Answered step by step

Verified Expert Solution

Question

1 Approved Answer

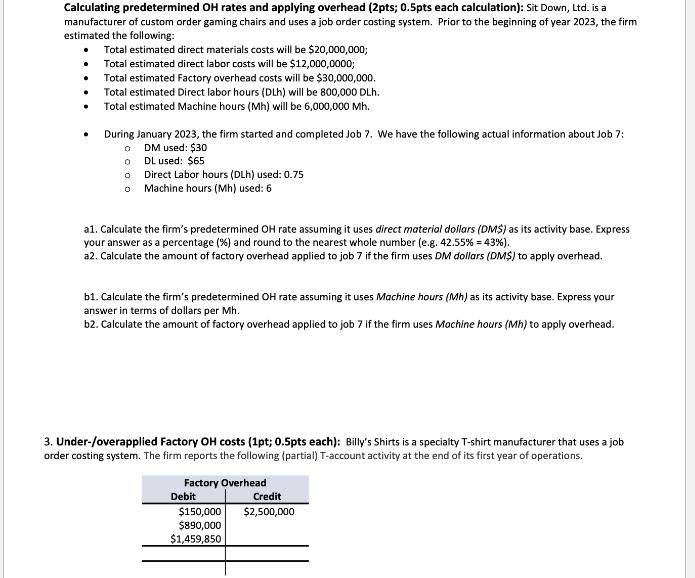

Calculating predetermined OH rates and applying overhead (2pts; 0.5pts each calculation): Sit Down, Ltd. is a manufacturer of custom order gaming chairs and uses

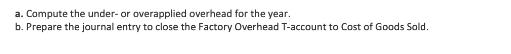

Calculating predetermined OH rates and applying overhead (2pts; 0.5pts each calculation): Sit Down, Ltd. is a manufacturer of custom order gaming chairs and uses a job order costing system. Prior to the beginning of year 2023, the firm estimated the following: Total estimated direct materials costs will be $20,000,000; . Total estimated direct labor costs will be $12,000,0000; . Total estimated Factory overhead costs will be $30,000,000. . . Total estimated Direct labor hours (DLh) will be 800,000 DLh. Total estimated Machine hours (Mh) will be 6,000,000 Mh. During January 2023, the firm started and completed Job 7. We have the following actual information about Job 7: DM used: $30 o DL used: $65 o Direct Labor hours (DLh) used: 0.75 Machine hours (Mh) used: 6 a1. Calculate the firm's predetermined OH rate assuming it uses direct material dollars (DMS) as its activity base. Express your answer as a percentage (%) and round to the nearest whole number (e.g. 42.55% = 43%). a2. Calculate the amount of factory overhead applied to job 7 if the firm uses DM dollars (DMS) to apply overhead. b1. Calculate the firm's predetermined OH rate assuming it uses Machine hours (Mh) as its activity base. Express your answer in terms of dollars per Mh. b2. Calculate the amount of factory overhead applied to job 7 if the firm uses Machine hours (Mh) to apply overhead. 3. Under-/overapplied Factory OH costs (1pt; 0.5pts each): Billy's Shirts is a specialty T-shirt manufacturer that uses a job order costing system. The firm reports the following (partial) T-account activity at the end of its first year of operations. Factory Overhead Debit $150,000 Credit $2,500,000 $890,000 $1,459,850 a. Compute the under- or overapplied overhead for the year. b. Prepare the journal entry to close the Factory Overhead T-account to Cost of Goods Sold.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a1 To calculate the predetermined overhead OH rate using direct material dollars DMS as the activity base we divide the total estimated factory overhe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started