Answered step by step

Verified Expert Solution

Question

1 Approved Answer

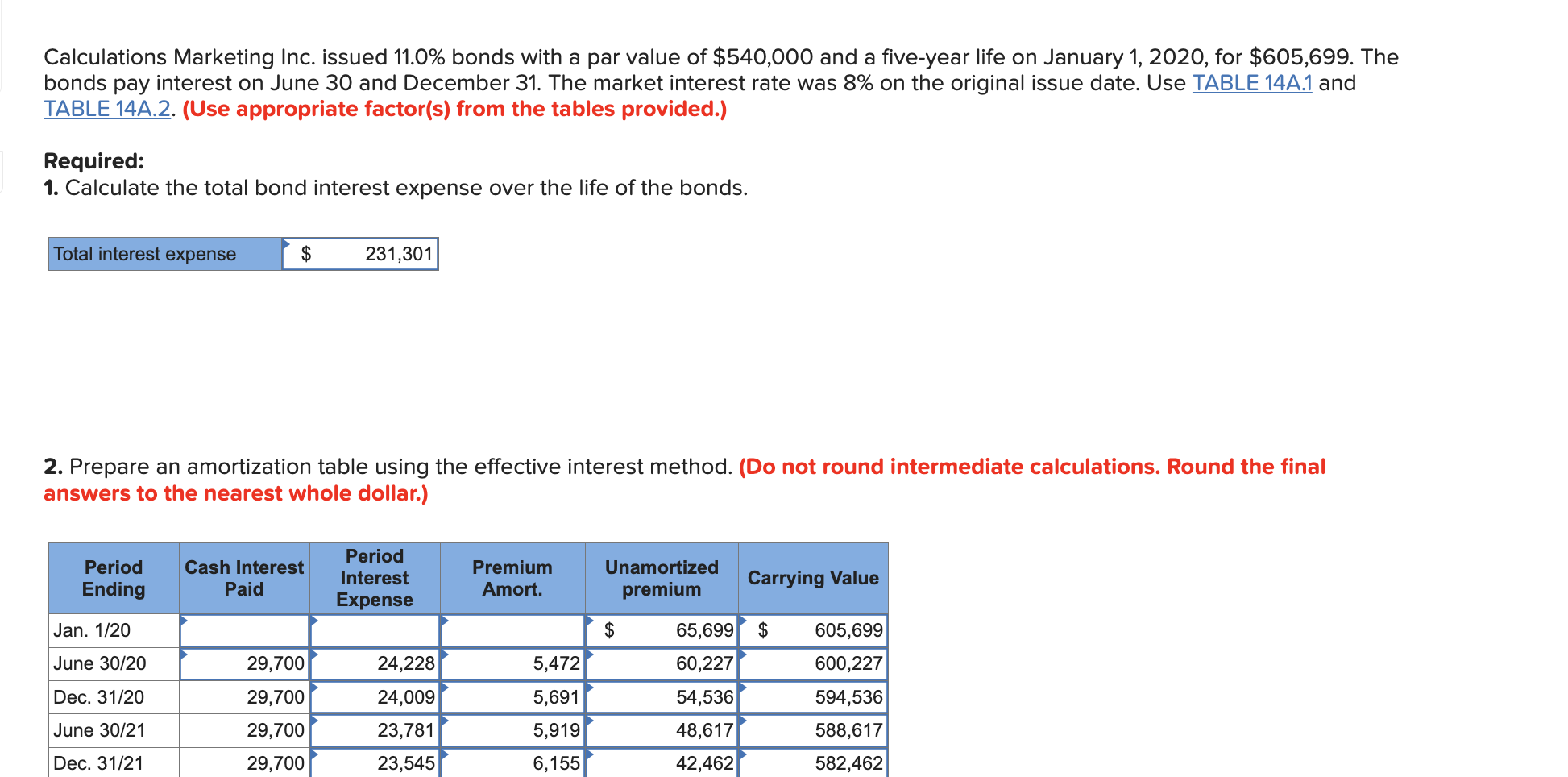

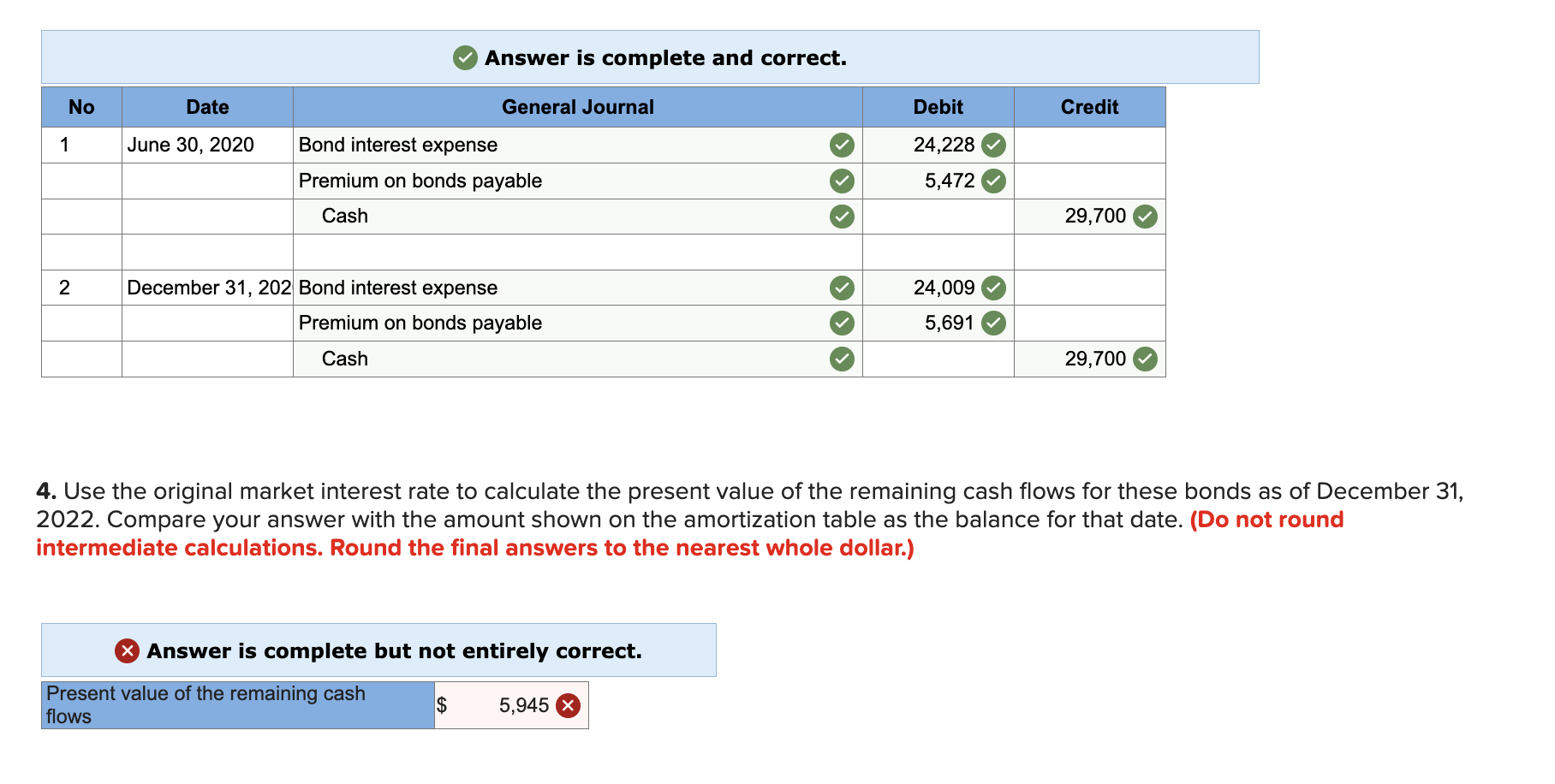

Calculations Marketing Inc. issued 11.0% bonds with a par value of $540,000 and a five-year life on January 1, 2020, for $605,699. The bonds

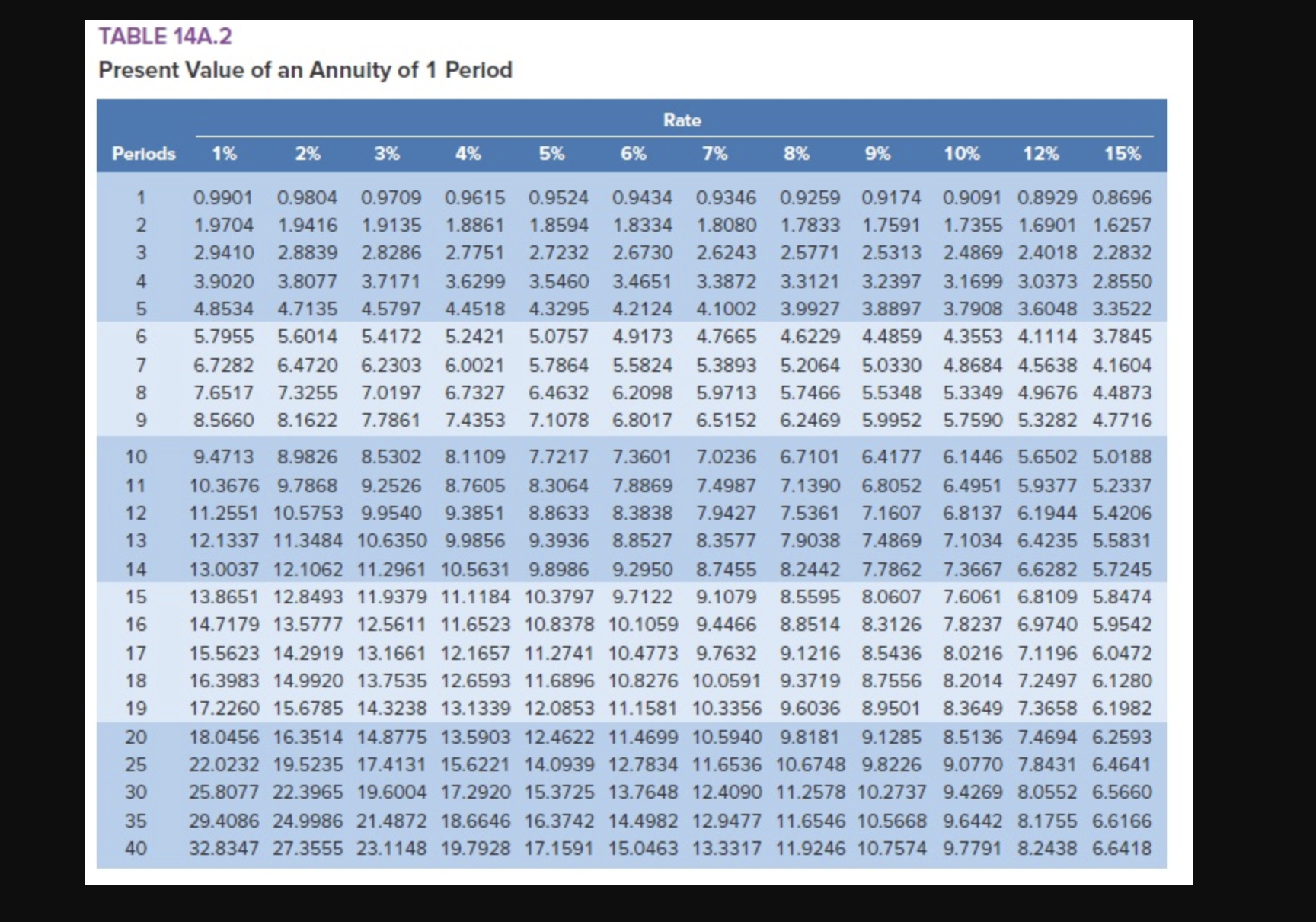

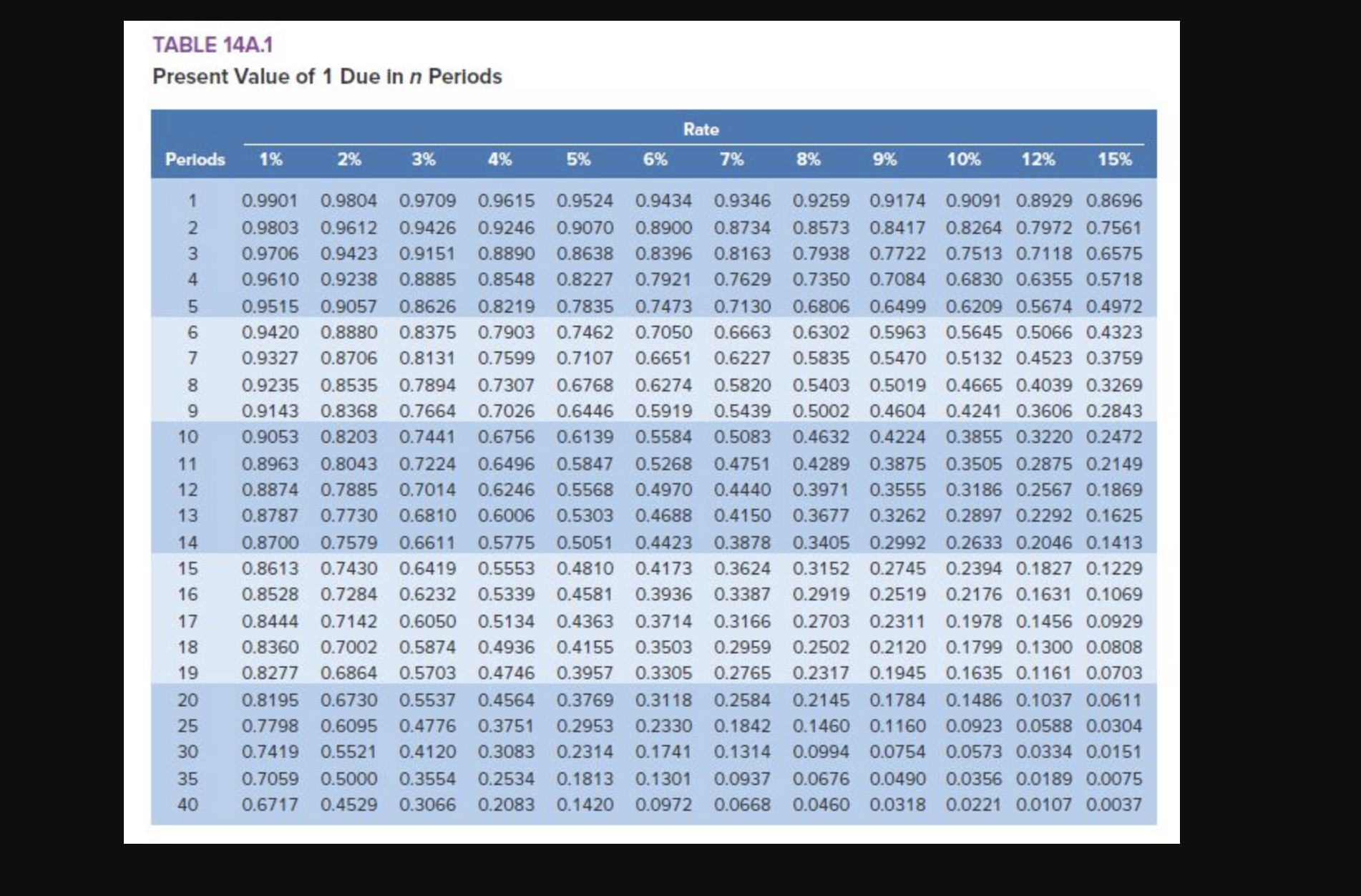

Calculations Marketing Inc. issued 11.0% bonds with a par value of $540,000 and a five-year life on January 1, 2020, for $605,699. The bonds pay interest on June 30 and December 31. The market interest rate was 8% on the original issue date. Use TABLE 14A.1 and TABLE 14A.2. (Use appropriate factor(s) from the tables provided.) Required: 1. Calculate the total bond interest expense over the life of the bonds. Total interest expense $ 231,301 2. Prepare an amortization table using the effective interest method. (Do not round intermediate calculations. Round the final answers to the nearest whole dollar.) Period Ending Jan. 1/20 Cash Interest Paid Period Interest Expense Premium Amort. Unamortized premium Carrying Value $ 65,699 $ 605,699 June 30/20 29,700 24,228 5,472 60,227 600,227 Dec. 31/20 29,700 24,009 5,691 54,536 594,536 June 30/21 29,700 23,781 5,919 48,617 588,617 Dec. 31/21 29,700 23,545 6,155 42,462 582,462 Answer is complete and correct. No Date General Journal 1 June 30, 2020 Bond interest expense Premium on bonds payable Cash 2 December 31, 202 Bond interest expense Premium on bonds payable Cash Debit Credit 24,228 5,472 29,700 24,009 5,691 29,700 4. Use the original market interest rate to calculate the present value of the remaining cash flows for these bonds as of December 31, 2022. Compare your answer with the amount shown on the amortization table as the balance for that date. (Do not round intermediate calculations. Round the final answers to the nearest whole dollar.) Answer is complete but not entirely correct. Present value of the remaining cash flows $ 5,945 TABLE 14A.2 Present Value of an Annuity of 1 Period Rate Periods 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 15% 1 2 0.9901 0.9804 0.9709 0.9615 1.9704 1.9416 1.9135 3 2.9410 2.8839 2.8286 4 3.9020 3.5460 5 4.8534 4.7135 4.5797 4.4518 6 5.7955 5.6014 5.4172 5.2421 7 6.7282 6.4720 6.2303 8 7.6517 9 10 11 12 9.4713 8.9826 8.5302 8.1109 10.3676 9.7868 9.2526 8.7605 11.2551 10.5753 9.9540 9.3851 7.7217 7.3601 8.3064 7.8869 8.8633 8.3838 13 12.1337 11.3484 10.6350 9.9856 14 15 16 17 18 19 20 25 35 40 0.9524 0.9434 0.9346 0.9259 0.9174 0.9091 0.8929 0.8696 1.8861 1.8594 1.8334 1.8080 1.7833 1.7591 1.7355 1.6901 1.6257 2.7751 2.7232 2.6730 2.6243 2.5771 2.5313 2.4869 2.4018 2.2832 3.8077 3.7171 3.6299 3.4651 3.3872 3.3121 3.2397 3.1699 3.0373 2.8550 4.3295 4.2124 4.1002 3.9927 3.8897 3.7908 3.6048 3.3522 5.0757 4.9173 4.7665 4.6229 4.4859 4.3553 4.1114 3.7845 6.0021 5.7864 5.5824 5.3893 5.2064 5.0330 4.8684 4.5638 4.1604 7.3255 7.0197 6.7327 6.4632 6.2098 5.9713 5.7466 5.5348 5.3349 4.9676 4.4873 8.5660 8.1622 7.7861 7.4353 7.1078 6.8017 6.5152 6.2469 5.9952 5.7590 5.3282 4.7716 7.0236 6.7101 6.4177 6.1446 5.6502 5.0188 7.4987 7.1390 6.8052 6.4951 5.9377 5.2337 7.9427 7.5361 7.1607 6.8137 6.1944 5.4206 9.3936 8.8527 8.3577 7.9038 7.4869 7.1034 6.4235 5.5831 13.0037 12.1062 11.2961 10.5631 9.8986 9.2950 8.7455 8.2442 7.7862 7.3667 6.6282 5.7245 13.8651 12.8493 11.9379 11.1184 10.3797 9.7122 9.1079 8.5595 8.0607 7.6061 6.8109 5.8474 14.7179 13.5777 12.5611 11.6523 10.8378 10.1059 9.4466 8.8514 8.3126 7.8237 6.9740 5.9542 15.5623 14.2919 13.1661 12.1657 11.2741 10.4773 9.7632 9.1216 8.5436 8.0216 7.1196 6.0472 16.3983 14.9920 13.7535 12.6593 11.6896 10.8276 10.0591 9.3719 8.7556 8.2014 7.2497 6.1280 17.2260 15.6785 14.3238 13.1339 12.0853 11.1581 10.3356 9.6036 8.9501 8.3649 7.3658 6.1982 18.0456 16.3514 14.8775 13.5903 12.4622 11.4699 10.5940 9.8181 9.1285 8.5136 7.4694 6.2593 22.0232 19.5235 17.4131 15.6221 14.0939 12.7834 11.6536 10.6748 9.8226 9.0770 7.8431 6.4641 30 25.8077 22.3965 19.6004 17.2920 15.3725 13.7648 12.4090 11.2578 10.2737 9.4269 8.0552 6.5660 29.4086 24.9986 21.4872 18.6646 16.3742 14.4982 12.9477 11.6546 10.5668 9.6442 8.1755 6.6166 32.8347 27.3555 23.1148 19.7928 17.1591 15.0463 13.3317 11.9246 10.7574 9.7791 8.2438 6.6418 TABLE 14A.1 Present Value of 1 Due in n Periods Rate Periods 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 15% 1 0.9901 0.9804 0.9709 0.9615 2 0.9803 0.9612 0.9426 0.9246 3 0.9706 0.9423 0.9151 0.8890 4 0.9610 0.9238 5 6 7 68 10 11 12 13 14 15 16 17 18 19 20 25 30 35 40 0.9524 0.9434 0.9346 0.9259 0.9174 0.9091 0.8929 0.8696 0.9070 0.8900 0.8734 0.8573 0.8417 0.8264 0.7972 0.7561 0.8638 0.8396 0.8163 0.7938 0.7722 0.7513 0.7118 0.6575 0.8885 0.8548 0.8227 0.7921 0.7629 0.7350 0.7084 0.6830 0.6355 0.5718 0.9515 0.9057 0.8626 0.8219 0.7835 0.7473 0.7130 0.6806 0.6499 0.6209 0.5674 0.4972 0.9420 0.8880 0.8375 0.7903 0.7462 0.7050 0.6663 0.6302 0.5963 0.5645 0.5066 0.4323 0.9327 0.8706 0.8131 0.7599 0.7107 0.6651 0.6227 0.5835 0.5470 0.5132 0.4523 0.3759 0.9235 0.8535 0.7894 0.7307 0.6768 0.6274 0.5820 0.5403 0.5019 0.4665 0.4039 0.3269 0.9143 0.8368 0.7664 0.7026 0.6446 0.5919 0.5439 0.5002 0.4604 0.4241 0.3606 0.2843 0.9053 0.8203 0.7441 0.6756 0.6139 0.5584 0.5083 0.4632 0.4224 0.8963 0.8043 0.7224 0.6496 0.5847 0.5268 0.4751 0.4289 0.3875 0.3505 0.2875 0.2149 0.8874 0.7885 0.7014 0.6246 0.5568 0.4970 0.4440 0.3971 0.3555 0.3186 0.2567 0.1869 0.8787 0.7730 0.6810 0.6006 0.5303 0.4688 0.4150 0.3677 0.3262 0.2897 0.2292 0.1625 0.8700 0.7579 0.6611 0.5775 0.5051 0.4423 0.3878 0.3405 0.2992 0.2633 0.2046 0.1413 0.8613 0.7430 0.6419 0.5553 0.4810 0.4173 0.3624 0.3152 0.2745 0.2394 0.1827 0.1229 0.8528 0.7284 0.6232 0.5339 0.4581 0.3936 0.3387 0.2919 0.2519 0.2176 0.1631 0.1069 0.8444 0.7142 0.6050 0.5134 0.4363 0.3714 0.3166 0.2703 0.2311 0.1978 0.1456 0.0929 0.8360 0.7002 0.5874 0.4936 0.4155 0.3503 0.2959 0.2502 0.2120 0.1799 0.1300 0.0808 0.8277 0.6864 0.5703 0.4746 0.3957 0.3305 0.2765 0.2317 0.1945 0.1635 0.1161 0.0703 0.8195 0.6730 0.5537 0.4564 0.3769 0.3118 0.2584 0.2145 0.1784 0.1486 0.1037 0.0611 0.7798 0.6095 0.4776 0.3751 0.2953 0.2330 0.1842 0.1460 0.1160 0.0923 0.0588 0.0304 0.7419 0.5521 0.4120 0.3083 0.2314 0.1741 0.1314 0.0994 0.0754 0.0573 0.0334 0.0151 0.7059 0.5000 0.3554 0.2534 0.6717 0.3855 0.3220 0.2472 0.1813 0.1301 0.0937 0.0676 0.0490 0.0356 0.0189 0.0075 0.4529 0.3066 0.2083 0.1420 0.0972 0.0668 0.0460 0.0318 0.0221 0.0107 0.0037

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started