Answered step by step

Verified Expert Solution

Question

1 Approved Answer

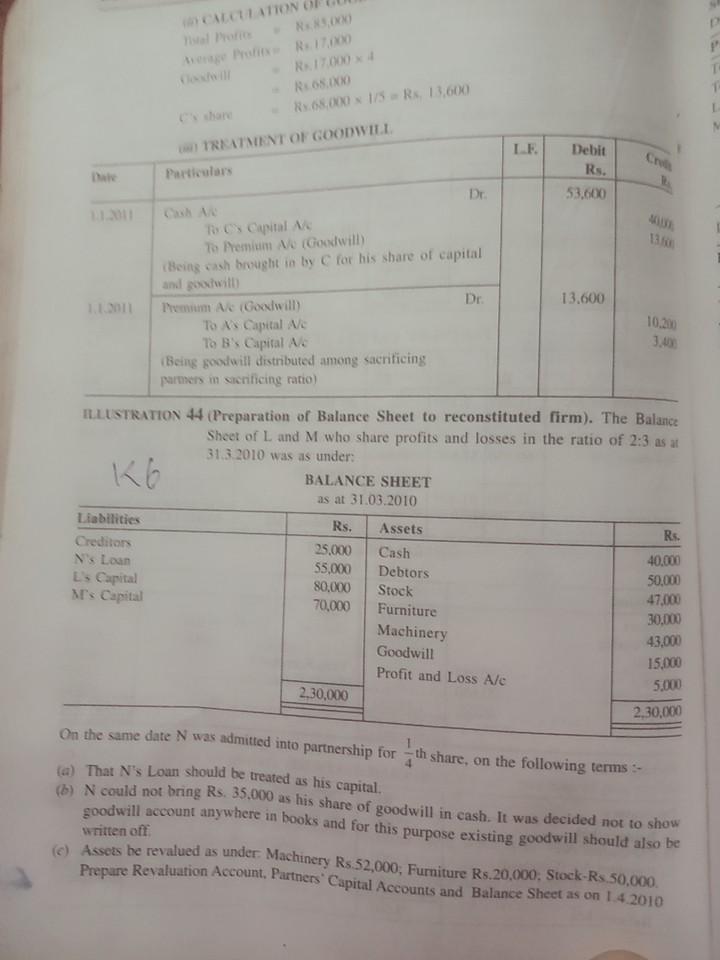

CALCULATION rool more N39,000 hoge te RTO Rs. 17.000 x REOS.XX 14.04.000 x 113 - Rs 13,600 TREATMENT OF GOODWILL LE Cru That Particulars Debit

CALCULATION rool more N39,000 hoge te RTO Rs. 17.000 x REOS.XX 14.04.000 x 113 - Rs 13,600 TREATMENT OF GOODWILL LE Cru That Particulars Debit Rs. 53.600 Dr. Cud An TC's Capital To Premium A Goodwill Being cash brought in by for his share of capital and goox wit Premium Ac Goodwill) Dr. To As Capital Me To B's Capital A Being goodwill distributed among sacrificing parmers in sacrificing ratio) 13.600 11.30 10.2010 KG ILLUSTRATION 44 (Preparation of Balance Sheet to reconstituted firm). The Balance Sheet of L and M who share profits and losses in the ratio of 2:3 as at 31.3.2010 was as under BALANCE SHEET as at 31.03.2010 Liabilities Rs. Assets Rs. Creditors 25,000 Cash 40.000 N's Loan 55,000 Debtors 50.000 Ls Capital 80,000 Stock 47.000 ar's Capital 70,000 Furniture 30.000 Machinery 43.000 Goodwill Profit and Loss Ale 2.30,000 2,30,000 15.000 5.000 On the same date N was admitted into partnership for th share, on the following terms- (a) That N's Loun should be treated as his capital. (b) N could not bring Rs. 35.000 as his share of goodwill in cash. It was decided not to show goodwill account anywhere in books and for this purpose existing goodwill should also be (c) Assets be revalued as under Machinery Rs 52,000, Furniture Rs.20,000, Stock-Rs 50,000 Prepare Revaluation Account. Partners Capital Accounts and Balance Sheet as on 1.4.2010 written oft

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started