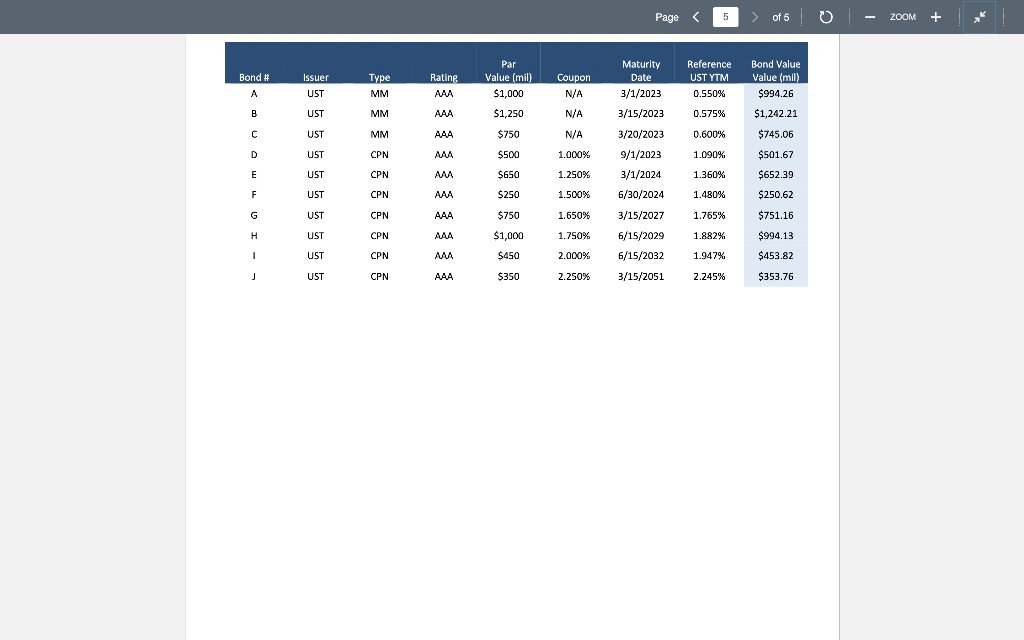

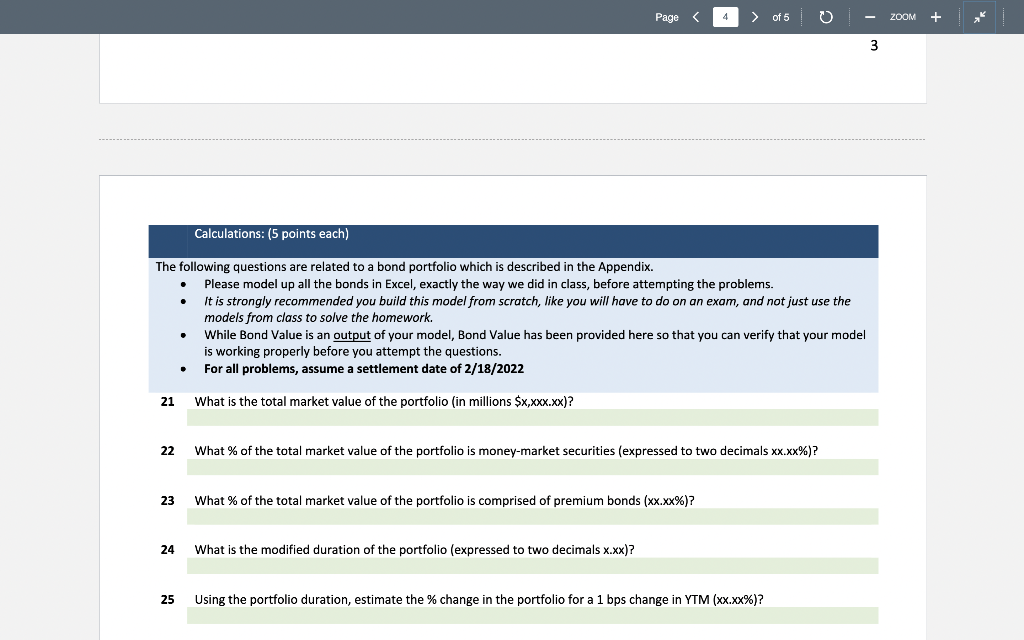

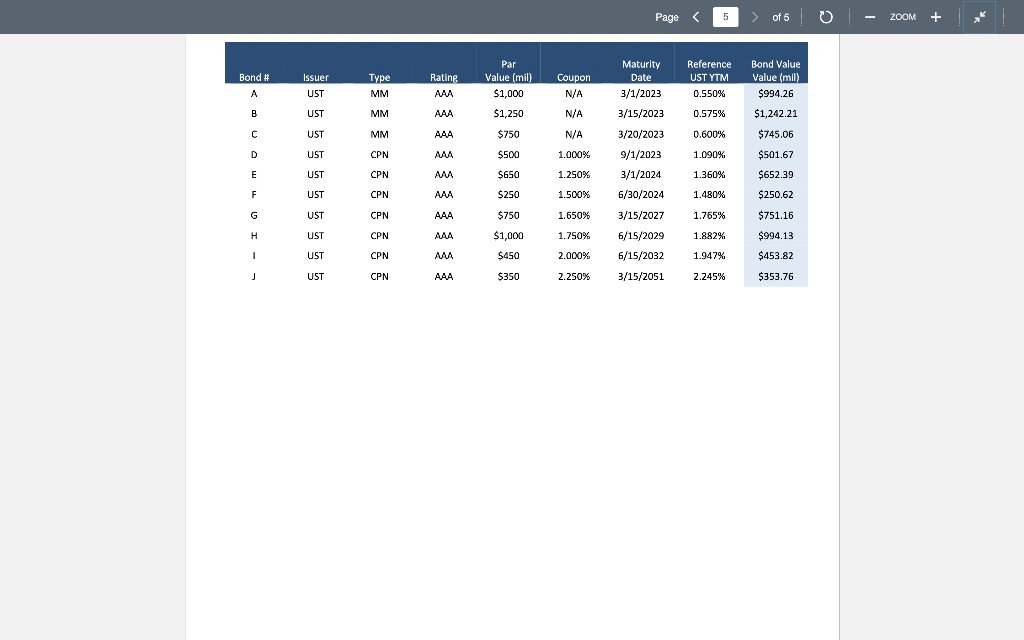

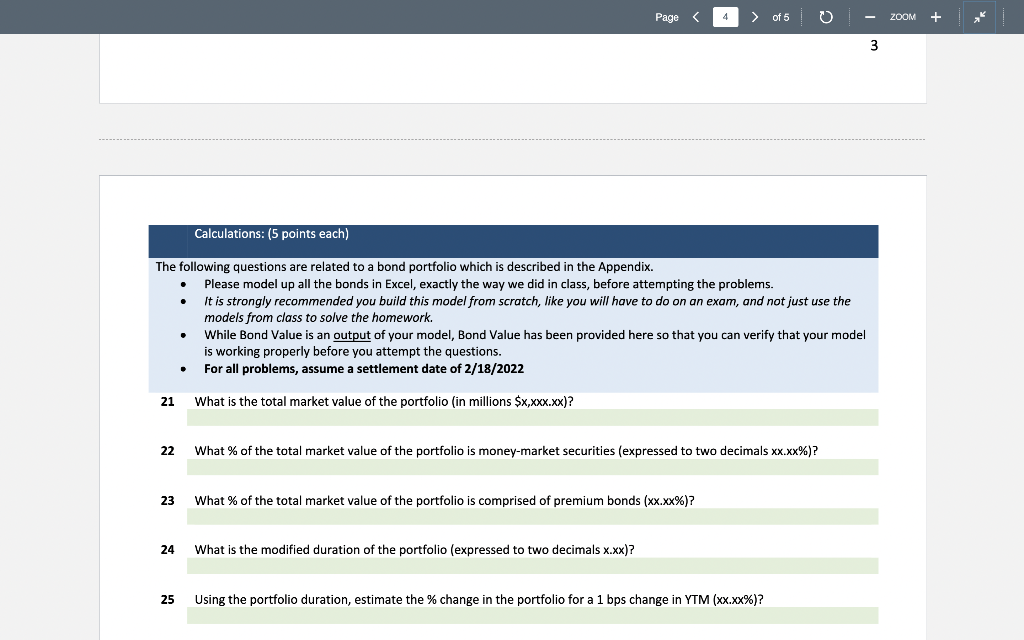

Calculations: (5 points each) The following questions are related to a bond portfolio which is described in the Appendix. - Please model up all the bonds in Excel, exactly the way we did in class, before attempting the problems. - It is strongly recommended you build this model from scratch, like you will have to do on an exam, and not just use the models from class to solve the homework. - While Bond Value is an output of your model, Bond Value has been provided here so that you can verify that your model is working properly before you attempt the questions. - For all problems, assume a settlement date of 2/18/2022 21 What is the total market value of the portfolio (in millions $x,xxx.xx )? 22 What \% of the total market value of the portfolio is money-market securities (expressed to two decimals xx.xx% ? 23 What % of the total market value of the portfolio is comprised of premium bonds (xx.xx\%)? 24 What is the modified duration of the portfolio (expressed to two decimals x.xx)? 25 Using the portfolio duration, estimate the \% change in the portfolio for a 1 bps change in YTM (xx.xx\%)? Calculations: (5 points each) The following questions are related to a bond portfolio which is described in the Appendix. - Please model up all the bonds in Excel, exactly the way we did in class, before attempting the problems. - It is strongly recommended you build this model from scratch, like you will have to do on an exam, and not just use the models from class to solve the homework. - While Bond Value is an output of your model, Bond Value has been provided here so that you can verify that your model is working properly before you attempt the questions. - For all problems, assume a settlement date of 2/18/2022 21 What is the total market value of the portfolio (in millions $x,xxx.xx )? 22 What \% of the total market value of the portfolio is money-market securities (expressed to two decimals xx.xx% ? 23 What % of the total market value of the portfolio is comprised of premium bonds (xx.xx\%)? 24 What is the modified duration of the portfolio (expressed to two decimals x.xx)? 25 Using the portfolio duration, estimate the \% change in the portfolio for a 1 bps change in YTM (xx.xx\%)