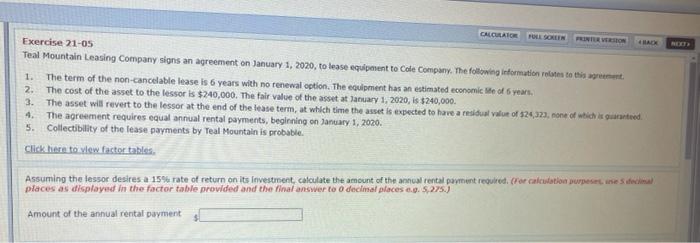

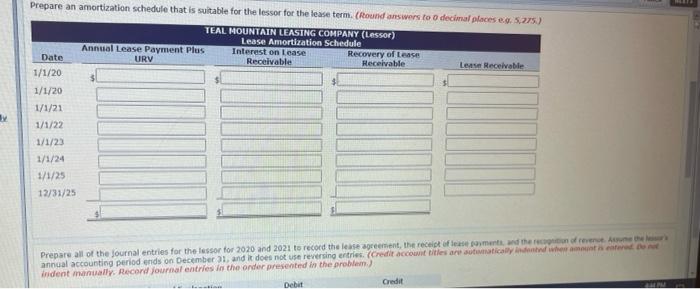

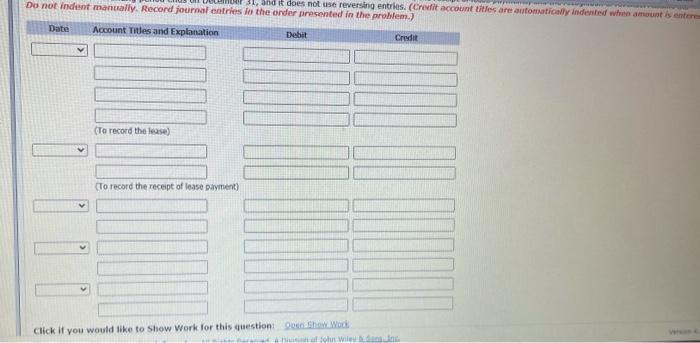

CALCULATOR FREIN VON Exercise 21-05 Teal Mountain Leasing Company signs an agreement on January 1, 2020, to lease equipment to Cole Company. The following information relates to this great 1. The term of the non-cancelable lease is 6 years with no renewal option. The equipment has an estimated economice of years, 2. The cost of the asset to the lessor is $240,000. The fair value of the asset at January 1, 2020, Is $240,000. 3. The asset will revert to the lessor at the end of the lease term, at which time the asset is expected to have a residual value of 324,323, none of which is goed 4. The agreement requires equal annual rental payments, beginning on January 1, 2020 5. Collectibility of the lease payments by Teal Mountain is probable. Click here to view factor tables Assuming the lessor desires a 15% rate of return on its Investment, calculate the amount of the annual rental payment required. (For calculation purposes se seda places as displayed in the factor table provided and the final answer to o decisal places 1.0.5.275.) Amount of the annual rental payment Prepare an amortization schedule that is suitable for the lessor for the lease term. (Round answers to o decimal places. 5.275) TEAL MOUNTAIN LEASING COMPANY (Lessor) Lease Amortization Schedule Annual Lease Payment Plus Interest on Lease Date Recovery of Lease URV Receivable Receivable Les Receivable 1/1/20 3 1/1/20 1/1/21 1/1/22 1/1/23 1/1/24 1/1/25 12/31/25 Prepare all of the Journal entries for the lessor for 2020 and 2021 to record the lease agreement, the receipt of lease payment and the free annual accounting period ends on December 1, and it does not use reversing entries. (Credit account titles are statically indeed whes amount indent manually. Record journal entries in the order presented in the problem Debit Credit 21. Ind it does not use reversing entries. (Crexit account titles are automatically indented when amount is entere Do not indent manually. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit (To record the lease) To record the receipt of lease payment) Click if you would like to show Work for this question: Don Show Work John