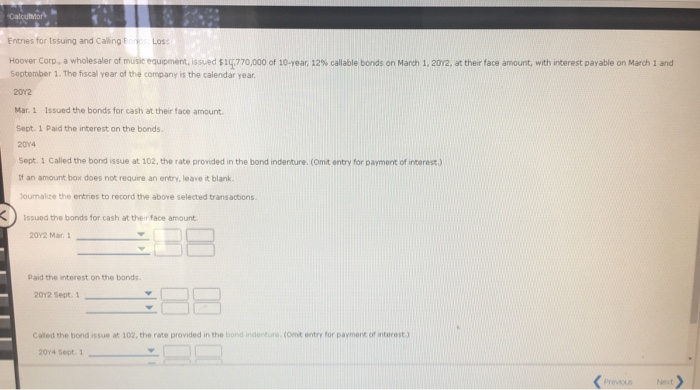

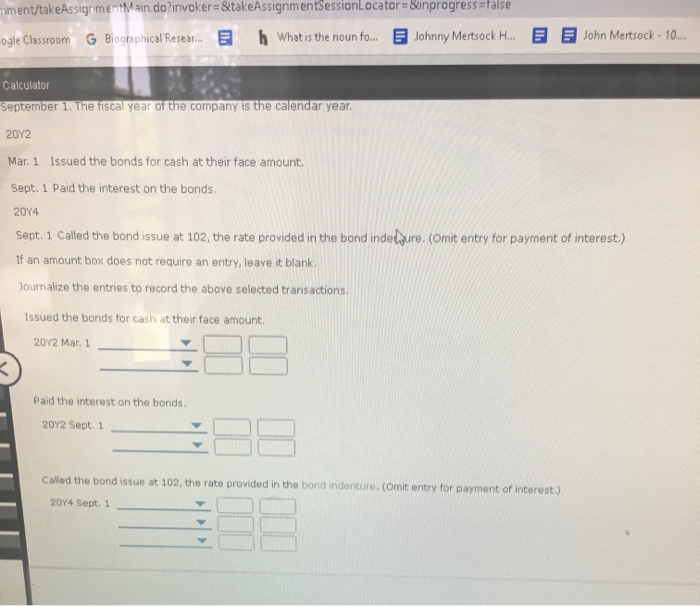

Calcution Entries for issuing and Calling on LOSS Hoover Corp. a wholesaler of music equipment, issued $19,770,000 of 10-year 12% callable bonds on March 1, 2012, at their face amount with interest payable on March 1 and September 1. The fiscal year of the company is the calendar year, 2012 Mar. 1 Issued the bonds for cash at their face amount Sept. 1 Paid the interest on the bonds. 2014 Sept. 1 Called the bond issue at 102, the rate provided in the bond indenture. (Omit entry for payment of interest.) If an amount box does not require an entry, leave it blank Joumalize the entries to record the above selected transactions Issued the bonds for cash at their face amount 2012 Mart Paid the interest on the bonds 2012 Sept. 1 Called the bond issue at 102, the rate provided in the bond indenture.com entry for payment of interest 2014 Sept 1 Previous nment/takeAssignment Main.do?invoker=&_takeAssignmentSessionLocator = Sinprogress=false ogle Classroom G Biographical Resear... h What is the noun fo. Johnny Mertsock H. John Mertsock - 10... Calculator September 1. The fiscal year of the company is the calendar year. 2012 Mar. 1 Issued the bonds for cash at their face amount. Sept. 1 Paid the interest on the bonds. 2014 Sept. 1 Called the bond issue at 102, the rate provided in the bond indelyure. (Omit entry for payment of interest.) If an amount box does not require an entry, leave it blank. Journalize the entries to record the above selected transactions Issued the bonds for cash at their face amount 2012 Mar. 1 Paid the interest on the bonds. 2012 Sept. 1 Called the bond issue at 102, the rate provided in the bond indenture. (Omit entry for payment of interest.) 2014 Sept. 1 Calcution Entries for issuing and Calling on LOSS Hoover Corp. a wholesaler of music equipment, issued $19,770,000 of 10-year 12% callable bonds on March 1, 2012, at their face amount with interest payable on March 1 and September 1. The fiscal year of the company is the calendar year, 2012 Mar. 1 Issued the bonds for cash at their face amount Sept. 1 Paid the interest on the bonds. 2014 Sept. 1 Called the bond issue at 102, the rate provided in the bond indenture. (Omit entry for payment of interest.) If an amount box does not require an entry, leave it blank Joumalize the entries to record the above selected transactions Issued the bonds for cash at their face amount 2012 Mart Paid the interest on the bonds 2012 Sept. 1 Called the bond issue at 102, the rate provided in the bond indenture.com entry for payment of interest 2014 Sept 1 Previous nment/takeAssignment Main.do?invoker=&_takeAssignmentSessionLocator = Sinprogress=false ogle Classroom G Biographical Resear... h What is the noun fo. Johnny Mertsock H. John Mertsock - 10... Calculator September 1. The fiscal year of the company is the calendar year. 2012 Mar. 1 Issued the bonds for cash at their face amount. Sept. 1 Paid the interest on the bonds. 2014 Sept. 1 Called the bond issue at 102, the rate provided in the bond indelyure. (Omit entry for payment of interest.) If an amount box does not require an entry, leave it blank. Journalize the entries to record the above selected transactions Issued the bonds for cash at their face amount 2012 Mar. 1 Paid the interest on the bonds. 2012 Sept. 1 Called the bond issue at 102, the rate provided in the bond indenture. (Omit entry for payment of interest.) 2014 Sept. 1