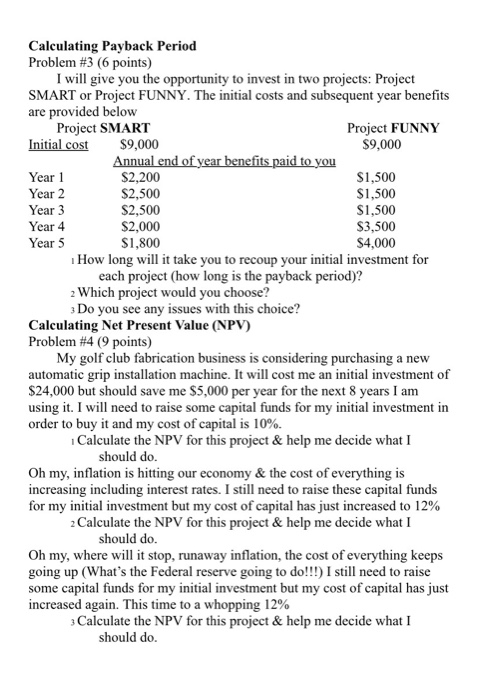

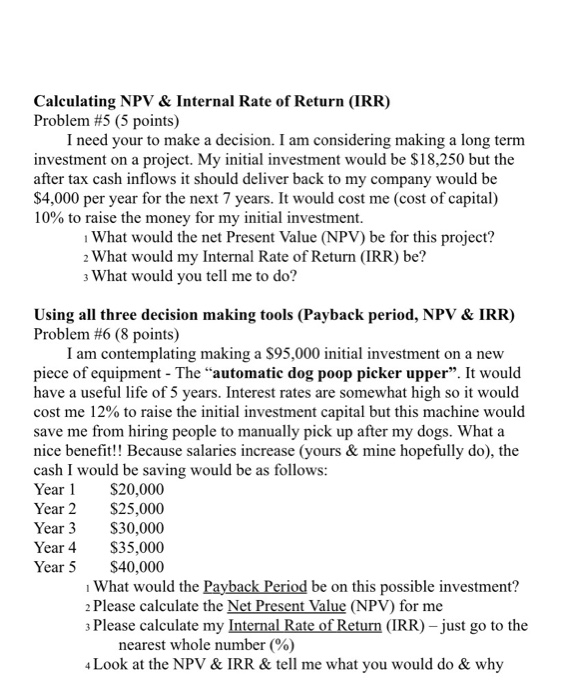

Calculating Payback Period Problem #3 (6 points) I will give you the opportunity to invest in two projects: Project SMART or Project FUNNY. The initial costs and subsequent year benefits are provided below Project SMART Project FUNNY Initial cost $9,000 $9,000 Annual end of year benefits paid to you Year 1 $2,200 $1,500 Year 2 $2.500 $1,500 Year 3 $2,500 $1,500 Year 4 $2,000 $3,500 Year 5 $1,800 $4,000 How long will it take you to recoup your initial investment for each project (how long is the payback period)? 2 Which project would you choose? 3 Do you see any issues with this choice? Calculating Net Present Value (NPV) Problem #4 (9 points) My golf club fabrication business is considering purchasing a new automatic grip installation machine. It will cost me an initial investment of $24,000 but should save me $5,000 per year for the next 8 years I am using it. I will need to raise some capital funds for my initial investment in order to buy it and my cost of capital is 10%. Calculate the NPV for this project & help me decide what I should do. Oh my, inflation is hitting our economy & the cost of everything is increasing including interest rates. I still need to raise these capital funds for my initial investment but my cost of capital has just increased to 12% Calculate the NPV for this project & help me decide what I should do. Oh my, where will it stop, runaway inflation, the cost of everything keeps going up (What's the Federal reserve going to do!!!) I still need to raise some capital funds for my initial investment but my cost of capital has just increased again. This time to a whopping 12% Calculate the NPV for this project & help me decide what I should do. Calculating NPV & Internal Rate of Return (IRR) Problem #5 (5 points) I need your to make a decision. I am considering making a long term investment on a project. My initial investment would be $18,250 but the after tax cash inflows it should deliver back to my company would be $4,000 per year for the next 7 years. It would cost me cost of capital) 10% to raise the money for my initial investment. What would the net Present Value (NPV) be for this project? 2 What would my Internal Rate of Return (IRR) be? 3 What would you tell me to do? Using all three decision making tools (Payback period, NPV & IRR) Problem #6 (8 points) I am contemplating making a $95.000 initial investment on a new piece of equipment - The "automatic dog poop picker upper. It would have a useful life of 5 years. Interest rates are somewhat high so it would cost me 12% to raise the initial investment capital but this machine would save me from hiring people to manually pick up after my dogs. What a nice benefit!! Because salaries increase yours & mine hopefully do), the cash I would be saving would be as follows: Year 1 $20,000 Year 2 $25,000 Year 3 $30,000 Year 4 $35,000 Year 5 $40,000 What would the Payback Period be on this possible investment? 2 Please calculate the Net Present Value (NPV) for me 3 Please calculate my Internal Rate of Return (IRR) - just go to the nearest whole number (%) 4 Look at the NPV & IRR & tell me what you would do & why