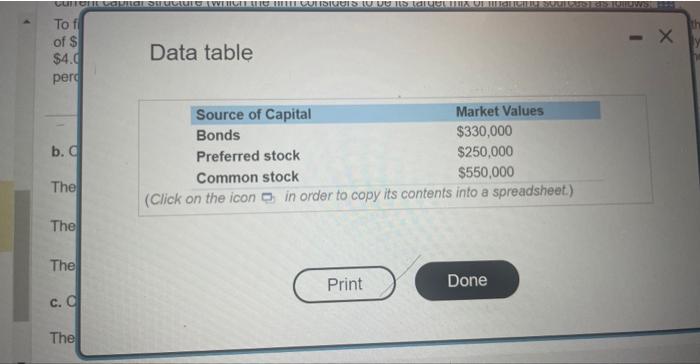

(Calculating the weighted average cost of capitai) You are working as a consultant to tho Lulu Athlotic Clolhing Congany, and you hawe Deon askiod is compute the approprlate discount rate to use in the ovaluation of the purchase of a now warohouse facility You hive detorminad the markef nitue of tilus frrirs current capital structure (which the firm considers to be its targot max of financing sources) as follows: To finance the purchase, Lulu will sell 20-year bonds with a $1,000 par value paying 6.1 percent per year (with interest paid semiannually) at the markel price of $1,034. Preferred stock paying a $2.57 dividend can be sold for $34.59. Common stock for Lulu is currently seling for $49974 por ahare The firm paid a $4.07 dividend last year and expects dividends to continue growing at a rate of 3.6 percent per year for the indefinter fiture. The firmis magnal tax natie is 34 percerit. What discount rate should you use to evaluate the warehouse projoct? a. Calculate component woights of capital The weight of debt in the firm's capital structure is \%. (Round to two decimal places.) The weight of preferred stock in the firm's capital structure is \%. (Round to two decimal places.) The weight of common stock in the firm's capital structure is \%. (Round to two decimal places.) b. Calculate component costs of capital. The aftertax cost of debt for the firm is, \%. (Round to two decimal places.) (Calculating the weighted average cost of capital) You ave working as a consultant to the Lulu Alhetic Ciothing Cormpary, and you have boen wimed is compute the appropriate discount rate to use in the evaluation of the purchase of a now warehouse facility. You have determined then manct ralie at thn frems current capital structure (which the firm considers to be its target mix of financing sources) as follows of $1,034. Preferred stock paying a $2.57 dividend can be sold for $34.50. Common stock for Lulu is cuirrentiy siling tor $49.74 per share. This firin pails a 54.07 dividend last year and expects dividends to continue growing at a rato of 3.6 percent per year for the indefinite thitige. The firmis magral tar rifle is 34 peroent. What diecount rate should you use to eviluate the warehouse projoct? b. Calculate component costs of capital. The aller-tax cost of debt for the firm is The cost of preforred stock for the firm is \%. (Round to two decimal places.) The cost of common equity for the firm is Y. (Round to two decimal places:) c. Caiculate the firm's weighted average cost of capital. The discount rate you should use to evaluate the warehouse project is %. (Round to three decirral places.) Data table