Answered step by step

Verified Expert Solution

Question

1 Approved Answer

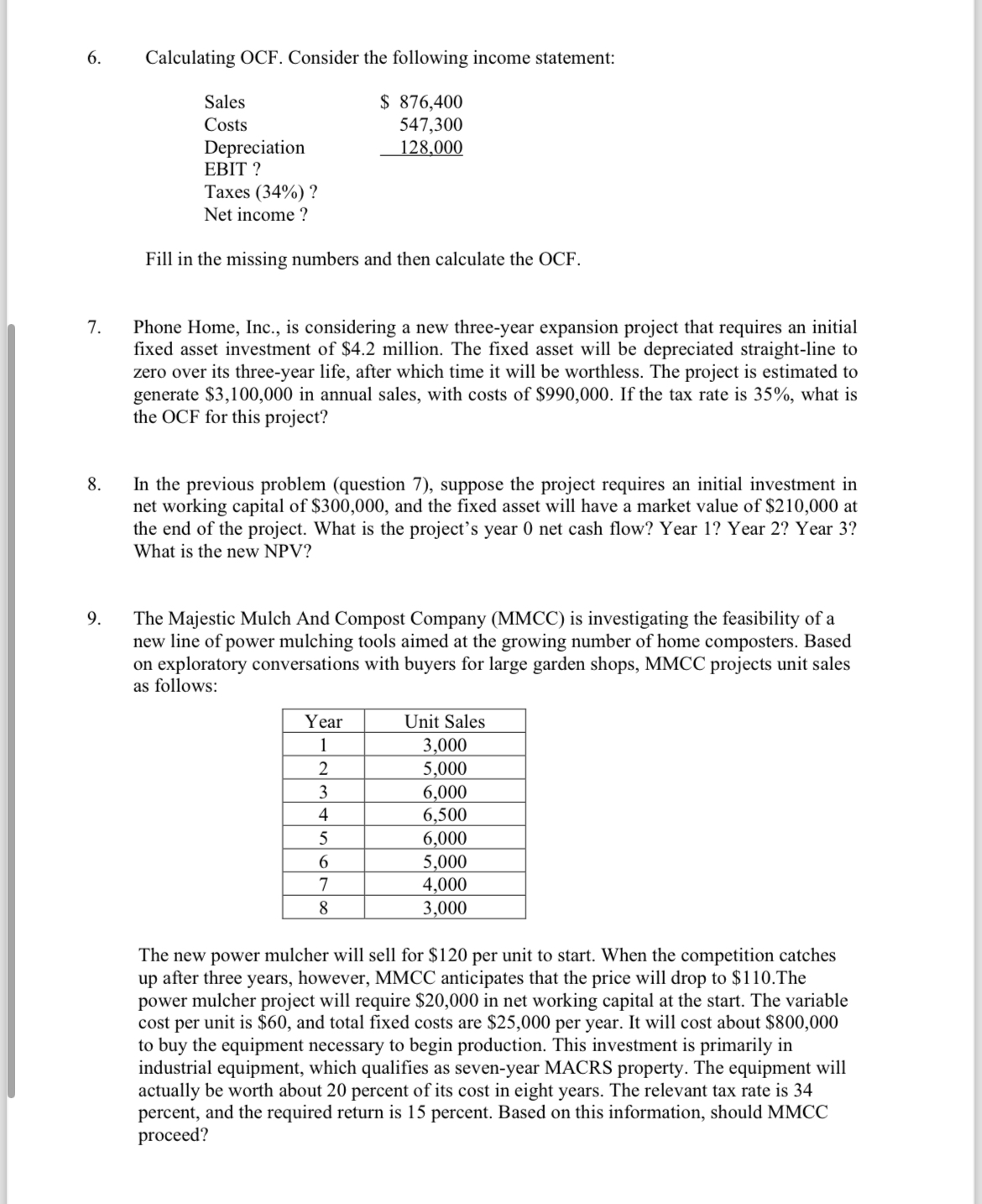

Calculating OCF. Consider the following income statement: Sales Costs Depreciation EBIT ? Taxes ( 3 4 % ) ? Net income? $ 8 7 6

Calculating OCF. Consider the following income statement:

Sales

Costs

Depreciation

EBIT

Taxes

Net income?

$

Fill in the missing numbers and then calculate the OCF.

Phone Home, Inc., is considering a new threeyear expansion project that requires an initial

fixed asset investment of $ million. The fixed asset will be depreciated straightline to

zero over its threeyear life, after which time it will be worthless. The project is estimated to

generate $ in annual sales, with costs of $ If the tax rate is what is

the OCF for this project?

In the previous problem question suppose the project requires an initial investment in

net working capital of $ and the fixed asset will have a market value of $ at

the end of the project. What is the project's year net cash flow? Year Year Year

What is the new NPV

The Majestic Mulch And Compost Company MMCC is investigating the feasibility of a

new line of power mulching tools aimed at the growing number of home composters. Based

on exploratory conversations with buyers for large garden shops, MMCC projects unit sales

as follows:

The new power mulcher will sell for $ per unit to start. When the competition catches

up after three years, however, MMCC anticipates that the price will drop to $The

power mulcher project will require $ in net working capital at the start. The variable

cost per unit is $ and total fixed costs are $ per year. It will cost about $

to buy the equipment necessary to begin production. This investment is primarily in

industrial equipment, which qualifies as sevenyear MACRS property. The equipment will

actually be worth about percent of its cost in eight years. The relevant tax rate is

percent, and the required return is percent. Based on this information, should MMCC

proceed?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started