Answered step by step

Verified Expert Solution

Question

1 Approved Answer

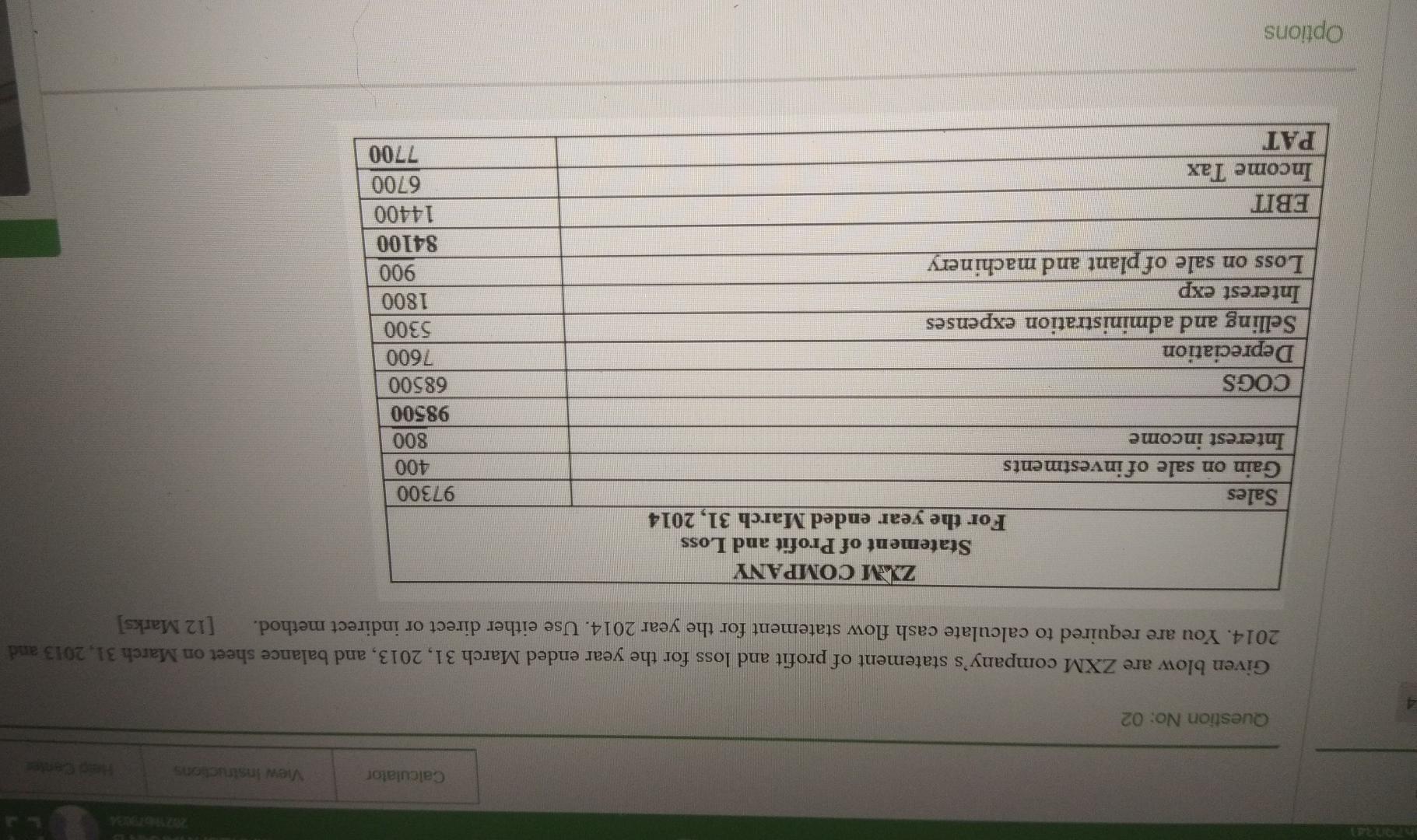

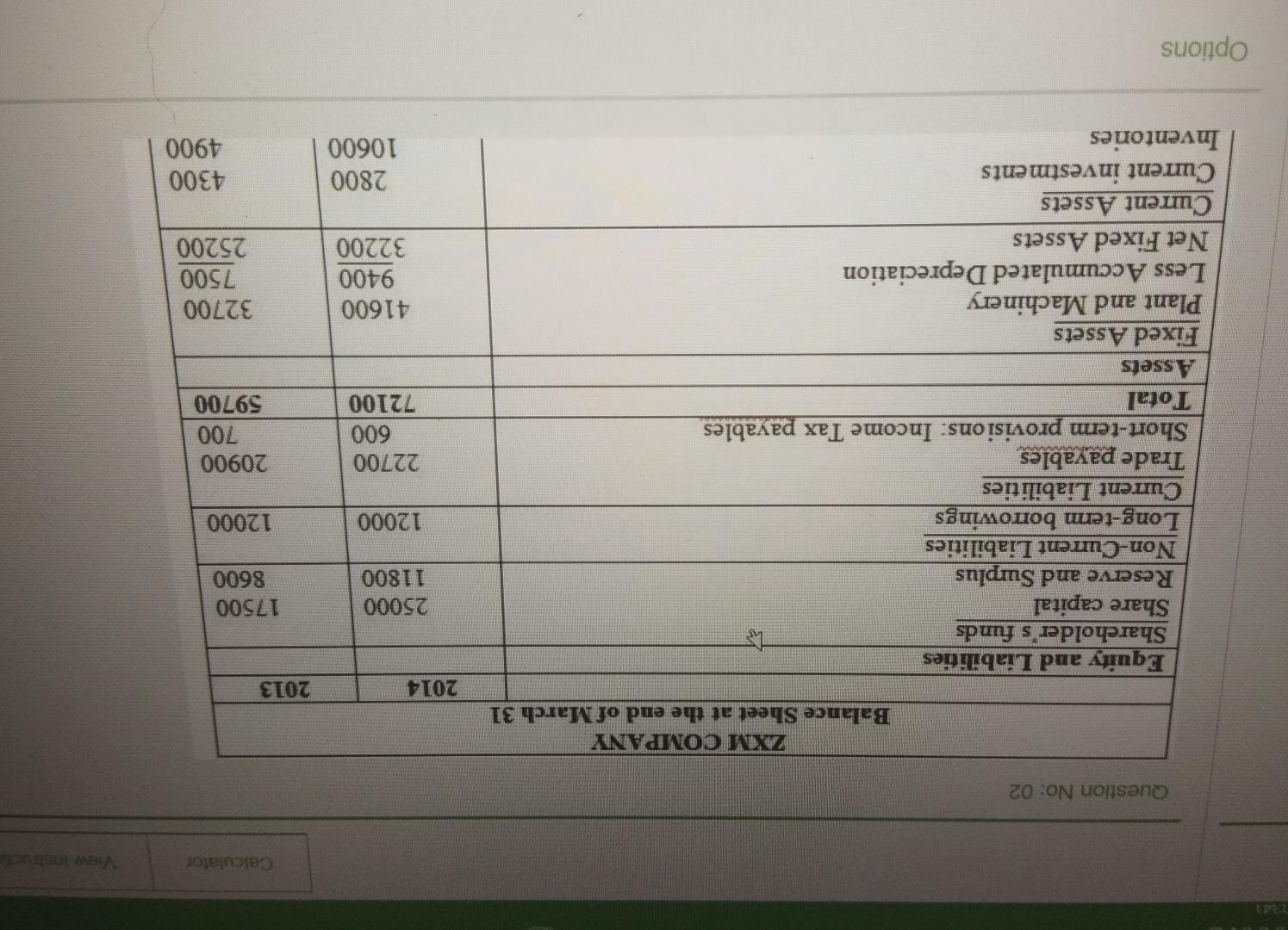

Calculator View Instructions Question No: 02 Given blow are ZXM company's statement of profit and loss for the year ended March 31, 2013, and balance

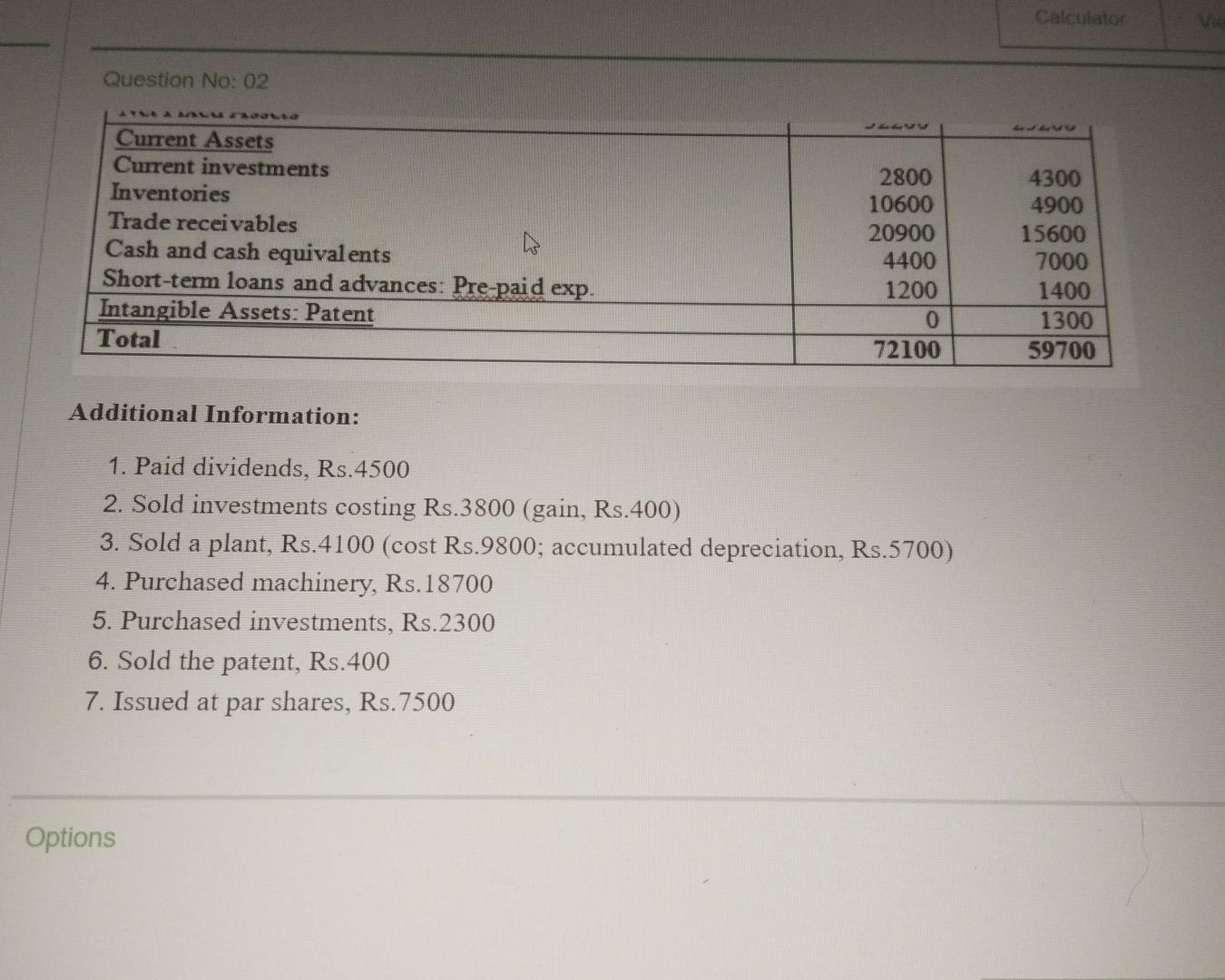

Calculator View Instructions Question No: 02 Given blow are ZXM company's statement of profit and loss for the year ended March 31, 2013, and balance sheet on March 31, 2013 and 2014. You are required to calculate cash flow statement for the year 2014. Use either direct or indirect method. [12 Marks] ZIM COMPANY Statement of Profit and Loss For the year ended March 31, 2014 Sales Gain on sale of investments Interest income COGS Depreciation Selling and administration expenses 97300 400 800 98500 68500 7600 5300 1800 900 84100 14400 6700 7700 Interest exp Loss on sale of plant and machinery EBIT Income Tax PAT Options Calculator View Instre Question No: 02 ZXM COMPANY Balance Sheet at the end of March 31 2014 2013 25000 11800 17500 8600 12000 12000 Equity and Liabilities Shareholder's funds ho Share capital Reserve and Surplus Non-Current Liabilities Long-tem borrowings Current Liabilities Trade payables Short-term provisions: Income Tax pavables Total Assets Fixed Assets Plant and Machinery Less Accumulated Depreciation Net Fixed Assets Current Assets Current investments Inventories 22700 600 72100 20900 700 59700 41600 9400 32200 32700 7500 25200 2800 10600 4300 4900 Options Calculator Question No: 02 Current Assets Current investments Inventories Trade receivables Cash and cash equivalents Short-term loans and advances: Pre-paid exp. Intangible Assets: Patent Total 2800 10600 20900 4400 1200 0 72100 4300 4900 15600 7000 1400 1300 59700 Additional Information: 1. Paid dividends, Rs.4500 2. Sold investments costing Rs.3800 (gain, Rs.400) 3. Sold a plant, Rs. 4100 (cost Rs.9800; accumulated depreciation, Rs.5700) 4. Purchased machinery, Rs.18700 5. Purchased investments, Rs.2300 6. Sold the patent, Rs.400 7. Issued at par shares, Rs.7500 Options

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started