Calculating the WACC and Determining the Optimal Capital Structure

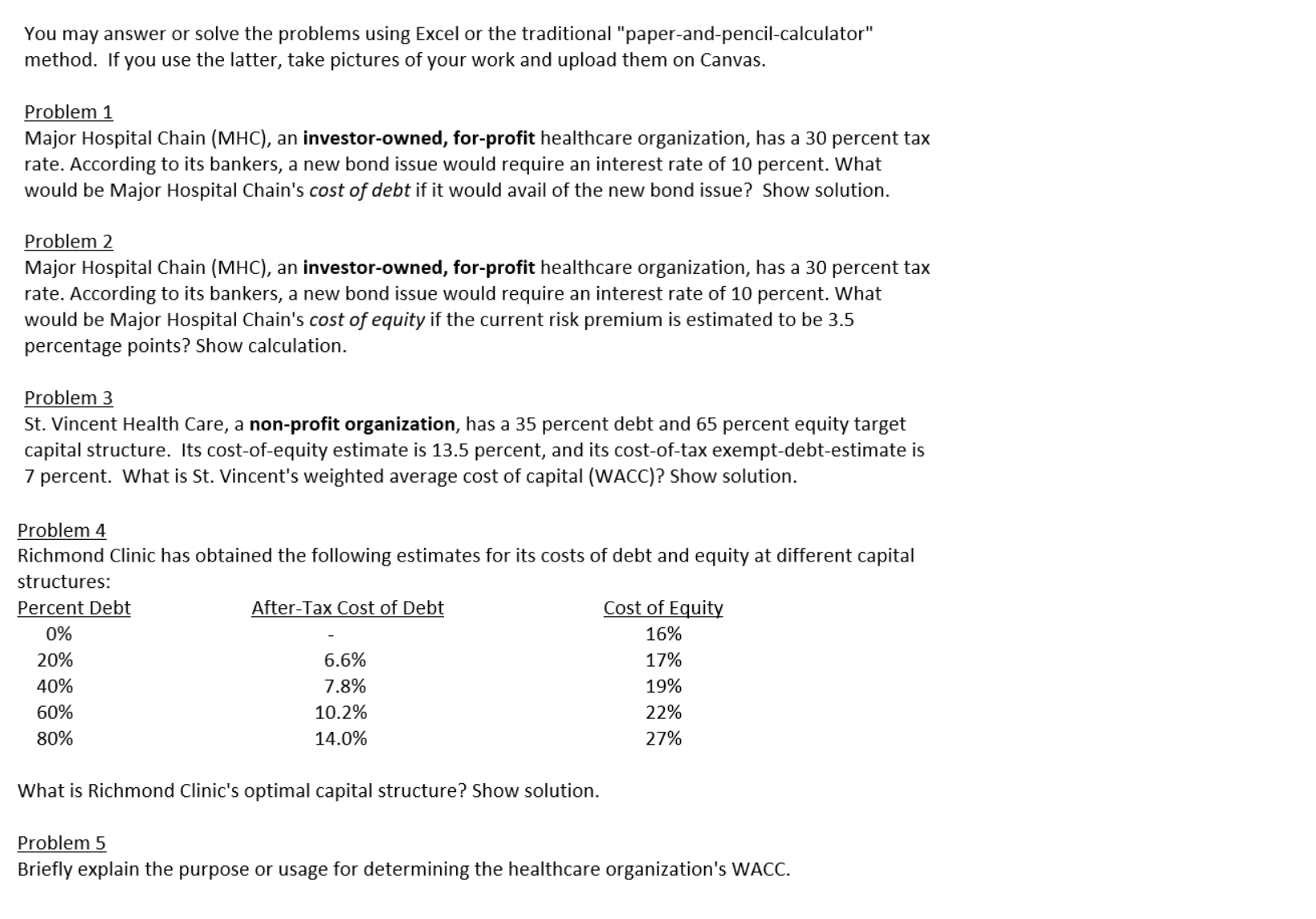

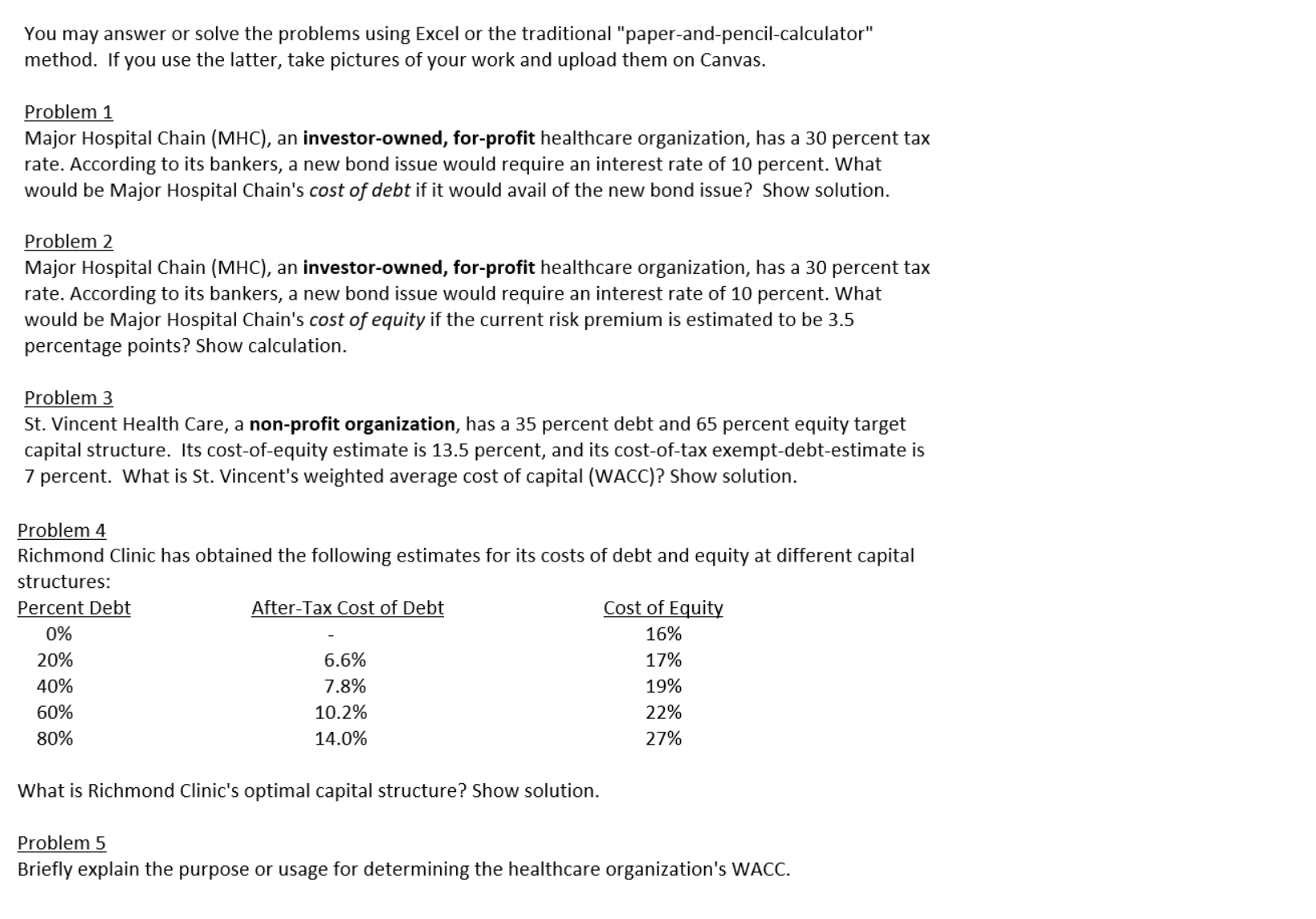

You may answer or solve the problems using Excel or the traditional "paper-and-pencil-calculator" method. If you use the latter, take pictures of your work and upload them on Canvas. Problem 1 Major Hospital Chain (MHC), an investor-owned, for-profit healthcare organization, has a 30 percent tax rate. According to its bankers, a new bond issue would require an interest rate of 10 percent. What would be Major Hospital Chain's cost of debt if it would avail of the new bond issue? Show solution. Problem 2 Major Hospital Chain (MHC), an investor-owned, for-profit healthcare organization, has a 30 percent tax rate. According to its bankers, a new bond issue would require an interest rate of 10 percent. What would be Major Hospital Chain's cost of equity if the current risk premium is estimated to be 3.5 percentage points? Show calculation. Problem 3 St. Vincent Health Care, a non-profit organization, has a 35 percent debt and 65 percent equity target capital structure. Its cost-of-equity estimate is 13.5 percent, and its cost-of-tax exempt-debt-estimate is 7 percent. What is St. Vincent's weighted average cost of capital (WACC)? Show solution. Problem 4 Richmond Clinic has obtained the following estimates for its costs of debt and equity at different capital structures: What is Richmond Clinic's optimal capital structure? Show solution. Problem 5 Briefly explain the purpose or usage for determining the healthcare organization's WACC. You may answer or solve the problems using Excel or the traditional "paper-and-pencil-calculator" method. If you use the latter, take pictures of your work and upload them on Canvas. Problem 1 Major Hospital Chain (MHC), an investor-owned, for-profit healthcare organization, has a 30 percent tax rate. According to its bankers, a new bond issue would require an interest rate of 10 percent. What would be Major Hospital Chain's cost of debt if it would avail of the new bond issue? Show solution. Problem 2 Major Hospital Chain (MHC), an investor-owned, for-profit healthcare organization, has a 30 percent tax rate. According to its bankers, a new bond issue would require an interest rate of 10 percent. What would be Major Hospital Chain's cost of equity if the current risk premium is estimated to be 3.5 percentage points? Show calculation. Problem 3 St. Vincent Health Care, a non-profit organization, has a 35 percent debt and 65 percent equity target capital structure. Its cost-of-equity estimate is 13.5 percent, and its cost-of-tax exempt-debt-estimate is 7 percent. What is St. Vincent's weighted average cost of capital (WACC)? Show solution. Problem 4 Richmond Clinic has obtained the following estimates for its costs of debt and equity at different capital structures: What is Richmond Clinic's optimal capital structure? Show solution. Problem 5 Briefly explain the purpose or usage for determining the healthcare organization's WACC