.

Net sales Cost of sales Earnings (Loss before income taxes) Income tax expense Accounts receivable Inventories Trade payables 2020 827.2 413.5 0.6 5.9 133.1 312.1 236.1 2019 884.5 456.9 26.8 11.4 162.5 283.2 219.4 2018 900.8 471.3 7.3 5.3 111.4 336.8 196.3Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started