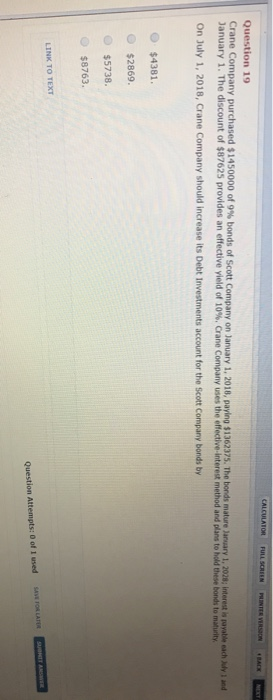

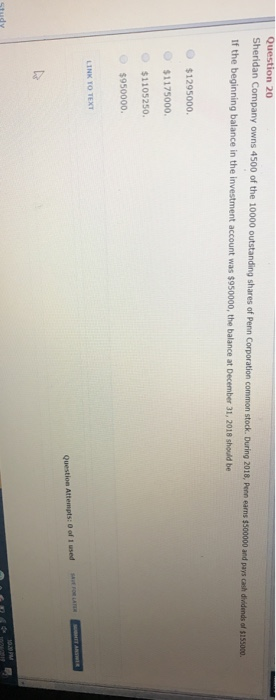

CALCULATOR FULL SCREEN PRINTER VERSION BACK NEXT Question 12 Sunland Company issued at a premium of $11000 a $203000 bond issue convertible into 3200 shares of common stock (par value $20). At the time of the conversion, the namortid premium is $3500, the market value of the bonds is $223000, and the stock is quoted on the market at $60 per share. If the bonds are converted into common what is the cont of paid-in capital in excess of par to be recorded on the conversion of the bonds? $150000 $139000 $142500 $162500 LINK TO TEXT Question Attempts: 0 of 1 used SAVE FOR LATER SUBMIT ANSWER CALCULATOR FULL SCREEN PRINTER VERSION BOX Question 13 On May 1, 2018, Bramble Corp. issued $2400000 of 8% bonds at 104, which are due on April 30, 2028. Twenty detachable stock warrants entitling the holder to purchase for $40 one share of Bramble's common stock, $15 par value, were attached to each $1000 bond. The bonds without the warrants would sell at 96. On May 1, 2018, the fair value of Brambles common stock was $34 per share and of the warrants was $2. On May 1, 2018, Bramble should credit Paid-in Capital from Stock Warrants for $92000 $192000 $99840 $96000 LINK TO TEXT SAVE FOR LATER Question Attempts: 0 of 1 used 1919 CALCULATOR FULL SCREEN PRINTER VERSION Question 14 Concord Corporation had 593000 shares of common stock outstanding on January 1, issued 899000 shares on July 1, and had income applicable to common stock of $290000 for the year ending December 31, 2018. Earnings per share of common stock for 2018 would be (rounded to the nearest penny) $2.34. $2.83 $3.29 $4.97 LINK TO TEXT SAVE POR LATE SUBITANOWE Question Attempts: 0 of 1 used Crane Company owns 11000 of the 50000 outstanding shares of Taylor, Inc. common stock. During 2018, Taylor earns $450000 and pars cash dividends of $780000 CALCULATOR POLL SCREEN PRINTER VERSION If the beginning balance in the investment account was $630000, the balance at December 31, 2018 should be $669600. $630000. $841200 $810000 LINK TO TEXT Question Attempts of I used FOR LATES T A CALCULATOR FULL SCREEN PINTARSON RAX Question 19 Crane Company purchased $1450000 of 9% bonds of Scott Company on January 1, 2018, paying 11362375. The bonds mature January 1, 2020 interest each January 1. The discount of $87625 provides an effective yield of 10%. Crane Company uses the effective interest method and plans to hold these bonds to maturity and On July 1, 2018, Crane Company should increase its Debt Investments account for the Scott Company bonds by $4381. $2869. $5738. $8763 LINK TO TEXT SAVE FOR LATO SPORTTASSE Question Attempts: 0 of 1 used Question 20 Sheridan Company owns 4500 of the 10000 outstanding shares of Penn Corporation common stock. During 2018, Pern earns $500000 and pays cash dividends of $15.000. If the beginning balance in the investment account was $950000, the balance at December 31, 2018 should be $1295000 $1175000. $1105250. $950000 LINK TO TEXT of I used FOR LATES Question Attempts MIT ABORIS Study TO