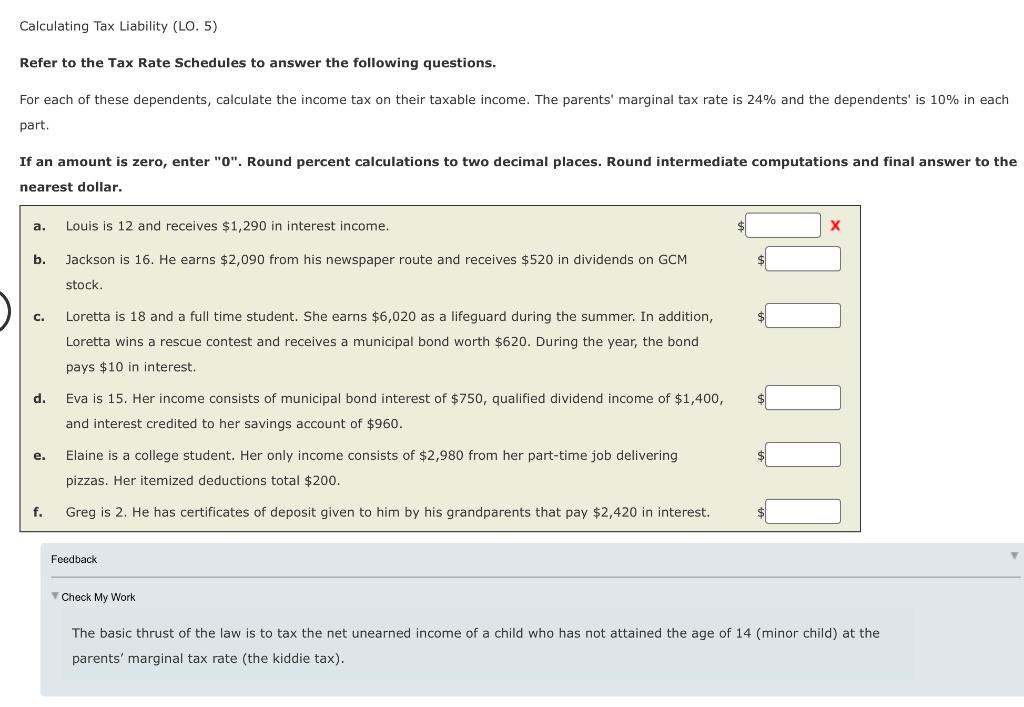

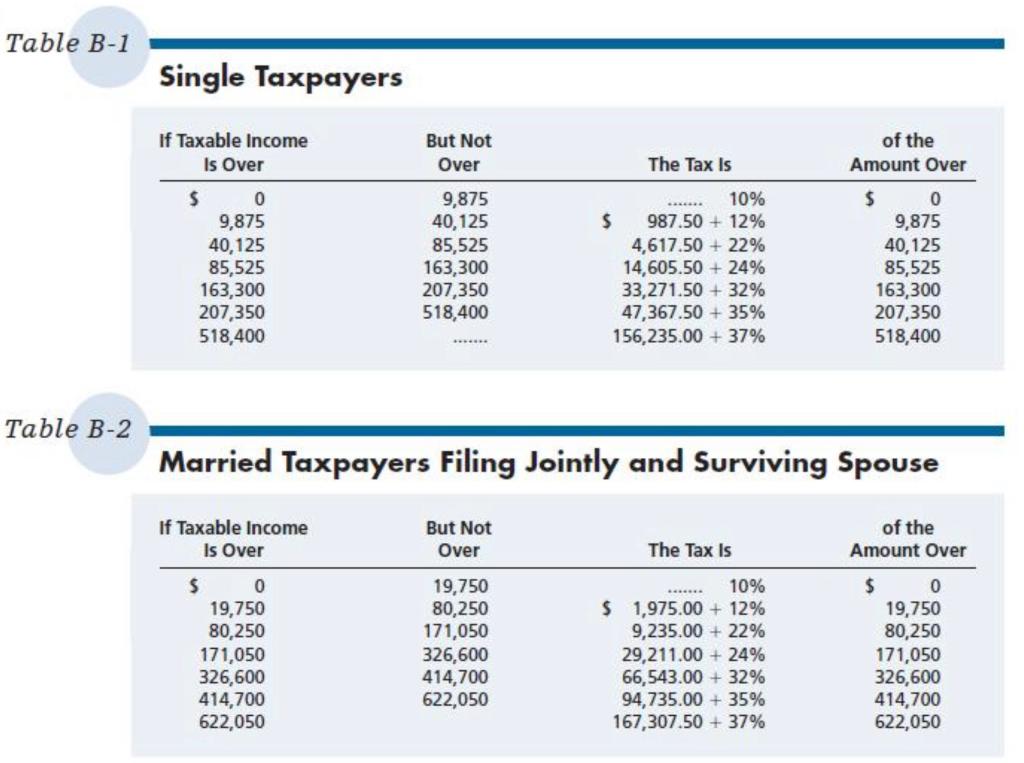

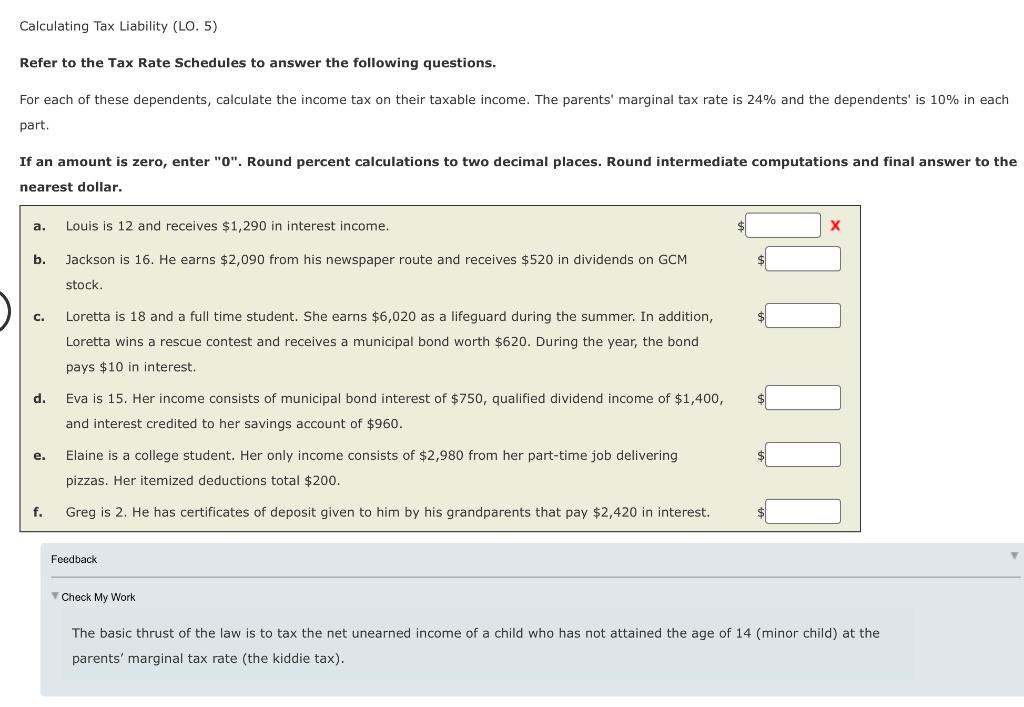

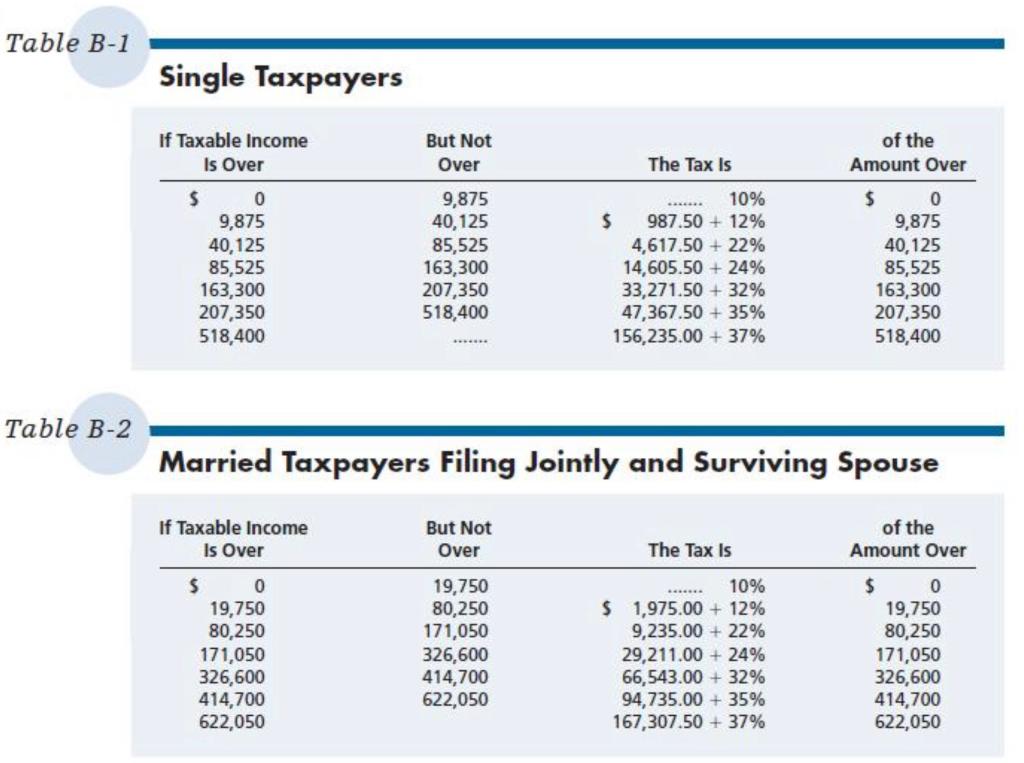

Calculating Tax Liability (LO. 5) Refer to the Tax Rate Schedules to answer the following questions. For each of these dependents, calculate the income tax on their taxable income. The parents' marginal tax rate is 24% and the dependents' is 10% in each part. If an amount is zero, enter "O". Round percent calculations to two decimal places. Round intermediate computations and final answer to the nearest dollar. a. Louis is 12 and receives $1,290 in interest income. b. Jackson is 16. He earns $2,090 from his newspaper route and receives $520 in dividends on GCM stock. C. Loretta is 18 and a full time student. She earns $6,020 as a lifeguard during the summer. In addition, Loretta wins a rescue contest and receives a municipal bond worth $620. During the year, the bond pays $10 in interest. d. Eva is 15. Her income consists of municipal bond interest of $750, qualified dividend income of $1,400, and interest credited to her savings account of $960. e. Elaine is a college student. Her only income consists of $2,980 from her part-time job delivering pizzas. Her itemized deductions total $200. f. Greg is 2. He has certificates of deposit given to him by his grandparents that pay $2,420 in interest. Feedback Check My Work The basic thrust of the law is to tax the net unearned income of a child who has not attained the age of 14 (minor child) at the parents' marginal tax rate (the kiddie tax). Table B-1 Single Taxpayers If Taxable income Is Over of the Amount Over The Tax Is . $ 0 9,875 40,125 85,525 163,300 207,350 518,400 But Not Over 9,875 40,125 85,525 163,300 207,350 518,400 10% $ 987.50 + 12% 4,617.50 + 22% 14,605.50 + 24% 33,271.50 + 32% 47,367.50 + 35% 156,235.00 + 37% $ 0 9,875 40,125 85,525 163,300 207,350 518,400 . Table B-2 Married Taxpayers Filing Jointly and Surviving Spouse If Taxable income Is Over But Not Over of the Amount Over The Tax Is $ 0 19,750 80,250 171,050 326,600 414,700 622,050 19,750 80,250 171,050 326,600 414,700 622,050 10% $ 1,975.00 + 12% 9,235.00 + 22% 29,211.00 + 24% 66,543.00 + 32% 94,735.00 + 35% 167,307.50 + 37% $ 0 19,750 80,250 171,050 326,600 414,700 622,050