Answered step by step

Verified Expert Solution

Question

1 Approved Answer

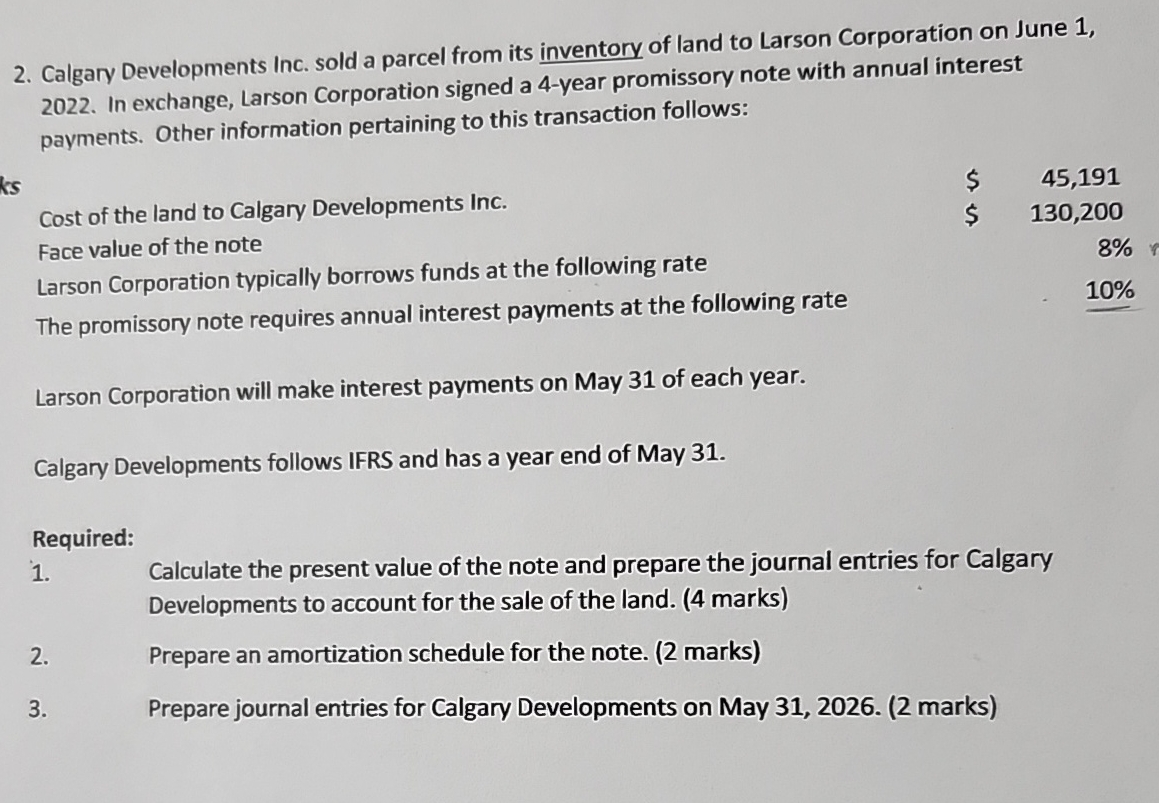

Calgary Developments Inc. sold a parcel from its inventory of land to Larson Corporation on June 1 , In exchange, Larson Corporation signed a 4

Calgary Developments Inc. sold a parcel from its inventory of land to Larson Corporation on June

In exchange, Larson Corporation signed a year promissory note with annual interest

payments. Other information pertaining to this transaction follows:

Cost of the land to Calgary Developments Inc.

Face value of the note

Larson Corporation typically borrows funds at the following rate

The promissory note requires annual interest payments at the following rate

Larson Corporation will make interest payments on May of each year.

Calgary Developments follows IFRS and has a year end of May

Required:

Calculate the present value of the note and prepare the journal entries for Calgary

Developments to account for the sale of the land. marks

Prepare an amortization schedule for the note. marks

Prepare journal entries for Calgary Developments on May marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started