Question

Calculating Social Security Primary Insurance Amounts (PIA) The purpose of this exercise is to make you familiar with the process of calculating the Social Security

Calculating Social Security Primary Insurance Amounts (PIA) The purpose of this exercise is to make you familiar with the process of calculating the Social Security retirement benefit. For this exercise, please focus more on the process, not the accuracy of your calculation, as you will not be required to perform a calculation for the course final exam.

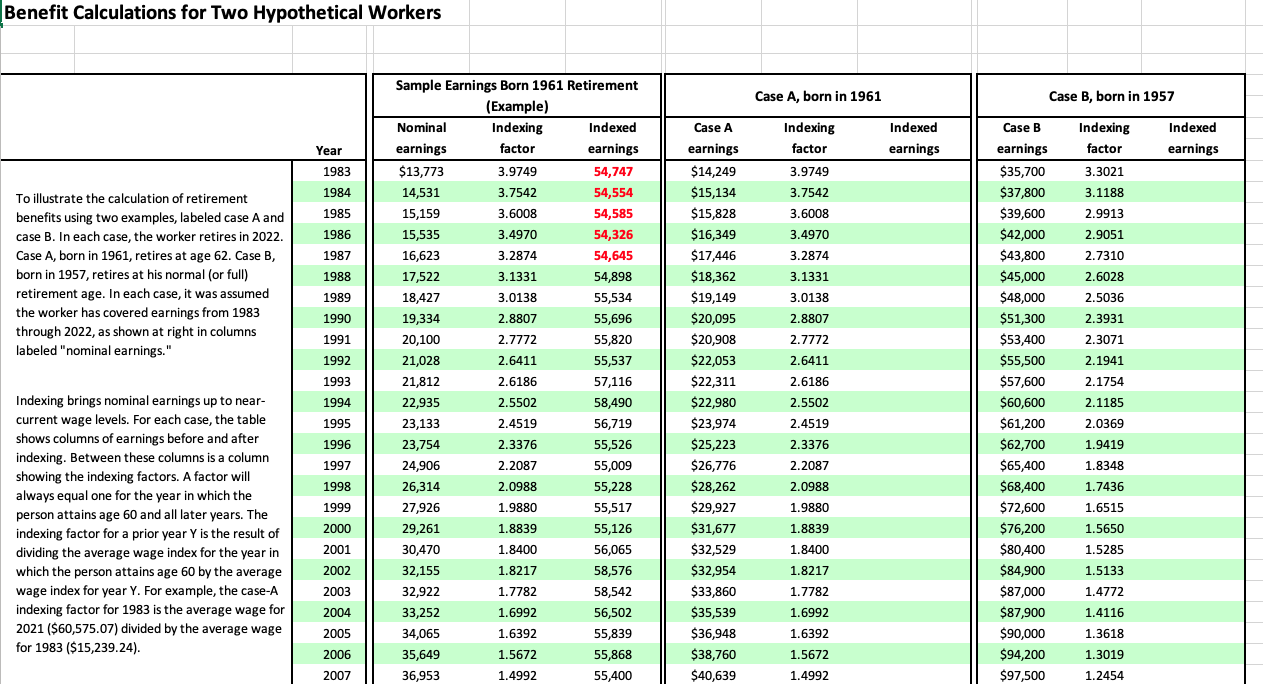

In this hypothetical example you need to calculate the average indexed monthly earnings (AIME) and the Primary Insurance Amount (PIA) for two workers. I have completed a calculation for one worker to get you started in the right direction. The calculations are as follows:

- Sample Example I completed this calculation in which I consider a worker who was born in 1961 and is retiring in 2023 on their 62nd birthday.

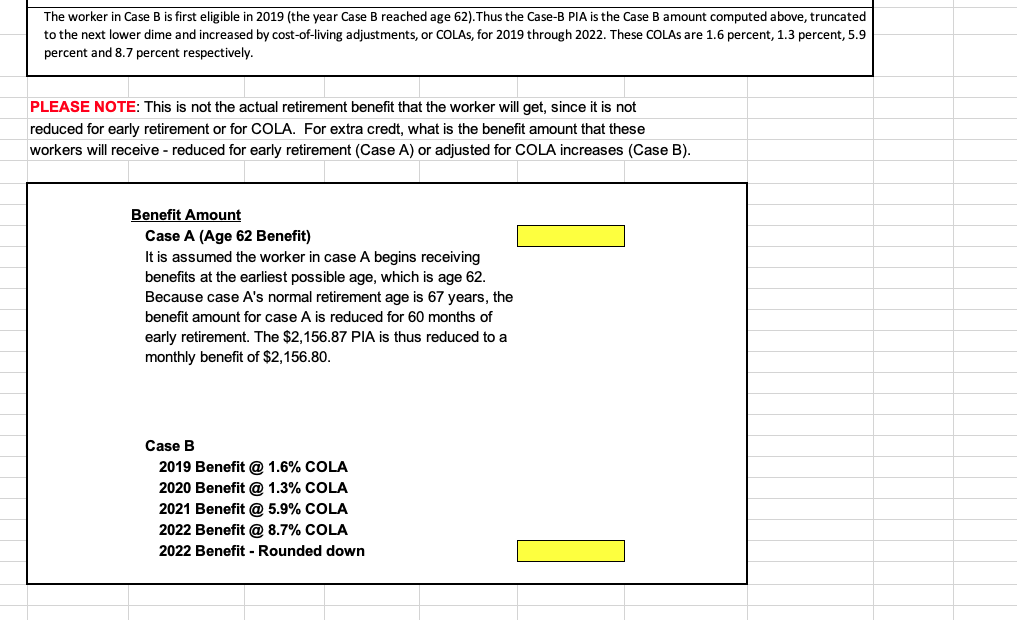

- Case A, born in 1961 You need to calculate the PIA for this worker. This worker was born in 1961 and is retiring in 2023 at age 62 (60 months from Normal Retirement).

- Case B, born in 1957 Calculate the PIA for this worker. This worker was born in 1957 and is retiring in 2023 at age 66 (Normal Retirement).

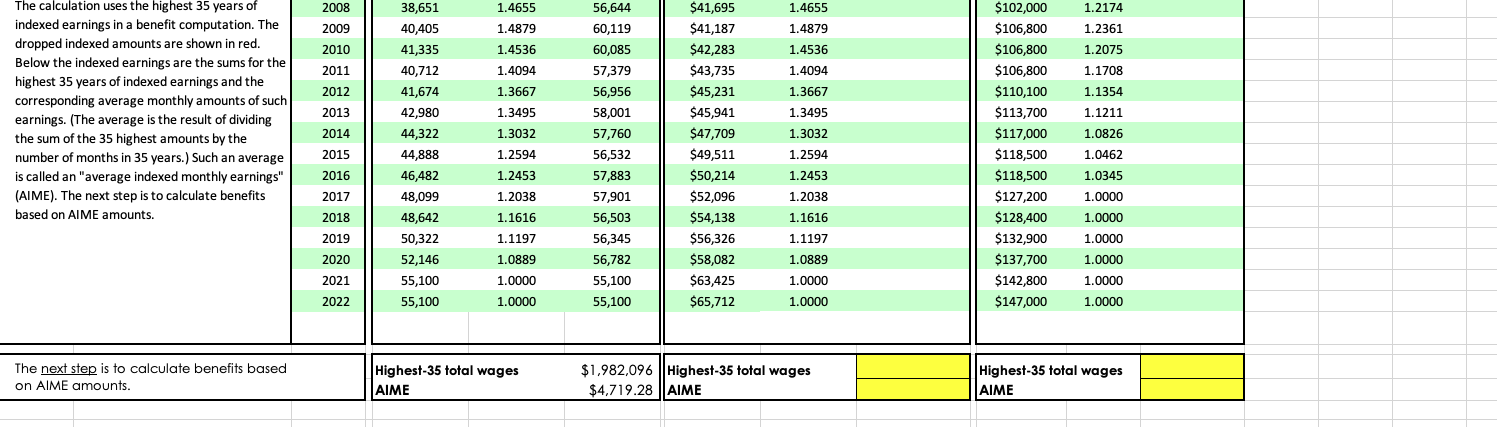

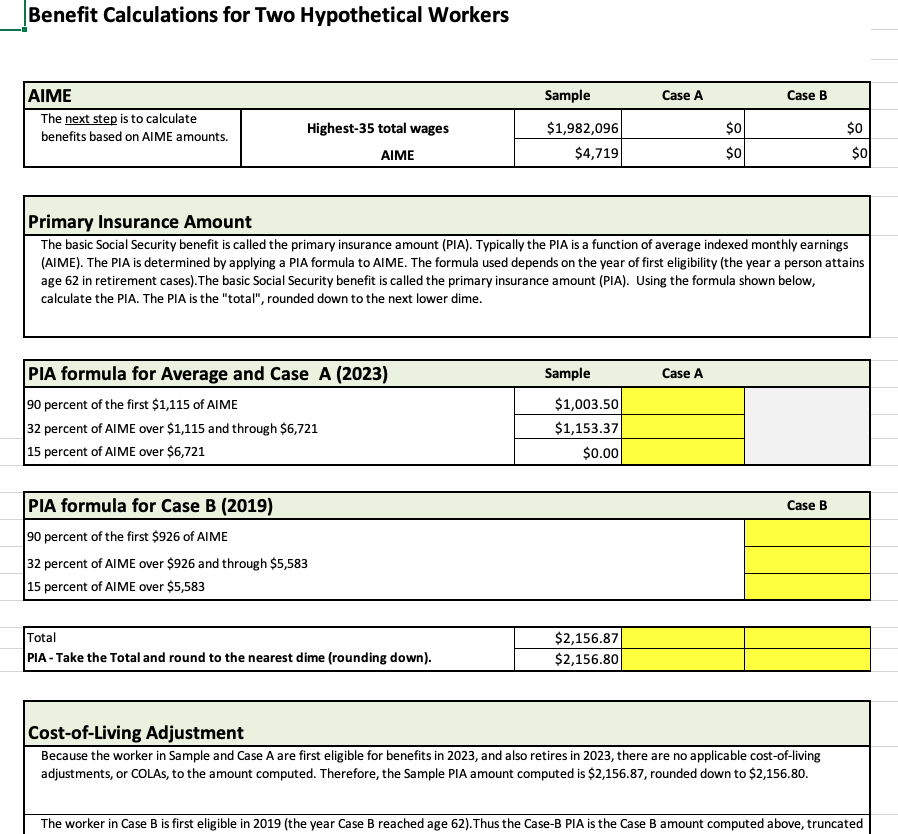

Benefit Calculations for Two Hypothetical Workers The calculation uses the highest 35 years of indexed earnings in a benefit computation. The dropped indexed amounts are shown in red. Below the indexed earnings are the sums for the highest 35 years of indexed earnings and the corresponding average monthly amounts of such earnings. (The average is the result of dividing the sum of the 35 highest amounts by the number of months in 35 years.) Such an average is called an "average indexed monthly earnings" (AIME). The next step is to calculate benefits based on AIME amounts. \begin{tabular}{l|l} 2008 \\ 2009 \\ 2010 \\ 2011 \\ 2012 \\ \hline based on AIME amounts. & 2013 \\ & 2014 \\ & 2015 \\ & 2016 \\ & 2017 \\ & 2018 \\ & 2020 \\ & 2022 \\ \hline \end{tabular} 38,6511.4655 $41,695 56,644 \begin{tabular}{lll||ll} 38,651 & 1.4655 & 56,644 & $41,695 & 1.4655 \end{tabular} 41,335 60,085 40,712 41,674 57,379 56,956 58,001 44,322 57,760 57,883 57,901 56,503 56,782 55,100 1.0000 55,100 The next step is to calculate benefits based on AIME amounts. \begin{tabular}{|lr|l|l|} \hline Highest-35 total wages & $1,982,096 & Highest-35 total wages & \\ \cline { 2 - 3 } AIME & $4,719.28 & AIME & \\ \hline \end{tabular} $102,000 $106,8001.2361 $106,8001.2075 $110,1001.1354 $117,0001.0826 $118,5001.0462 $118,5001.0345 $128,4001.0000 $132,9001.0000 $137,700$142,8001.00001.0000 $147,0001.0000 \begin{tabular}{|l|l|} \hline Highest-35 total wages & \\ \cline { 2 - 2 } AIME & \\ \hline \end{tabular} Benefit Calculations for Two Hypothetical Workers The worker in Case B is first eligible in 2019 (the vear Case B reached age 62). Thus the Case-B PIA is the Case B amount comnuted above. truncated Benefit Calculations for Two Hypothetical Workers The calculation uses the highest 35 years of indexed earnings in a benefit computation. The dropped indexed amounts are shown in red. Below the indexed earnings are the sums for the highest 35 years of indexed earnings and the corresponding average monthly amounts of such earnings. (The average is the result of dividing the sum of the 35 highest amounts by the number of months in 35 years.) Such an average is called an "average indexed monthly earnings" (AIME). The next step is to calculate benefits based on AIME amounts. \begin{tabular}{l|l} 2008 \\ 2009 \\ 2010 \\ 2011 \\ 2012 \\ \hline based on AIME amounts. & 2013 \\ & 2014 \\ & 2015 \\ & 2016 \\ & 2017 \\ & 2018 \\ & 2020 \\ & 2022 \\ \hline \end{tabular} 38,6511.4655 $41,695 56,644 \begin{tabular}{lll||ll} 38,651 & 1.4655 & 56,644 & $41,695 & 1.4655 \end{tabular} 41,335 60,085 40,712 41,674 57,379 56,956 58,001 44,322 57,760 57,883 57,901 56,503 56,782 55,100 1.0000 55,100 The next step is to calculate benefits based on AIME amounts. \begin{tabular}{|lr|l|l|} \hline Highest-35 total wages & $1,982,096 & Highest-35 total wages & \\ \cline { 2 - 3 } AIME & $4,719.28 & AIME & \\ \hline \end{tabular} $102,000 $106,8001.2361 $106,8001.2075 $110,1001.1354 $117,0001.0826 $118,5001.0462 $118,5001.0345 $128,4001.0000 $132,9001.0000 $137,700$142,8001.00001.0000 $147,0001.0000 \begin{tabular}{|l|l|} \hline Highest-35 total wages & \\ \cline { 2 - 2 } AIME & \\ \hline \end{tabular} Benefit Calculations for Two Hypothetical Workers The worker in Case B is first eligible in 2019 (the vear Case B reached age 62). Thus the Case-B PIA is the Case B amount comnuted above. truncated

Benefit Calculations for Two Hypothetical Workers The calculation uses the highest 35 years of indexed earnings in a benefit computation. The dropped indexed amounts are shown in red. Below the indexed earnings are the sums for the highest 35 years of indexed earnings and the corresponding average monthly amounts of such earnings. (The average is the result of dividing the sum of the 35 highest amounts by the number of months in 35 years.) Such an average is called an "average indexed monthly earnings" (AIME). The next step is to calculate benefits based on AIME amounts. \begin{tabular}{l|l} 2008 \\ 2009 \\ 2010 \\ 2011 \\ 2012 \\ \hline based on AIME amounts. & 2013 \\ & 2014 \\ & 2015 \\ & 2016 \\ & 2017 \\ & 2018 \\ & 2020 \\ & 2022 \\ \hline \end{tabular} 38,6511.4655 $41,695 56,644 \begin{tabular}{lll||ll} 38,651 & 1.4655 & 56,644 & $41,695 & 1.4655 \end{tabular} 41,335 60,085 40,712 41,674 57,379 56,956 58,001 44,322 57,760 57,883 57,901 56,503 56,782 55,100 1.0000 55,100 The next step is to calculate benefits based on AIME amounts. \begin{tabular}{|lr|l|l|} \hline Highest-35 total wages & $1,982,096 & Highest-35 total wages & \\ \cline { 2 - 3 } AIME & $4,719.28 & AIME & \\ \hline \end{tabular} $102,000 $106,8001.2361 $106,8001.2075 $110,1001.1354 $117,0001.0826 $118,5001.0462 $118,5001.0345 $128,4001.0000 $132,9001.0000 $137,700$142,8001.00001.0000 $147,0001.0000 \begin{tabular}{|l|l|} \hline Highest-35 total wages & \\ \cline { 2 - 2 } AIME & \\ \hline \end{tabular} Benefit Calculations for Two Hypothetical Workers The worker in Case B is first eligible in 2019 (the vear Case B reached age 62). Thus the Case-B PIA is the Case B amount comnuted above. truncated Benefit Calculations for Two Hypothetical Workers The calculation uses the highest 35 years of indexed earnings in a benefit computation. The dropped indexed amounts are shown in red. Below the indexed earnings are the sums for the highest 35 years of indexed earnings and the corresponding average monthly amounts of such earnings. (The average is the result of dividing the sum of the 35 highest amounts by the number of months in 35 years.) Such an average is called an "average indexed monthly earnings" (AIME). The next step is to calculate benefits based on AIME amounts. \begin{tabular}{l|l} 2008 \\ 2009 \\ 2010 \\ 2011 \\ 2012 \\ \hline based on AIME amounts. & 2013 \\ & 2014 \\ & 2015 \\ & 2016 \\ & 2017 \\ & 2018 \\ & 2020 \\ & 2022 \\ \hline \end{tabular} 38,6511.4655 $41,695 56,644 \begin{tabular}{lll||ll} 38,651 & 1.4655 & 56,644 & $41,695 & 1.4655 \end{tabular} 41,335 60,085 40,712 41,674 57,379 56,956 58,001 44,322 57,760 57,883 57,901 56,503 56,782 55,100 1.0000 55,100 The next step is to calculate benefits based on AIME amounts. \begin{tabular}{|lr|l|l|} \hline Highest-35 total wages & $1,982,096 & Highest-35 total wages & \\ \cline { 2 - 3 } AIME & $4,719.28 & AIME & \\ \hline \end{tabular} $102,000 $106,8001.2361 $106,8001.2075 $110,1001.1354 $117,0001.0826 $118,5001.0462 $118,5001.0345 $128,4001.0000 $132,9001.0000 $137,700$142,8001.00001.0000 $147,0001.0000 \begin{tabular}{|l|l|} \hline Highest-35 total wages & \\ \cline { 2 - 2 } AIME & \\ \hline \end{tabular} Benefit Calculations for Two Hypothetical Workers The worker in Case B is first eligible in 2019 (the vear Case B reached age 62). Thus the Case-B PIA is the Case B amount comnuted above. truncated Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started