Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculating rates of return. please help. thumbs up if correct. (Related to Checkpoint 7.1) (Calculating rates of return) On December 3, 2007, the common stock

Calculating rates of return. please help. thumbs up if correct.

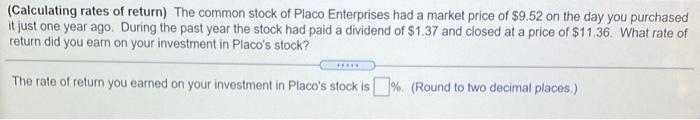

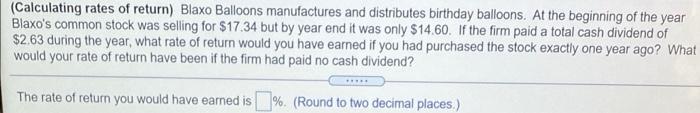

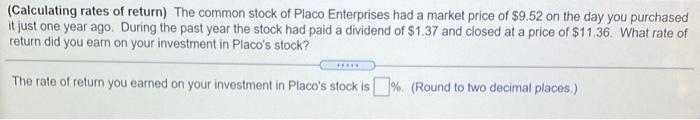

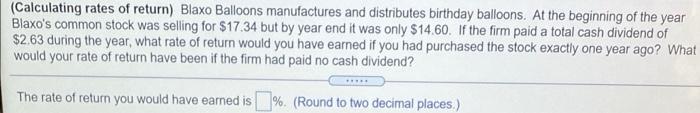

(Related to Checkpoint 7.1) (Calculating rates of return) On December 3, 2007, the common stock of Google Inc. (GOOG) was trading for $681.53. One year later the shares sold for only $279.43, Google has never paid a common stock dividend. What rate of return would you have earned on your investment had you purchased the shares on December 3, 2007? The rate of return you would have earned is % (Round to two decimal places.) (Calculating rates of return) The common stock of Placo Enterprises had a market price of $9.52 on the day you purchased it just one year ago. During the past year the stock had paid a dividend of $1. 37 and closed at a price of $11.36. What rate of return did you earn on your investment in Placo's stock? The rate of return you earned on your investment in Placo's stock is % (Round to two decimal places.) (Calculating rates of return) Blaxo Balloons manufactures and distributes birthday balloons. At the beginning of the year Blaxo's common stock was selling for $17.34 but by year end it was only $14.60. If the firm paid a total cash dividend of $2.63 during the year, what rate of return would you have earned if you had purchased the stock exactly one year ago? What would your rate of return have been if the firm had paid no cash dividend? The rate of return you would have earned is %. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started