Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculation of Net cash flows from adopting new project (Design A)-Expansion Project Step A: Estimating Initial Cash Outflow - Cost of new asset - Capitalized

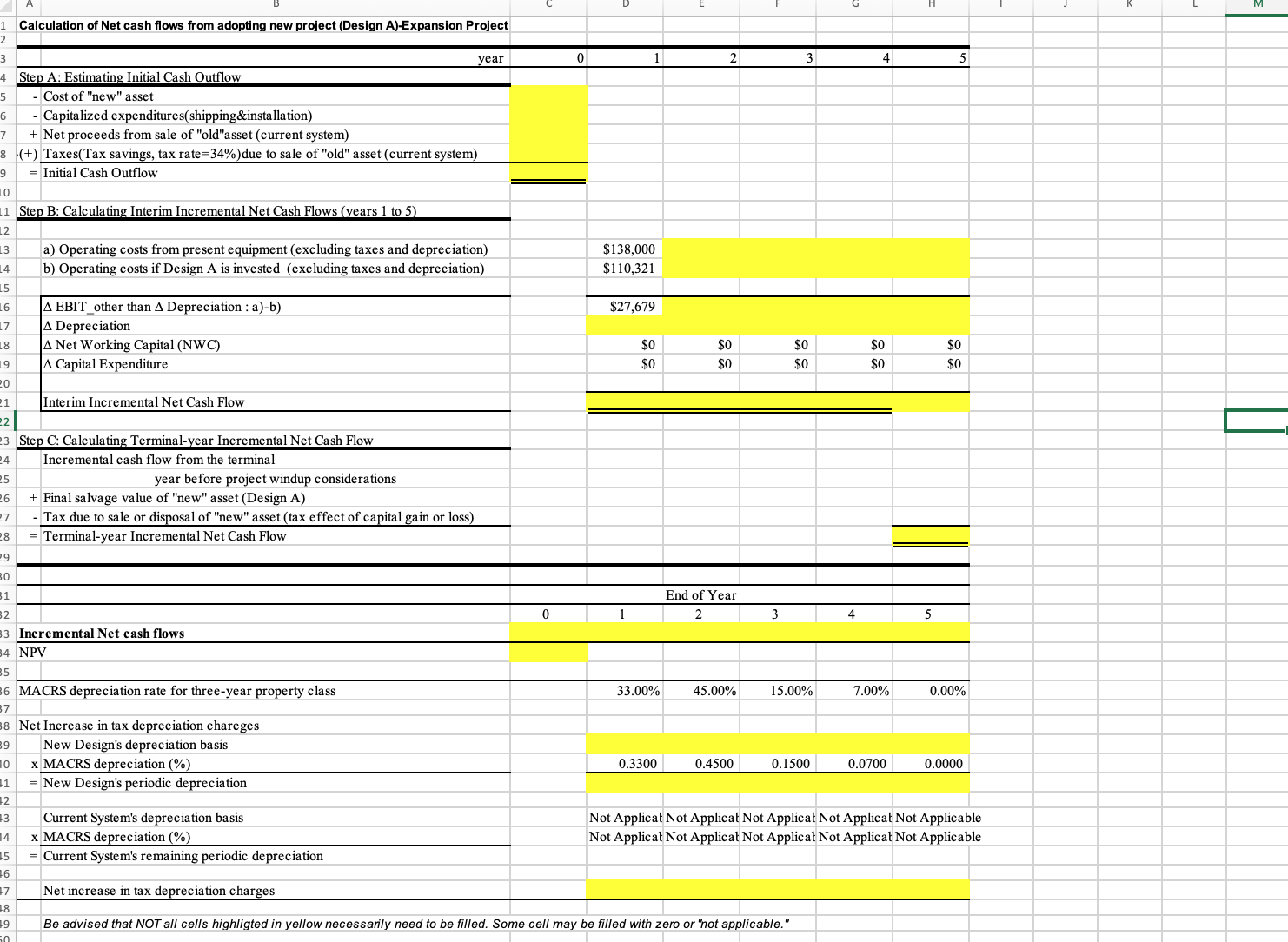

Calculation of Net cash flows from adopting new project (Design A)-Expansion Project Step A: Estimating Initial Cash Outflow - Cost of "new" asset - Capitalized expenditures(shipping\&installation) + Net proceeds from sale of "old"asset (current system) (+) Taxes(Tax savings, tax rate =34% )due to sale of "old" asset (current system) = Initial Cash Outflow Step B: Calculating Interim Incremental Net Cash Flows (years 1 to 5) a) Operating costs from present equipment (excluding taxes and depreciation) b) Operating costs if Design A is invested (excluding taxes and depreciation) EBIT_other than Depreciation : a)-b) Depreciation Net Working Capital (NWC) Capital Expenditure Interim Incremental Net Cash Flow Step C: Calculating Terminal-year Incremental Net Cash Flow Incremental cash flow from the terminal year before project windup considerations + Final salvage value of "new" asset (Design A) - Tax due to sale or disposal of "new" asset (tax effect of capital gain or loss) = Terminal-year Incremental Net Cash Flow year 0 1 2 3 4 $138,000 5 $27,679 \begin{tabular}{l|l|l|l|l|} \hline \$0 & $0 & $0 & $0 & $0 \\ \hline \$0 & $0 & $0 & $0 & $0 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline \multicolumn{4}{|c|}{ End of Year } & \\ \hline 1 & 2 & 3 & 4 & 5 \\ \hline & & & & \\ \hline 33.00% & 45.00% & 15.00% & 7.00% & 0.00% \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline 0.3300 & 0.4500 & 0.1500 & 0.0700 & 0.0000 \\ \hline \end{tabular} Incremental Net cash flows NPV MACRS depreciation rate for three-year property class Net Increase in tax depreciation chareges New Design's depreciation basis x MACRS depreciation (\%) = New Design's periodic depreciation Current System's depreciation basis Not Applicat Not Applicat Not Applicat Not Applicat Not Applicable x MACRS depreciation (\%) Not Applicat Not Applicat Not Applicat Not Applicat Not Applicable = Current System's remaining periodic depreciation Net increase in tax depreciation charges Be advised that NOT all cells highligted in yellow necessarily need to be filled. Some cell may be filled with zero or "not applicable

Calculation of Net cash flows from adopting new project (Design A)-Expansion Project Step A: Estimating Initial Cash Outflow - Cost of "new" asset - Capitalized expenditures(shipping\&installation) + Net proceeds from sale of "old"asset (current system) (+) Taxes(Tax savings, tax rate =34% )due to sale of "old" asset (current system) = Initial Cash Outflow Step B: Calculating Interim Incremental Net Cash Flows (years 1 to 5) a) Operating costs from present equipment (excluding taxes and depreciation) b) Operating costs if Design A is invested (excluding taxes and depreciation) EBIT_other than Depreciation : a)-b) Depreciation Net Working Capital (NWC) Capital Expenditure Interim Incremental Net Cash Flow Step C: Calculating Terminal-year Incremental Net Cash Flow Incremental cash flow from the terminal year before project windup considerations + Final salvage value of "new" asset (Design A) - Tax due to sale or disposal of "new" asset (tax effect of capital gain or loss) = Terminal-year Incremental Net Cash Flow year 0 1 2 3 4 $138,000 5 $27,679 \begin{tabular}{l|l|l|l|l|} \hline \$0 & $0 & $0 & $0 & $0 \\ \hline \$0 & $0 & $0 & $0 & $0 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline \multicolumn{4}{|c|}{ End of Year } & \\ \hline 1 & 2 & 3 & 4 & 5 \\ \hline & & & & \\ \hline 33.00% & 45.00% & 15.00% & 7.00% & 0.00% \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline 0.3300 & 0.4500 & 0.1500 & 0.0700 & 0.0000 \\ \hline \end{tabular} Incremental Net cash flows NPV MACRS depreciation rate for three-year property class Net Increase in tax depreciation chareges New Design's depreciation basis x MACRS depreciation (\%) = New Design's periodic depreciation Current System's depreciation basis Not Applicat Not Applicat Not Applicat Not Applicat Not Applicable x MACRS depreciation (\%) Not Applicat Not Applicat Not Applicat Not Applicat Not Applicable = Current System's remaining periodic depreciation Net increase in tax depreciation charges Be advised that NOT all cells highligted in yellow necessarily need to be filled. Some cell may be filled with zero or "not applicable Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started