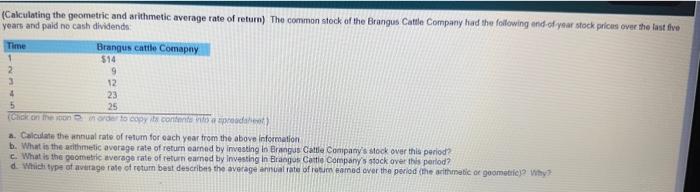

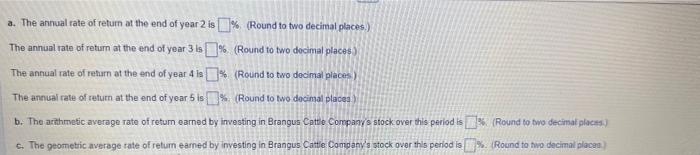

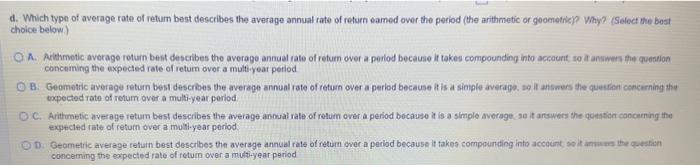

(Calculating the geometric and arithmetic average rate of return). The common stock of the Brangus Catile Company had the following and-of year stock pricas over the last five years and paid no cash dividends: a. Calculate the annual rate of telum for each year trom the above infermetion b. What is the asithmelic avorage rate of retum earned by imvesting in Erangus Catte Conipatry's slock over this period? c. What is the peomethic eversge rate of return earnod ty Investing in Erangus Catie Company/s stock over this period? a. The annual rate of retum at the end of year 2 is (Round to two decimal places.) The annual rate of return at the end of year 3 is \%6. (Round to two docimal places) The annual rate of return at the end of year 4 is \%. (Round to two docimal places) The annual rate of refum at the end of year 5 is \%. (Round to wo docimal places) b. The arathmetic average rate of retum earned by imesting in Brangus Cattlo Compayrs stock over this period is 2. (Round to two decimal placess) c. The geometric average rate of retum eamed by investing in Brangus Cattie Company's stock over this perlod is W. Round to two decimal placea d. Which type of average rate of return best describes the average annual rate of return eamed over the poriod (the arithmetic or geometric)? Why? (Select the best choice below) A. Arithmetic average rotum bent describes the averago annual rate of retum over a period because if takes compounding into account, so it answers the question concerning the expected rate of retum over a multi-year perlod B. Geometric average return best describes the average annual rate of retuin over a period because if is a simple average. se If antwers the questien concerning the expected rate of return ovor a multi-year period. C. Arithmetic average tetum best describes the average annual rate of return over a period because it is a simple average. so it answers the questicn cancarming the expected rate of return over a multl-year period. D. Gecmetric average refirn best describes the average annual rate of return over a period because it takes compounding into account so it anmans ithe question concerning the expected rate of return over a multi-year period