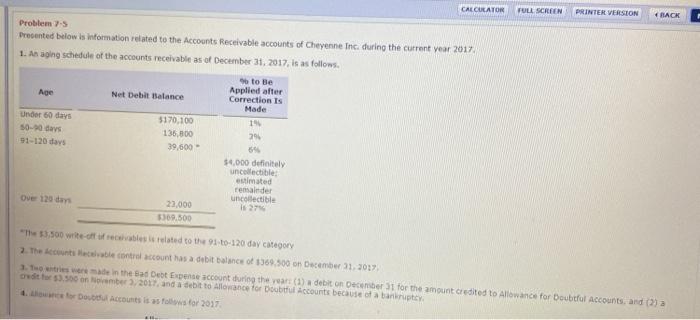

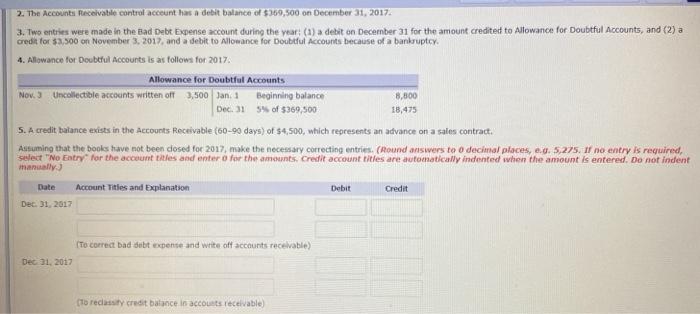

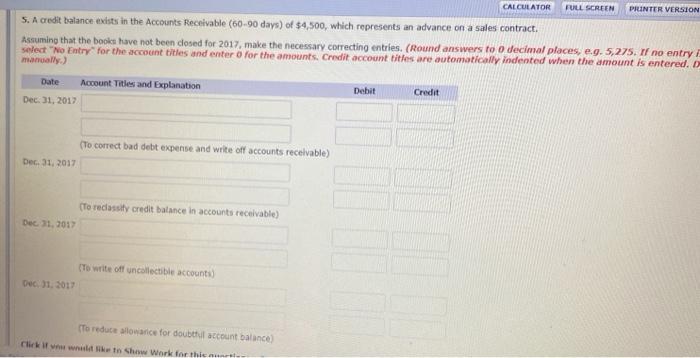

CALCULATOR FULL SCREEN PRINTER VERSION BACK Problem 75 Drevented below is information related to the Accounts Receivable accounts of Cheyenne Inc during the current year 2017 1. An aging schedule of the accounts receivable as of December 31, 2017, is as follows. Age Net Debit Balance Under 60 days 50-90 days 91-120 days 9 to Be Applied after Correction is Made 14 29 $170,100 136,800 39.600 $4.000 definitely un collectible estimated remainder uncollectible 1627 Ove 120 22,000 309.500 "The $3.500wide-off recibles related to the 9110-120 day category 2. The che control account has a debit balance of 5369.500 on December 31, 2017 ten the sad Det Expense account during the year (1) debit on December 31 for the amount credited to allowance for Doubtful Accounts and a odio 53.500 omber, 2017 and set to race for Dot Accounts because of a bankruptcy or ott is as fosfor 2017 2. The Accounts Receivable control account has a debit balance of $369,500 on December 31, 2017 3. Two entries were made in the Bad Debt Expense account during the year: () a debit on December 31 for the amount credited to Allowance for Doubtful Accounts, and (2) a credit for $3,500 on November 3, 2017 and a debit to allowance for Doubtful Accounts because of a bankruptcy. 4. Allowance for Doubtful Accounts is as follows for 2017 Allowance for Doubtful Accounts Nov. 3 Uncollectible accounts written off 3,500 Jana Beginning balance 8,800 Dec. 15 of $369,500 18,475 5. A credit balance exists in the Accounts Receivable (60-90 days) of $4,500, which represents an advance on a sales contract Assuming that the books have not been closed for 2017, make the necessary correcting entries (Round answers to decimal places, eg. 5,275. If no entry is required, select "No Entry for the account titles and enter for the amounts, Credit account titles are automatically indented when the amount is entered. Do not indent manually Account Titles and Explanation Debit Credit Dec 31, 2017 Date To correct bad debt expense and write off accounts receivable) Dec 31, 2017 (to resi credit balance in accounts receivable) CALCULATOR FULL SCREEN PRINTER VERSION 5. A credit balance exists in the Accounts Receivable (60-90 days) of $4,500, which represents an advance on a sales contract. Assuming that the books have not been closed for 2017, make the necessary correcting entries. (Round answers to o decimal places, e.g. 5,275. If no entry select "No Entry for the account titles and enter for the amounts Credit account titles are automatically indented when the amount is entered. O manually.) Account Titles and Explanation Debit Credit Dec 31, 2017 Date (To correct bad debt expense and write off accounts receivable) Dec 31, 2017 To redassity credit balance in accounts receivable) Dec 31, 2017 (To write off uncollectible accounts Dec 31, 2017 To reduce slowance for doubt account balance Click it and to Show Work for thich