Answered step by step

Verified Expert Solution

Question

1 Approved Answer

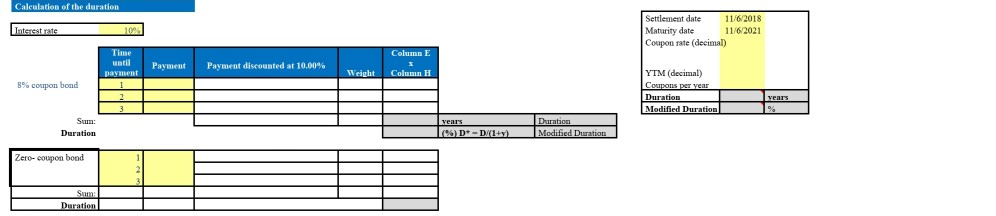

Calculation of the duration Interstate Settlement date 11/6/2018 Maturity date 11/6/2021 Coupon rate (decimal) Time Column E Payment Payment discounted at 10.00% payment Weight Column

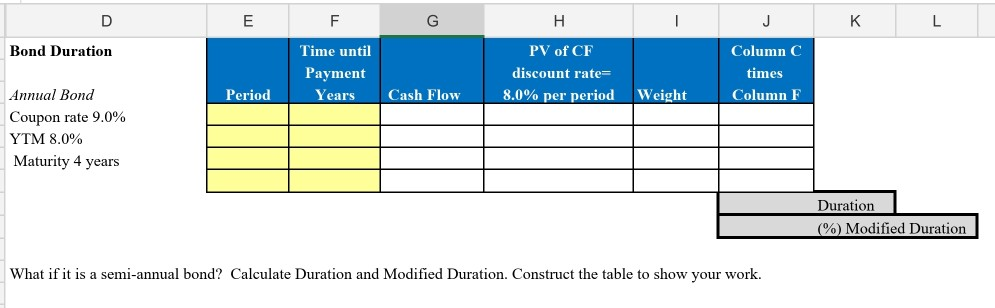

Calculation of the duration Interstate Settlement date 11/6/2018 Maturity date 11/6/2021 Coupon rate (decimal) Time Column E Payment Payment discounted at 10.00% payment Weight Column II 8% coupon bond YTM (decimal) Coupons per year Duration Modified Duration years Sun: Duration vears (%) D-D/(1+y) Duration Modified Duration Zero-coupon bond Sum Duration D E F G H - J K L Bond Duration Time until Payment Years PV of CF discount rate= 8.0% per period Column C times Column F Period Cash Flow Weight Annual Bond Coupon rate 9.0% YTM 8.0% Maturity 4 years Duration (%) Modified Duration What if it is a semi-annual bond? Calculate Duration and Modified Duration. Construct the table to show your work

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started