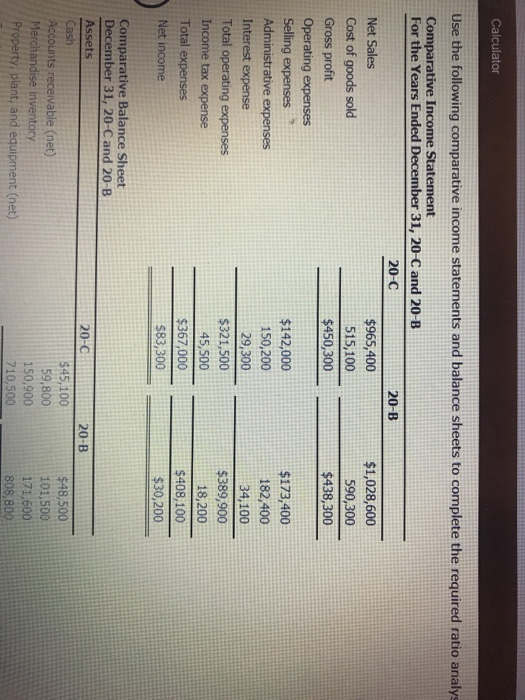

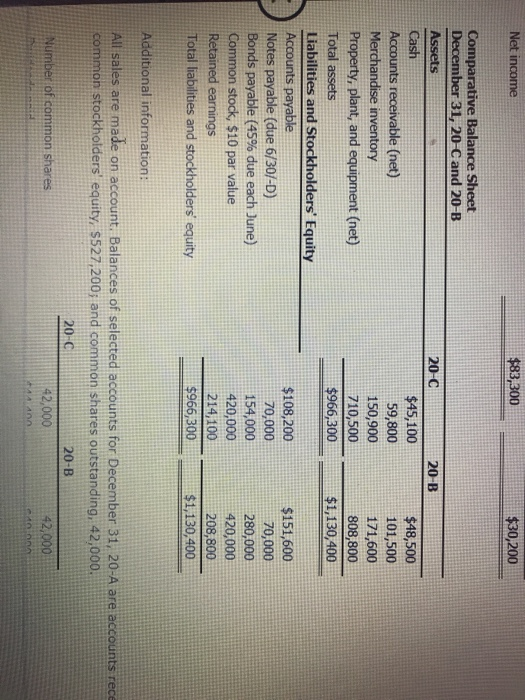

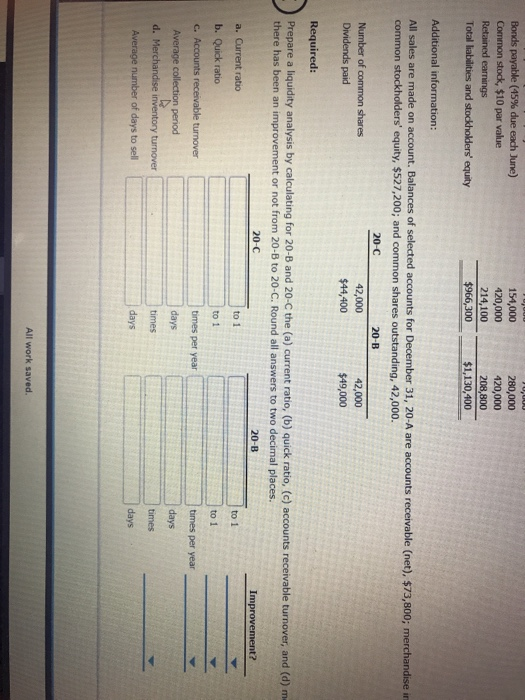

Calculator Use the following comparative income statements and balance sheets to complete the required ratio analys Comparative Income Statement For the Years Ended December 31, 20-C and 20-B 20-C 20-B $965,400 515,100 $450,300 $1,028,600 590,300 $438,300 Net Sales Cost of goods sold Gross profit Operating expenses Selling expenses Administrative expenses Total operating expenses Income tax expense Total expenses Net income $142,000 150,200 29,300 $321,500 $173,400 182,400 34,100 $389,900 18,200 $408,100 $30,200 45,500ut 367,000 583,300 Comparative Balance Sheet December 31, 20-C and 20-B Assets 20- 20-B $45,100 59,800 150,900 710,500 $48,500 101,500 171,600 Accounts receivable (net) Property, plant, and equipment (net) Net income $83,300 $30,200 Comparative Balance Sheet December 31, 20-C and 20-B 20-C 20-B Cash Accounts receivable (net) Merchandise inventory Property, plant, and equipment (net) Total assets Liabilities and Stockholders' Equity Accounts payable Notes payable (due 6/30/-D) Bonds payable (45% due each June) Common stock, $10 par value Retained earnings Total liabilities and stockholders' equity $45,100 59,800 150,900 710,500 $48,500 101,500 171,600 808,800 5966 300$1,130, 400 $108,200 70,000 154,000 420,000 214,100 $966,300 $151,600 70,000 280,000 420,000 208,800 $1,130,400 3 Additional information: All sales are made on account. Balances of selected accounts for December 31, 20-A are accounts rece common stockholders' equity, s527,200; and common shares outstanding, 42,000 20-C 20-B 42,000 42,000 154,000 420,000 214,100 $966,300 280,000 420,000 208,800 Total liabilities and Additional information: All sales are made on account. Balances of selected accounts for December 31, 20-A are accounts receivable (net), $73,800; merchandise in common stockholders' equity, $527,200; and common shares outstanding, 42,000. 20-C 20-B 42,000 $44,400 42,000 $49,000 Required: Prepare a liquidity analysis by calculating for 20-B and 20 C the (a) current ratio, (b) quick ratio, (c) accounts receivable turnover, and (d) m there has been an improvement or not from 20-B to 20-C. Round all answers to two decimal places. 20-C 20-B to 1 to 1 times per days to 1 to 1 times per year days times b. Quick ratio days Calculator Use the following comparative income statements and balance sheets to complete the required ratio analys Comparative Income Statement For the Years Ended December 31, 20-C and 20-B 20-C 20-B $965,400 515,100 $450,300 $1,028,600 590,300 $438,300 Net Sales Cost of goods sold Gross profit Operating expenses Selling expenses Administrative expenses Total operating expenses Income tax expense Total expenses Net income $142,000 150,200 29,300 $321,500 $173,400 182,400 34,100 $389,900 18,200 $408,100 $30,200 45,500ut 367,000 583,300 Comparative Balance Sheet December 31, 20-C and 20-B Assets 20- 20-B $45,100 59,800 150,900 710,500 $48,500 101,500 171,600 Accounts receivable (net) Property, plant, and equipment (net) Net income $83,300 $30,200 Comparative Balance Sheet December 31, 20-C and 20-B 20-C 20-B Cash Accounts receivable (net) Merchandise inventory Property, plant, and equipment (net) Total assets Liabilities and Stockholders' Equity Accounts payable Notes payable (due 6/30/-D) Bonds payable (45% due each June) Common stock, $10 par value Retained earnings Total liabilities and stockholders' equity $45,100 59,800 150,900 710,500 $48,500 101,500 171,600 808,800 5966 300$1,130, 400 $108,200 70,000 154,000 420,000 214,100 $966,300 $151,600 70,000 280,000 420,000 208,800 $1,130,400 3 Additional information: All sales are made on account. Balances of selected accounts for December 31, 20-A are accounts rece common stockholders' equity, s527,200; and common shares outstanding, 42,000 20-C 20-B 42,000 42,000 154,000 420,000 214,100 $966,300 280,000 420,000 208,800 Total liabilities and Additional information: All sales are made on account. Balances of selected accounts for December 31, 20-A are accounts receivable (net), $73,800; merchandise in common stockholders' equity, $527,200; and common shares outstanding, 42,000. 20-C 20-B 42,000 $44,400 42,000 $49,000 Required: Prepare a liquidity analysis by calculating for 20-B and 20 C the (a) current ratio, (b) quick ratio, (c) accounts receivable turnover, and (d) m there has been an improvement or not from 20-B to 20-C. Round all answers to two decimal places. 20-C 20-B to 1 to 1 times per days to 1 to 1 times per year days times b. Quick ratio days