Calculations please

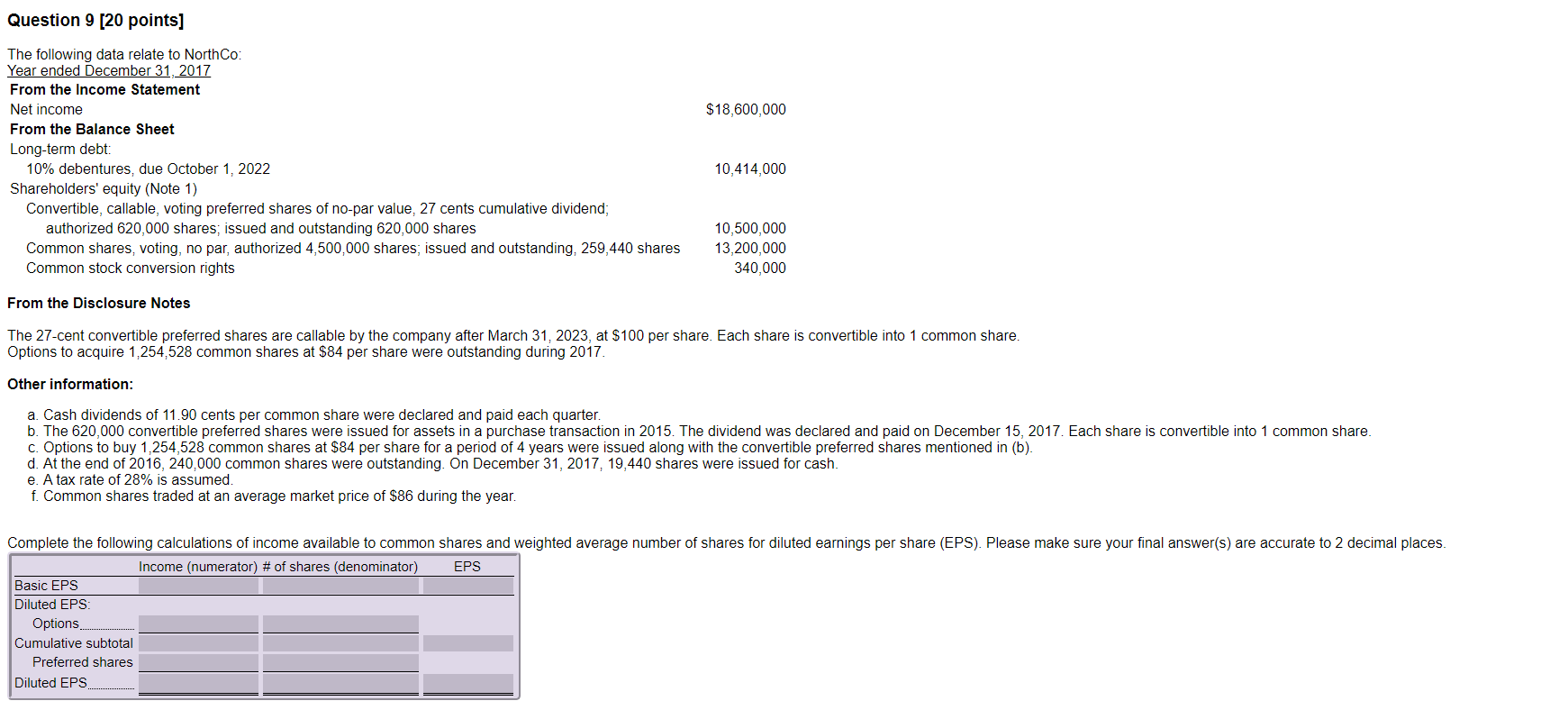

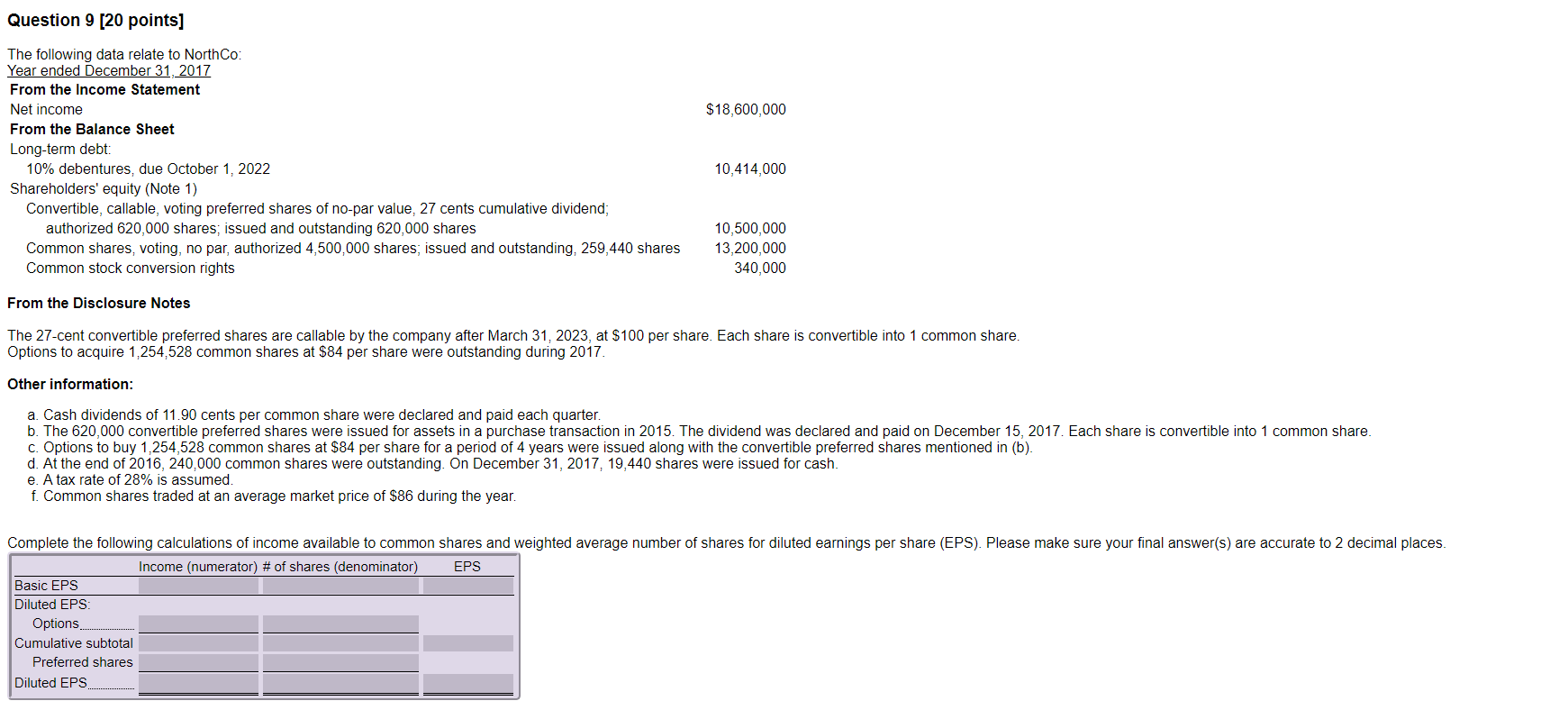

Question 9 [20 points] $18,600,000 The following data relate to North Co: Year ended December 31, 2017 From the Income Statement Net income From the Balance Sheet Long-term debt: 10% debentures, due October 1, 2022 Shareholders' equity (Note 1) Convertible, callable, voting preferred shares of no-par value, 27 cents cumulative dividend; authorized 620,000 shares, issued and outstanding 620,000 shares Common shares, voting, no par, authorized 4,500,000 shares, issued and outstanding, 259,440 shares Common stock conversion rights 10,414,000 10,500,000 13,200,000 340,000 From the Disclosure Notes The 27-cent convertible preferred shares are callable by the company after March 31, 2023, at $100 per share. Each share is convertible into 1 common share. Options to acquire 1,254,528 common shares at $84 per share were outstanding during 2017 Other information: a. Cash dividends of 11.90 cents per common share were declared and paid each quarter. b. The 620,000 convertible preferred shares were issued for assets in a purchase transaction in 2015. The dividend was declared and paid on December 15, 2017. Each share is convertible into 1 common share. c. Options to buy 1,254,528 common shares at $84 per share for a period of 4 years were issued along with the convertible preferred shares mentioned in (b). d. At the end of 2016, 240,000 common shares were outstanding. On December 31, 2017, 19,440 shares were issued for cash. e. A tax rate of 28% is assumed. f. Common shares traded at an average market price of $86 during the year. Complete the following calculations of income available to common shares and weighted average number of shares for diluted earnings per share (EPS). Please make sure your final answer(s) are accurate to 2 decimal places. Income (numerator) # of shares (denominator) EPS Basic EPS Diluted EPS Options. Cumulative subtotal Preferred shares Diluted EPS Question 9 [20 points] $18,600,000 The following data relate to North Co: Year ended December 31, 2017 From the Income Statement Net income From the Balance Sheet Long-term debt: 10% debentures, due October 1, 2022 Shareholders' equity (Note 1) Convertible, callable, voting preferred shares of no-par value, 27 cents cumulative dividend; authorized 620,000 shares, issued and outstanding 620,000 shares Common shares, voting, no par, authorized 4,500,000 shares, issued and outstanding, 259,440 shares Common stock conversion rights 10,414,000 10,500,000 13,200,000 340,000 From the Disclosure Notes The 27-cent convertible preferred shares are callable by the company after March 31, 2023, at $100 per share. Each share is convertible into 1 common share. Options to acquire 1,254,528 common shares at $84 per share were outstanding during 2017 Other information: a. Cash dividends of 11.90 cents per common share were declared and paid each quarter. b. The 620,000 convertible preferred shares were issued for assets in a purchase transaction in 2015. The dividend was declared and paid on December 15, 2017. Each share is convertible into 1 common share. c. Options to buy 1,254,528 common shares at $84 per share for a period of 4 years were issued along with the convertible preferred shares mentioned in (b). d. At the end of 2016, 240,000 common shares were outstanding. On December 31, 2017, 19,440 shares were issued for cash. e. A tax rate of 28% is assumed. f. Common shares traded at an average market price of $86 during the year. Complete the following calculations of income available to common shares and weighted average number of shares for diluted earnings per share (EPS). Please make sure your final answer(s) are accurate to 2 decimal places. Income (numerator) # of shares (denominator) EPS Basic EPS Diluted EPS Options. Cumulative subtotal Preferred shares Diluted EPS