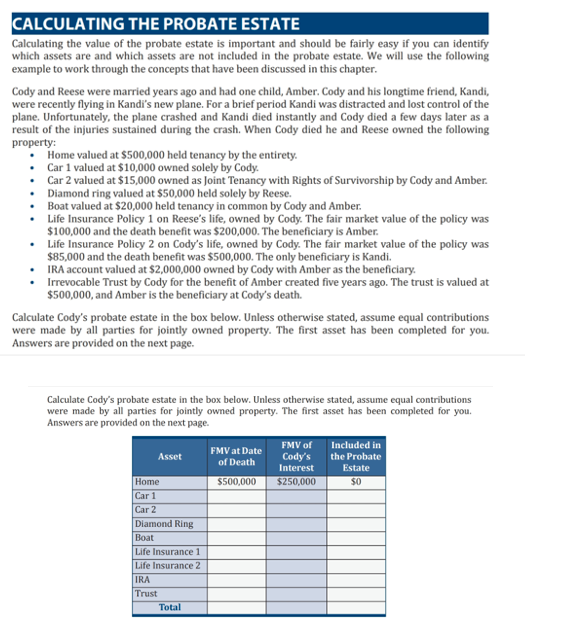

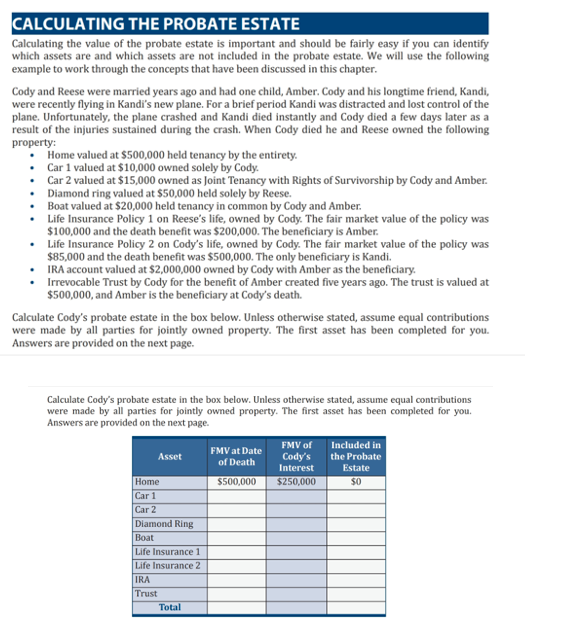

CALCULATING THE PROBATE ESTATE Calculating the value of the probate estate is important and should be fairly easy if you can identify which assets are and which assets are not included in the probate estate. We will use the following example to work through the concepts that have been discussed in this chapter. Cody and Reese were married years ago and had one child, Amber. Cody and his longtime friend, Kandi, were recently flying in Kandi's new plane. For a brief period Kandi was distracted and lost control of the plane. Unfortunately, the plane crashed and Kandi died instantly and Cody died a few days later as a result of the injuries sustained during the crash. When Cody died he and Reese owned the following property: Home valued at $500,000 held tenancy by the entirety. Car 1 valued at $10,000 owned solely by Cody. Car 2 valued at $15,000 owned as Joint Tenancy with Rights of Survivorship by Cody and Amber. Diamond ring valued at $50,000 held solely by Reese. Boat valued at $20,000 held tenancy in common by Cody and Amber. Life Insurance Policy 1 on Reese's life, owned by Cody. The fair market value of the policy was $100,000 and the death benefit was $200,000. The beneficiary is Amber. Life Insurance Policy 2 on Cody's life, owned by Cody. The fair market value of the policy was $85,000 and the death benefit was $500,000. The only beneficiary is Kandi. IRA account valued at $2,000,000 owned by Cody with Amber as the beneficiary. Irrevocable Trust by Cody for the benefit of Amber created five years ago. The trust is valued at $500,000, and Amber is the beneficiary at Cody's death. Calculate Cody's probate estate in the box below. Unless otherwise stated, assume equal contributions were made by all parties for jointly owned property. The first asset has been completed for you. Answers are provided on the next page. . Calculate Cody's probate estate in the box below. Unless otherwise stated, assume equal contributions were made by all parties for jointly owned property. The first asset has been completed for you. Answers are provided on the next page. FMV of Included in Asset FMV at Date Cody's the Probate of Death Interest Estate Home $500,000 $250,000 so Car 1 Car 2 Diamond Ring Boat Life Insurance 1 Life Insurance 2 IRA Trust Total CALCULATING THE PROBATE ESTATE Calculating the value of the probate estate is important and should be fairly easy if you can identify which assets are and which assets are not included in the probate estate. We will use the following example to work through the concepts that have been discussed in this chapter. Cody and Reese were married years ago and had one child, Amber. Cody and his longtime friend, Kandi, were recently flying in Kandi's new plane. For a brief period Kandi was distracted and lost control of the plane. Unfortunately, the plane crashed and Kandi died instantly and Cody died a few days later as a result of the injuries sustained during the crash. When Cody died he and Reese owned the following property: Home valued at $500,000 held tenancy by the entirety. Car 1 valued at $10,000 owned solely by Cody. Car 2 valued at $15,000 owned as Joint Tenancy with Rights of Survivorship by Cody and Amber. Diamond ring valued at $50,000 held solely by Reese. Boat valued at $20,000 held tenancy in common by Cody and Amber. Life Insurance Policy 1 on Reese's life, owned by Cody. The fair market value of the policy was $100,000 and the death benefit was $200,000. The beneficiary is Amber. Life Insurance Policy 2 on Cody's life, owned by Cody. The fair market value of the policy was $85,000 and the death benefit was $500,000. The only beneficiary is Kandi. IRA account valued at $2,000,000 owned by Cody with Amber as the beneficiary. Irrevocable Trust by Cody for the benefit of Amber created five years ago. The trust is valued at $500,000, and Amber is the beneficiary at Cody's death. Calculate Cody's probate estate in the box below. Unless otherwise stated, assume equal contributions were made by all parties for jointly owned property. The first asset has been completed for you. Answers are provided on the next page. . Calculate Cody's probate estate in the box below. Unless otherwise stated, assume equal contributions were made by all parties for jointly owned property. The first asset has been completed for you. Answers are provided on the next page. FMV of Included in Asset FMV at Date Cody's the Probate of Death Interest Estate Home $500,000 $250,000 so Car 1 Car 2 Diamond Ring Boat Life Insurance 1 Life Insurance 2 IRA Trust Total