Question

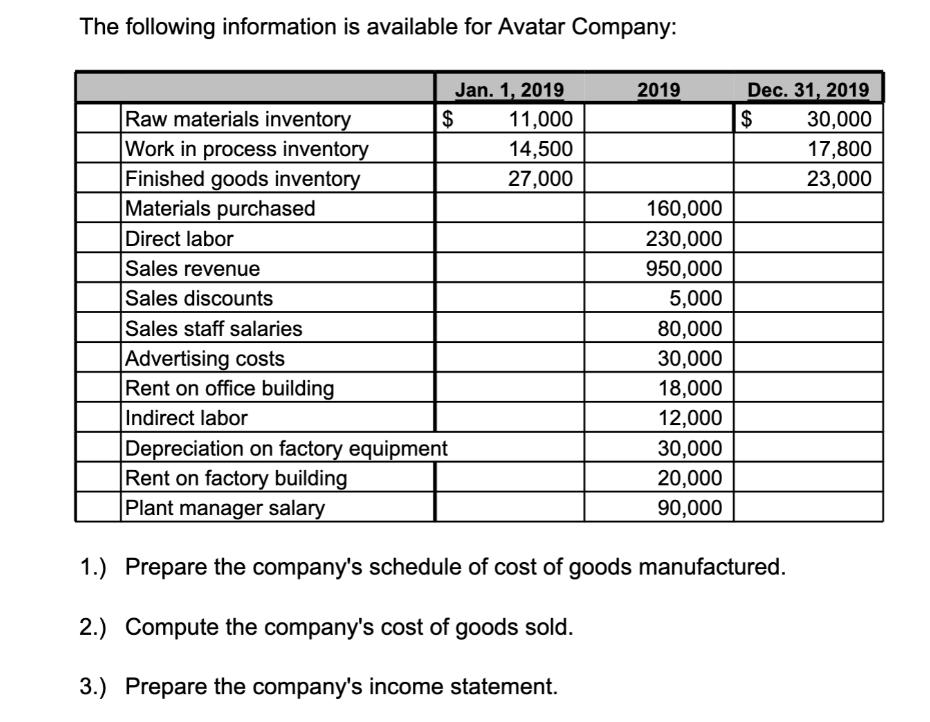

The following information is available for Avatar Company: Raw materials inventory Work in process inventory Finished goods inventory Materials purchased Direct labor Sales revenue

The following information is available for Avatar Company: Raw materials inventory Work in process inventory Finished goods inventory Materials purchased Direct labor Sales revenue Sales discounts Sales staff salaries Advertising costs Rent on office building Indirect labor |Depreciation on factory equipment Rent on factory building Plant manager salary Jan. 1, 2019 2019 Dec. 31, 2019 $ 11,000 $ 30,000 14,500 17,800 27,000 23,000 160,000 230,000 950,000 5,000 80,000 30,000 18,000 12,000 30,000 20,000 90,000 1.) Prepare the company's schedule of cost of goods manufactured. 2.) Compute the company's cost of goods sold. 3.) Prepare the company's income statement.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial Accounting A Focus on Ethical Decision Making

Authors: Steve Jackson, Roby Sawyers, Greg Jenkins

5th edition

324663854, 978-0324663853

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App