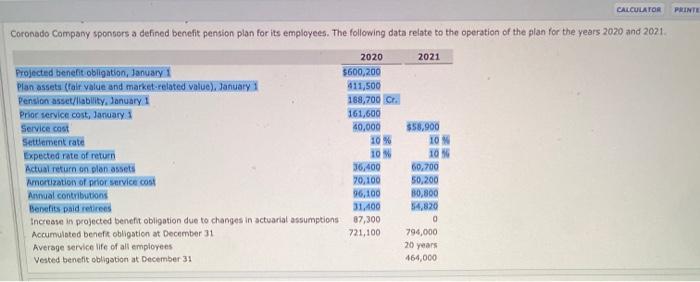

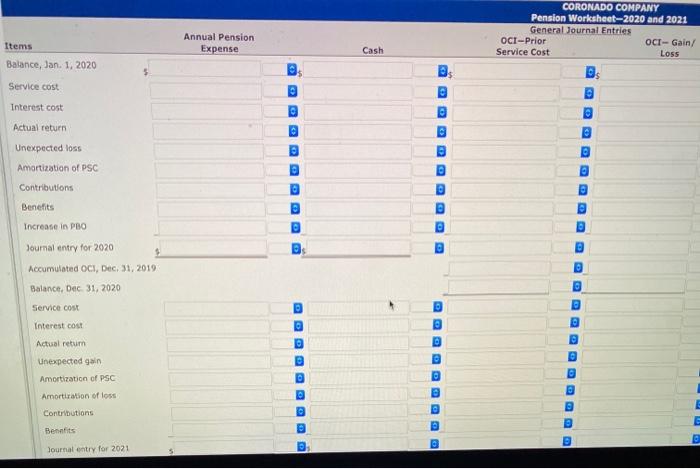

CALCULATOR PRINTE Coronado Company sponsors a defined benefit pension plan for its employees. The following data relate to the operation of the plan for the years 2020 and 2021. 2020 2021 Projected benefit obligation, January $600,200 Plan assets fall value and market-related value). January 411,500 Pension asset/liability. Sonury 188,700 cm Prior service cost, January 161,600 Service cost 40,000 $58.900 Settlement rate 10% 10 M Expected rate of return 10 10 Actual return on plan assets 36,400 60,700 Amortization of prior service cost 70.100 50,200 Arvual contributions 96,100 30.800 Benefits paid retirees 31,400 54,820 Increase in projected benefit obligation due to changes in actuarial assumptions 87,300 Accumulated benefit obligation at December 31 721,100 796,000 Average service life of all employees Vested benefit obligation at December 31 464,000 0 20 years CORONADO COMPANY Pension Worksheet-2020 and 2021 General Journal Entries OCI-Prior OC-Gain/ Service Cost Loss Items Annual Pension Expense Cash Balance, Jan. 1. 2020 Service cost Interest cost Actual return Unexpected loss Amortization of PSC Contributions Benefits D D Increase in PRO Journal entry for 2020 Accumulated OCI, Dec 31, 2019 Balance, Dec 31, 2020 Service cost Interest cost Actual return Unexpected gain Amortization of PSC Amortation of loss Contributions D Bennfits Journal entry for 2021 CALCULATOR PRINTE Coronado Company sponsors a defined benefit pension plan for its employees. The following data relate to the operation of the plan for the years 2020 and 2021. 2020 2021 Projected benefit obligation, January $600,200 Plan assets fall value and market-related value). January 411,500 Pension asset/liability. Sonury 188,700 cm Prior service cost, January 161,600 Service cost 40,000 $58.900 Settlement rate 10% 10 M Expected rate of return 10 10 Actual return on plan assets 36,400 60,700 Amortization of prior service cost 70.100 50,200 Arvual contributions 96,100 30.800 Benefits paid retirees 31,400 54,820 Increase in projected benefit obligation due to changes in actuarial assumptions 87,300 Accumulated benefit obligation at December 31 721,100 796,000 Average service life of all employees Vested benefit obligation at December 31 464,000 0 20 years CORONADO COMPANY Pension Worksheet-2020 and 2021 General Journal Entries OCI-Prior OC-Gain/ Service Cost Loss Items Annual Pension Expense Cash Balance, Jan. 1. 2020 Service cost Interest cost Actual return Unexpected loss Amortization of PSC Contributions Benefits D D Increase in PRO Journal entry for 2020 Accumulated OCI, Dec 31, 2019 Balance, Dec 31, 2020 Service cost Interest cost Actual return Unexpected gain Amortization of PSC Amortation of loss Contributions D Bennfits Journal entry for 2021