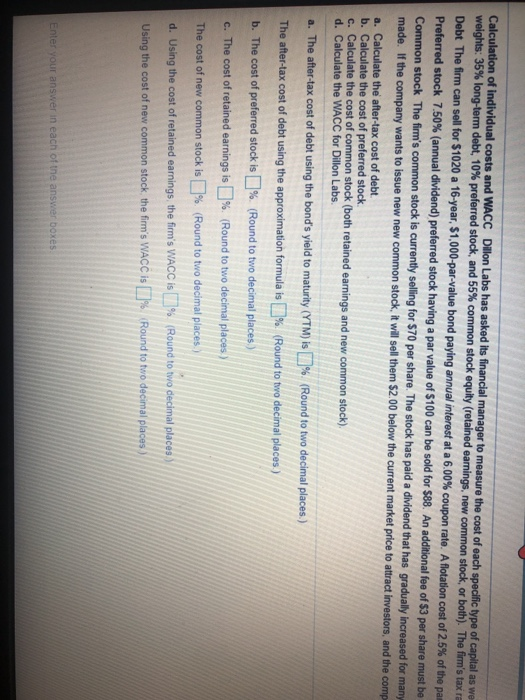

Calculation of individual costs and WACC Olon Labs has asked financial manager to measure the cost of each spell type of capital as well as the weighed average cost of capital The weighted average cost is to be measured by using the following weight long term dubt, 10% preferred lock, and 5 common stock qully retained earnings, new common stock arbol The firm's tax rate is 21% Debt The tem caso for $100 a 16 year. 1.000 a value bond paying interest at 600 coupon rate A Botafon cost of the par value is required Preferred stock 70 annual ridend preferred to having a par value of 100 can be sold for $88. An additional foof) pare must be paid to the understors Common stock The's common stock is currently wing for STO per share. The stock has paid a dividend that has gradually increased for many years sing from 12.25 ton years ago to 513) vidend payment that the company record made the company wants to new common stock will then 2.00 below the current market price to tract investors and the company way 350 per share infotation costs . Calculate the cost of b. Calculate the cost of preferred stock c. Calculate the cost of common stock (both retained comings and new conmonok d. Call the WACC Don Labs .. Theater tax cost of debt using the band's yold to maturty T h I Round to two decimal) The tax cost of debt using the approximation formula I Round to two decimal places) h. The cost of proferred to sound to two decimal places) c. The cost of retained caring is Round to be decimal places) The cost of common stock N Round to be decimal place d. Using the coming the WACC Round to be decimal places Using the common stock the form VICCI Round to be decimal places) Calculation of individual costs and WACC Dillon Labs has asked its financial manager to measure the cost of each specific type of capital as we weights: 35% long-term debt, 10% preferred stock, and 55% common stock equity (retained earnings, new common stock, or both). The firm's tax r= Debt The firm can sell for $1020 a 16-year, $1,000-par-value bond paying annual interest at a 6.00% coupon rate. A flotation cost of 2.5% of the pan Preferred stock 7.50% (annual dividend) preferred stock having a par value of $100 can be sold for $88. An additional fee of $3 per share must be Common stock The firm's common stock is currently selling for $70 per share. The stock has paid a dividend that has gradually increased for many made. If the company wants to issue new new common stock, it will sell them $2.00 below the current market price to attract investors, and the comp- a. Calculate the after-tax cost of debt. b. Calculate the cost of preferred stock. c. Calculate the cost of common stock (both retained earnings and new common stock) d. Calculate the WACC for Dillon Labs a. The after-tax cost of debt using the bond's yield to maturity (YTM) is 1% (Round to two decimal places.) The after-tax cost of debt using the approximation formula is 1% (Round to two decimal places) b. The cost of preferred stock is % (Round to two decimal places) c. The cost of retained earnings is 3% (Round to two decimal places The cost of new common stock is % (Round to two decimal places) d. Using the cost of retained earnings, the firm's WACC IS 1% (Round to two decimal places Using the cost of new common stock, the firm's WACC is L% Round to two decimal places) Enter your answer in each of the answer boxes asked its financial manager to measure the cost of each specific type of capital as well as the weighted average cost of capital. The weighted average cost is to be measured by using the following common stock equity (retained earings, new common stock, or both). The firm's tax rate is 21% bond paying annual interest at a 6.00% coupon rate. A flotation cost of 25% of the par value is required aving a par value of 5100 can be sold for 588. An additional fee of $3 per share must be paid to the underwriters. for $70 per share. The stock has paid a dividend that has gradually increased for many years, rising from $225 ten years ago to the $3.33 dividend payment. Do, that the company just recently k. It will sell them $2.00 below the current market price to attract investors, and the company will pay $3.50 per share in flotation costs ngs and new common stock) urity (TM) is % (Round to two decimal places) is [%. (Round to two decimal places) cimal places) decimal places) decimal places [ Round to two decimal places) Il Round to two decimal places)