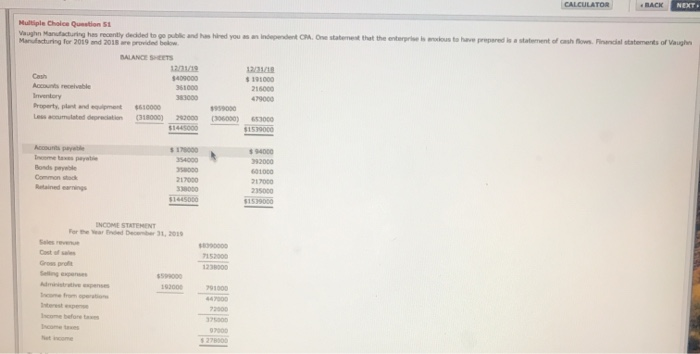

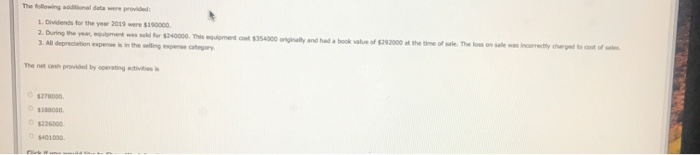

CALCULATOR BACKC NEXT Multiple Choice Question 51. Vaughn Manuacturing has recently decided to go public and has hired you as an independent CA Oe statemest that the enterprise is anocous to have prepared is a statement of cash ows Financial statements of Vaughn Manufacturing for 2019 and 2018 are provided below DALANCE SHEETS 12/01/19 12/31/18 Cash $409000 191000 Accounts recevable 361000 216000 Ientory 383000 479000 Property, plant and equipment $610000 $959000 Less acnumulated depreciation (318000) 292000 s1445000 (306000) 653000 $1539000 Accounts payeble $ 17000 $94000 Iome tas pyate Bonds pryable 354000 392000 358000 601000 Common stock 217000 338000 $1445000 217000 Rtained earnings 235000 $1539000 INCOME STATEEMENT For the ear Bed December 31, 201 Sales revenue s8090000 Cost of sale 7152000 Gross proft 1238000 Selling expenses s599000 Administratie expenses 192000 791000 Ime from operation bteest epen 447000 72000 Iscome before tax 375000 Inoome taxes 97000 s 278000 Net income The following addional data were provided 1. Dividends for the year 2019 were $190000 2. During the year, equlpment ws sold or $240000 This equipment cot $354000 orgially and had a book value of s292000 at the time of sale The loss on sale was incorrectly tharged to cot of sle 3. All deprediatioen expense is in the selling expense category The net cash provided by operating adtivites 270000 $1880s0 $226000 401000 NONM CALCULATOR BACKC NEXT Multiple Choice Question 51. Vaughn Manuacturing has recently decided to go public and has hired you as an independent CA Oe statemest that the enterprise is anocous to have prepared is a statement of cash ows Financial statements of Vaughn Manufacturing for 2019 and 2018 are provided below DALANCE SHEETS 12/01/19 12/31/18 Cash $409000 191000 Accounts recevable 361000 216000 Ientory 383000 479000 Property, plant and equipment $610000 $959000 Less acnumulated depreciation (318000) 292000 s1445000 (306000) 653000 $1539000 Accounts payeble $ 17000 $94000 Iome tas pyate Bonds pryable 354000 392000 358000 601000 Common stock 217000 338000 $1445000 217000 Rtained earnings 235000 $1539000 INCOME STATEEMENT For the ear Bed December 31, 201 Sales revenue s8090000 Cost of sale 7152000 Gross proft 1238000 Selling expenses s599000 Administratie expenses 192000 791000 Ime from operation bteest epen 447000 72000 Iscome before tax 375000 Inoome taxes 97000 s 278000 Net income The following addional data were provided 1. Dividends for the year 2019 were $190000 2. During the year, equlpment ws sold or $240000 This equipment cot $354000 orgially and had a book value of s292000 at the time of sale The loss on sale was incorrectly tharged to cot of sle 3. All deprediatioen expense is in the selling expense category The net cash provided by operating adtivites 270000 $1880s0 $226000 401000 NONM