Answered step by step

Verified Expert Solution

Question

1 Approved Answer

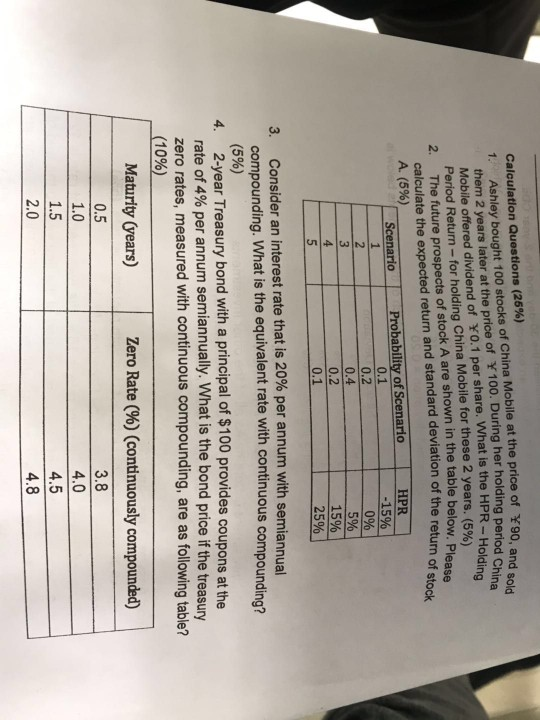

Calculation Questions (26 %) 1. Ashley bought 100 stocks of China Mobile at the price of 90, and sold them 2 years later at the

Calculation Questions (26 %) 1. Ashley bought 100 stocks of China Mobile at the price of 90, and sold them 2 years later at the price of Y 100, During her holding period China Mobile offered dividend of Y0.1 per share. What is the HPR-Holding Period Return-for holding China Mobile for these 2 years. (5%) The future prospects of stock A are shown in the table below, Please calculate the expected return and standard deviation of the return of stock A. (5%) 2. Probability of Scenario 0.1 0.2 HPR Scenario -15% 0% 1 2 5% 15% 25% 0.4 3 4 0.2 5 0.1 an interest rate that is 20 % per annum with semiannual Consider compounding. What is the equivalent rate with continuous compounding? (5%) 4. 3. 2-year Treasury bond with a principal of $100 provides coupons at the rate of 4% per annum semiannually. What is the bond price if the treasury zero rates, measured with continu compounding, are as following table? (10%) Maturity (years) Zero Rate (%) (continuously compounded) 0.5 3.8 1.0 4.0 1.5 4.5 2.0 4.8

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started